Ethereum price has rekindled a bullish flame as traders aim for $3,500

- Ethereum price has made a higher high.

- ETH price could print an N-shaped pattern in the near future.

- A break below $2,870 will invalidate the bullish thesis.

Ethereum price needs to maintain momentum

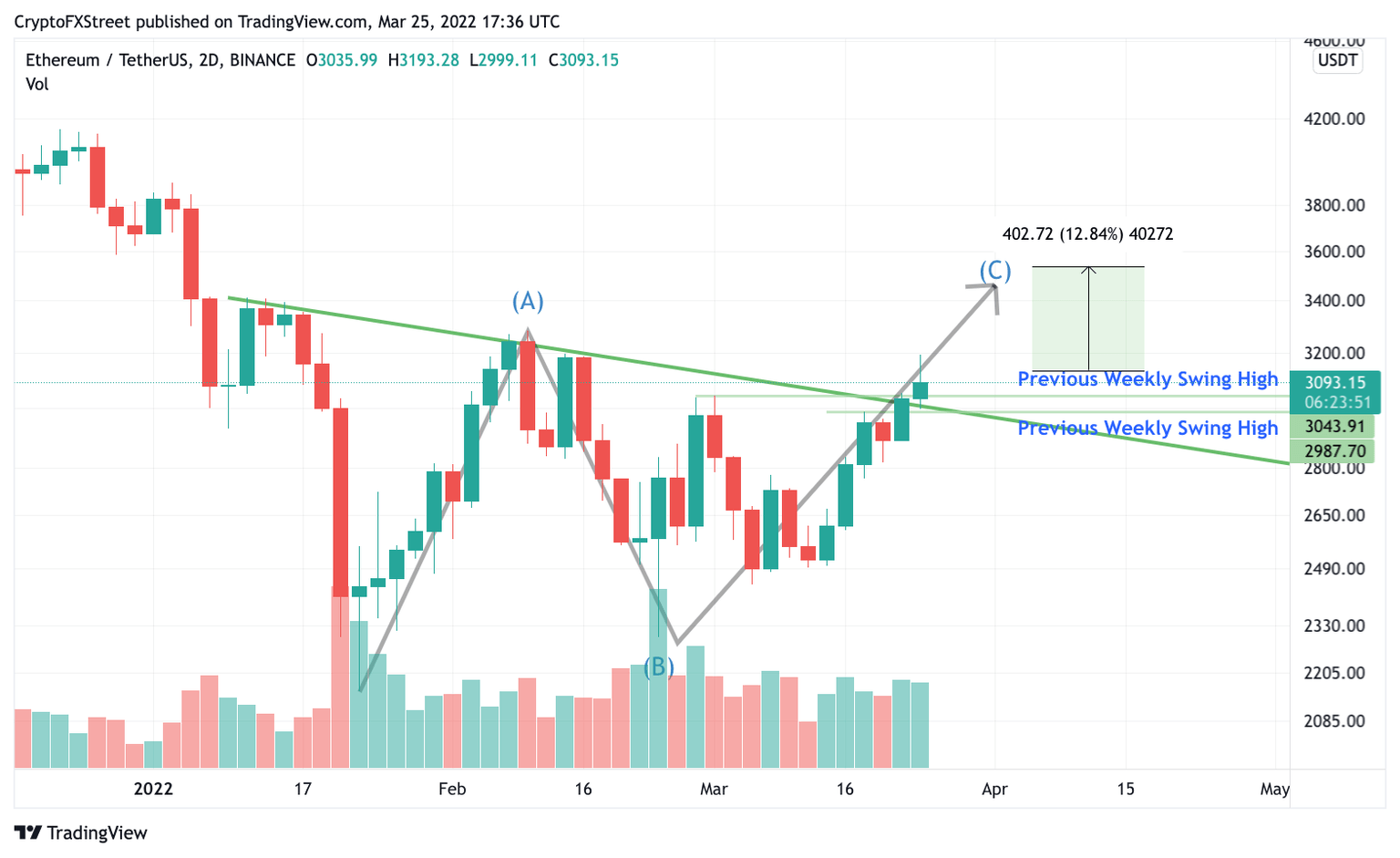

Ethereum price has seen an excellent performance this week as the decentralized giant has climbed 12% into today's high at $3,193. It was mentioned in Tuesday's thesis that a breach of the weekly trendline could be the catalyst to send ETH price higher. Just hours later, the moment arrived. ETH price soared through the trend line spiking the previous weekly swing high at $2,987. Today the price has also spiked through another weekly swing high that occurred earlier this month at $3,043.

ETH price is currently fluctuating around $3,100 and needs to create a new floor above the broken resistance at $3000 to sustain its momentum. If bulls can manage, then ETH price will likely reach $3,500, an additional 13% from the current price.

It is worth noting that an N-shaped pattern projection could potentially reveal itself once the Ethereum price were to enter the $3,500 zone. N-shaped patterns are considered very sneaky bearish patterns amongst Elliott Wave practitioners. N patterns tend to trap bulls as the last of the N usually unfolds as a bullish impulse. Traders should cautiously trail stops as these N-shaped patterns can yield monstrous downside rallies.

ETH/USDT 2-Day Chart

Still, the N-shaped pattern is more speculative than tangible evidence at the moment. Traders currently in profit should watch the Ethereum price action around the $3,000-$2,870 zone. If the bulls fail to provide support, the ETH price will likely fall back to $2,800 and potentially $2,700, resulting in a 10% correction from the current price.

Author

FXStreet Team

FXStreet