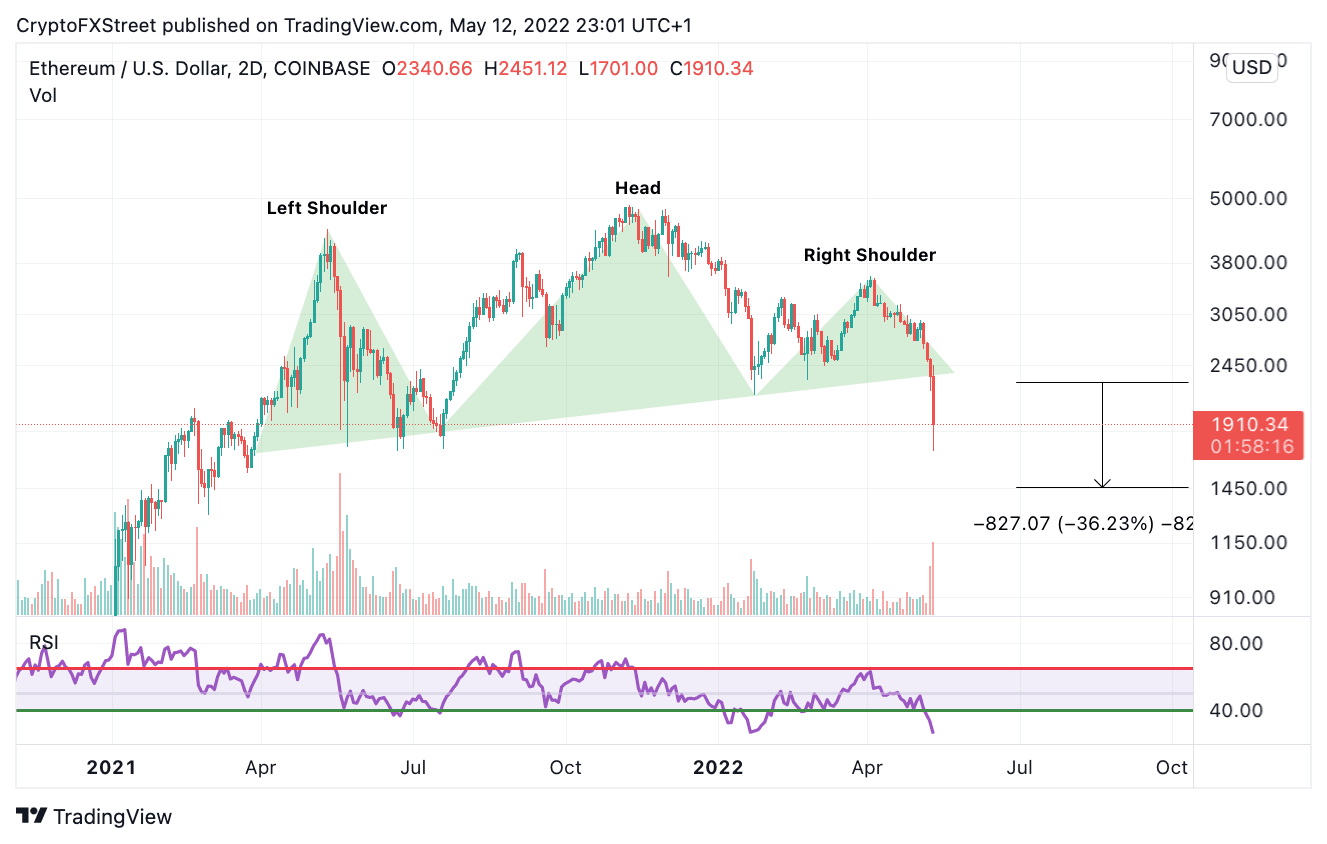

Ethereum Price Head and Shoulders pattern forecasts a drop to $1400

- Ethereum price spots a classic Head & Shoulders pattern.

- Ethereum price is halfway to the intended target.

- Invalidation of the bearish outlook is a breach above $2725.

ETH price is setting up a classic trading pattern, an opportunity to go short could present itself in the days to come.

ETH price could present a bearish trade setup

Ethereum price is currently trading at $1935 as the bears have pushed into the lowest price territory for 2022. Ethereum price sell-off is primarily correlated with the overall sentiment in the crypto market regarding security vs. asset arguments, NASDAQ correlations, and the most recent LUNA / UST algorithmic stablecoin scandal, which proposes the sustainability question for other cryptocurrencies in the space.

Ethereum price sell-off is quite powerful according to the volume profile indicator. The technicals depict a classic head and shoulders pattern, which forecasts a price target of $1400. Currently, the ETH price is about halfway from the target and could likely retrace upwards before making the next move down. A bearish trade setup could present in the days between $2100-$2400, but the scenario has not materialized enough to give a specific entry point.

ETH/USDT 2-Day Chart

Overall the invalidation of the downtrend will be a breach above $2725. If the bulls can breach this target, the bearish outlook will be void. The ETH price could aim for $3800, resulting in a 100% increase from the current Ethereum price.

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.