Ethereum price likely to retest $2,300 despite recent rebound

- Ethereum price has printed its lowest daily close in the last 30 days.

- ETH has failed to find support on all monthly Fibonacci retracement ratios.

- There is a high chance for a retest of the previous monthly low at $2,300.

Ethereum continues to trend downwards after the recent sell-off late last week and could reverse some of the gains recently incurred.

Ethereum price fails to respect monthly Fibonacci levels

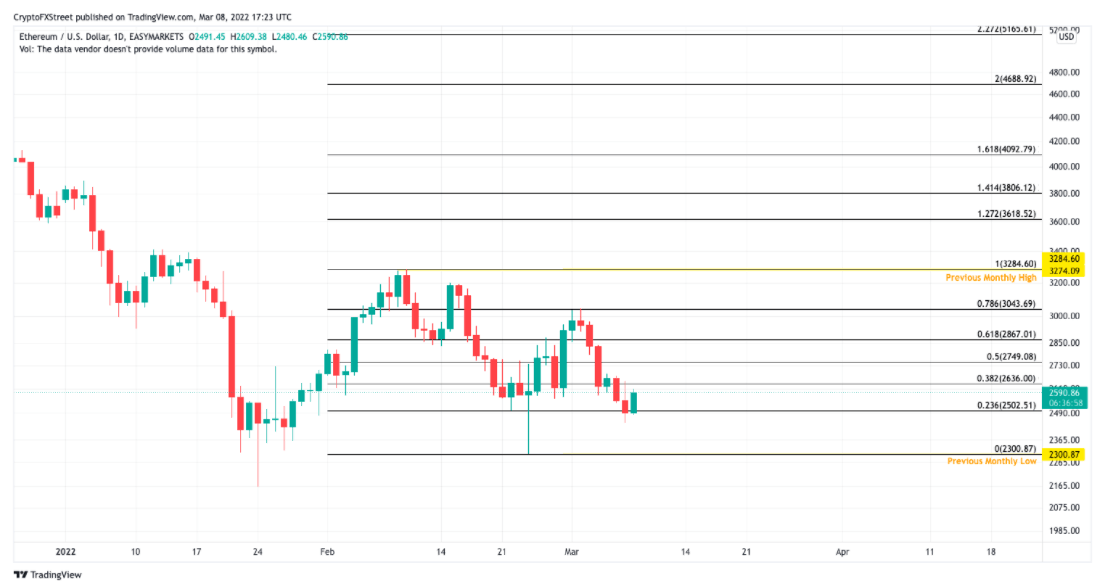

Ethereum bears seem to have complete control over ETH price after closing at the lowest point in 30 days at $2,485. Secondly, bulls have failed to support both the .5 and .382 monthly Fibonacci retracement levels.

Today’s price of $2,583 is floating above the .236 Fibonacci retracement level. Unfortunately, the .236 Fibonacci retracement level is not considered a strong level of support.

The current Ethereum price action suggests more consolidation from the token is needed before the bears can ultimately grab liquidity lying under the previous monthly low at $2,300.

Ethereum Daily Chart

There is currently no evidence of a bullish reversal for Ethereum price. Bears who profited early from this week’s sell-off are likely to move their orders into take-profit zones. Thus, sideways action between $2,500 and $2,650 is very likely on the intraday chart for days to come.

It is worth noting that Ethereum price seems to be printing a bullish morning star on the daily chart. This pattern will further validate the idea of temporary range-bound price action. Early buyers should be warned not to open large positions as bears are likely to push price back to February’s monthly low of $2,300.

A daily close above the .5 monthly Fibonacci retracement level at $2,750 will be the first bullish signal to invalidate the pessimistic outlook. If invalidation occurs, then Ethereum price will likely see an increase of 10-15%, going back up to $2,870 and even $3,000.

Author

FXStreet Team

FXStreet