- ETH is bullish as long as it stays above SMA50 weekly.

- The first recovery target is set at $270.

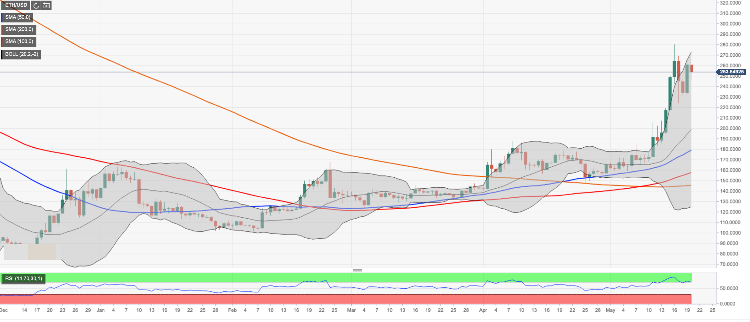

Ethereum retraced from the recent high of $280.17 reached during the previous week and settled at $253.50 by the time of writing. The second largest digital asset with the current market value of $27 billion and an average daily trading volume of $11 billion has gained 1.4% since this time on Sunday, though it is still down 2.5% since the beginning of Monday.

Ethereum's technical picture

While ETH/USD has lost some ground, it is still above the upper boundary of weekly Bollinger Band ($227) and SMA50 weekly (currently at $221), which creates a positive technical environment and implies that the coin retains bullish potential in the long run. The weekly RSI (Relative Strength Index) also points upwards in confirmation of the bull's case scenario.

A sustainable move below the said support area will open up the way towards psychological $200, strengthened by SMA100 (4-hour), followed by $180.00 with DMA50 located marginally above this level.

On the upside, the coin needs to regain $270 barrier (Sunday's high and an upper boundary of the 1-day Bollinger Band) to resume the upside trend with the next aim at $280. Once it is cleared, the upside is likely to gain traction with the next focus on critical $300.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

TRON gains 10% in 2024, supply of stablecoins reaches over $50 billion in Q1

TRON, a blockchain-based digital platform, has seen positive growth in the first quarter of 2024, as seen in a Messari report. TRON noted gains across several metrics like market capitalization, revenue and total value locked.

XRP hovers near $0.50 as Ripple CTO addresses concerns related to stablecoin launch

XRP is hovering near $0.53 on Friday, spending nearly all week below $0.55. Ripple CTO David Schwartz addressed concerns on stablecoin and XRP utility on Thursday.

Terraform Labs set to restrict access for users in the US after recent ruling in SEC lawsuit

Blockchain company Terraform Labs said Thursday that it will restrict access to some of its products and services for US-based users as it expects to receive a court order soon in light of its legal battle against the US Securities and Exchange Commission (SEC).

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s (BTC) recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Bitcoin: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s (BTC) recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.