Ethereum Price Forecast: BitMine adds 40K ETH as Thomas Lee predicts recovery

Ethereum price today: $2,130

- Ethereum treasury firm BitMine Immersion lifted its holdings to 4.32 million ETH after acquiring 40,613 ETH last week.

- Thomas Lee says ETH could see another V-shaped recovery in 2026.

- ETH could test $2,380 if it holds its rise above $2,100.

Ethereum (ETH) treasury firm BitMine Immersion Technologies (BMNR) added to its digital asset stash last week, acquiring 40,613 ETH.

As a result, the company has pushed its holdings to 4.32 million ETH, worth about $8.9 billion at the time of publication. From that figure, the Nevada-based firm has staked 2.89 million ETH, about 67% of its entire stash.

BitMine's latest acquisition follows a sustained decline in ETH's price after a wider crypto market slump over the past few weeks.

The top altcoin has lost 62% of its value since reaching a new all-time high last August, even as daily active addresses and transactions have surged to record levels. In a statement on Monday, BitMine Chairman Thomas Lee noted that such drawdowns are annual for ETH, highlighting that the recent decline marks the eighth time ETH has seen a 50% decline or more from a recent high.

"ETH sees V-shaped recoveries from major lows. This happened in each of the 8 prior declines of 50% or more," said Lee. "A similar recovery is expected in 2026. The best investment opportunities in crypto have presented themselves after declines. Think back to 2025, the single best entry points in crypto occurred after markets fell sharply due to tariff concerns."

BitMine is seeing unrealized losses of over $7 billion on its ETH holdings, according to smart money tracker Lookonchain.

The firm also reported holdings of 193 Bitcoin (BTC), a $200 million stake in Beast Industries, a $19 million stake in Worldcoin (WLD) treasury Eightco Holdings (ORBS) and total cash of $595 million.

Ethereum Price Forecast: ETH could rise to $2,380 if it holds $2,100

Ethereum saw $92.5 million in liquidations over the past 24 hours, led by $49.3 million in short liquidations, according to Coinglass data.

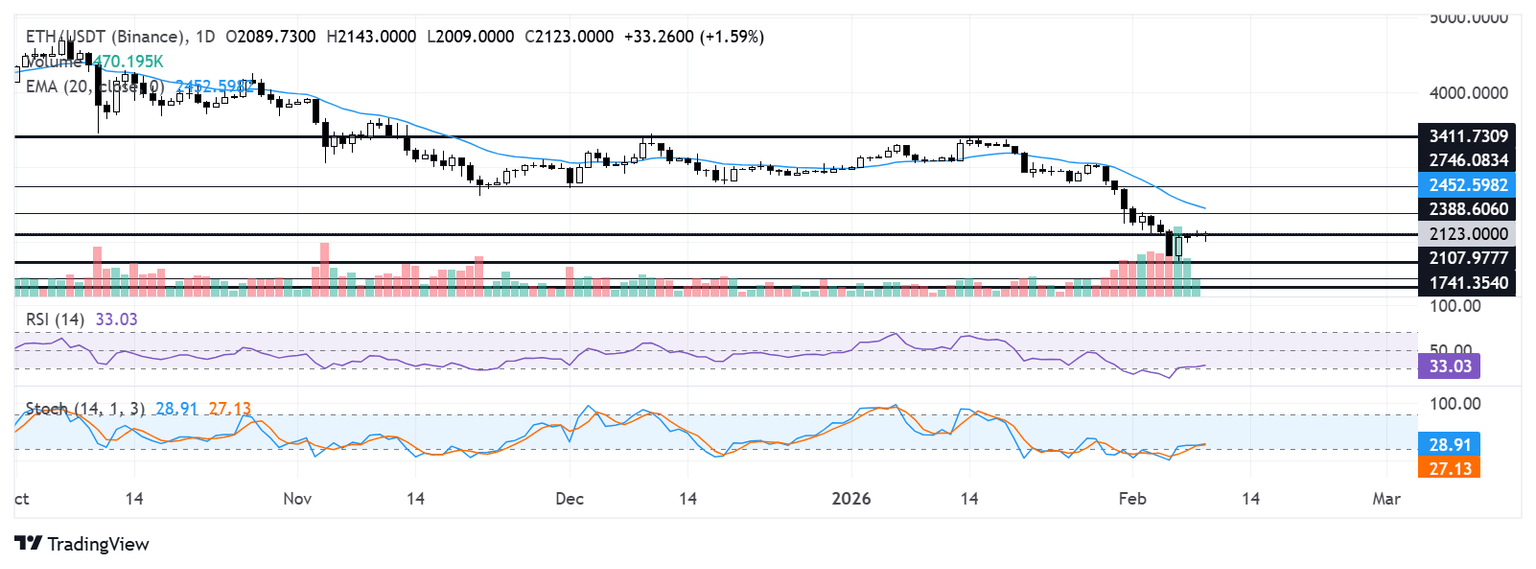

ETH held the $2,000 psychological level throughout the weekend and is attempting to rise above the $2,100. On the upside, ETH faces resistance at $2,388, just below the 20-day Exponential Moving Average (EMA).

A failure to hold above $2,100 could see ETH decline toward $1,740.

The Relative Strength Index (RSI) and Stochastic Oscillator (Stoch) have slightly retreated from oversold territory, indicating a modest drop in bearish momentum.

Author

Michael Ebiekutan

FXStreet

With a deep passion for web3 technology, he's collaborated with industry-leading brands like Mara, ITAK, and FXStreet in delivering groundbreaking reports on web3's transformative potential across diverse sectors. In addi