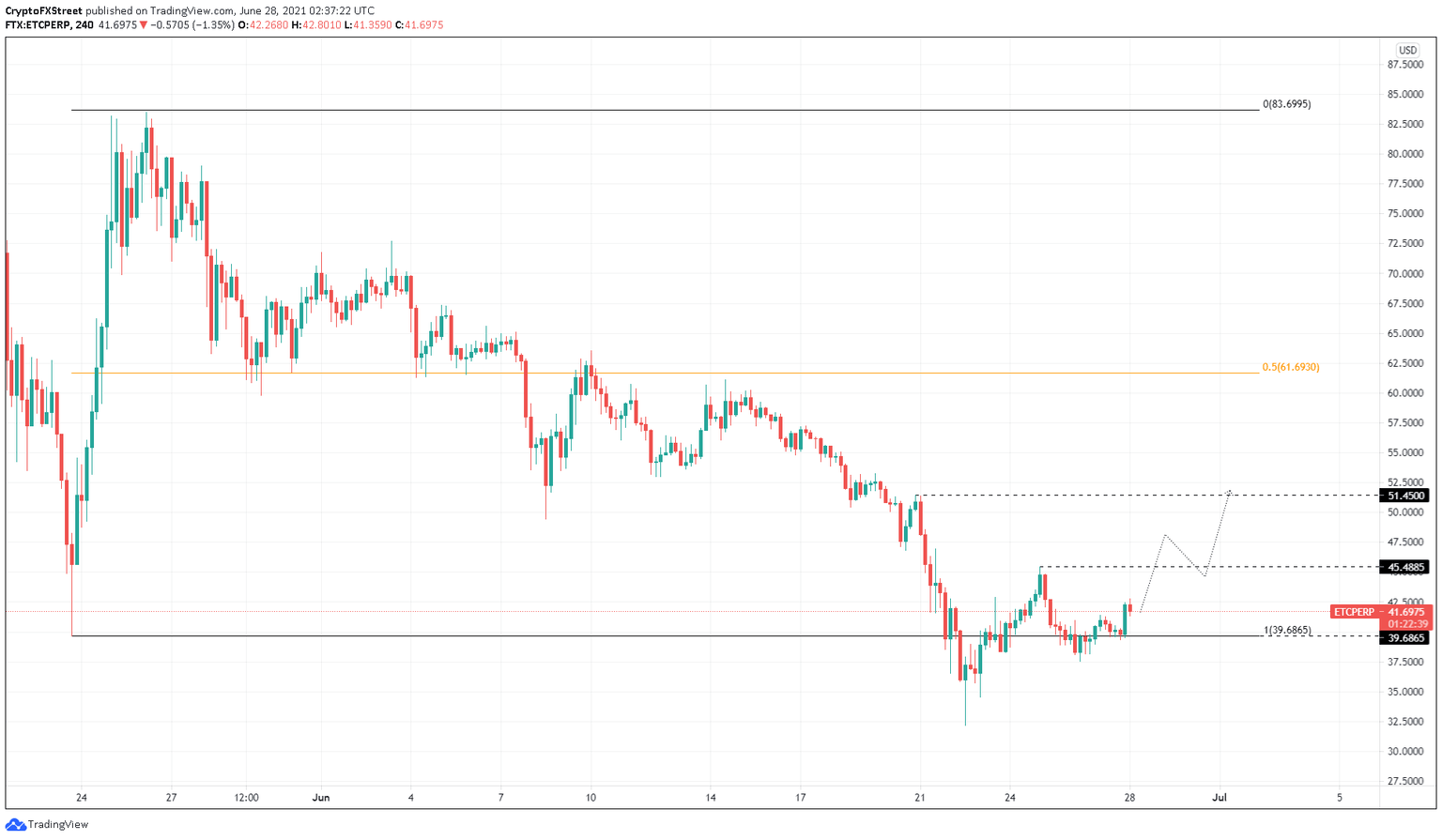

Ethereum Classic Price Prediction: ETC eyes 23% upswing

- Ethereum Classic price has climbed above the range low at $39.69, an attempt to move higher.

- A minor pullback might occur before ETC rallies 23% to tag $51.45.

- If the swing low at $37.53 is breached, it will invalidate the bullish thesis.

Ethereum Classic price dipped below the range low on June 22 but climbed above it only recently. This move indicates that buyers are back and a mean reversion is likely.

Ethereum Cassic price primed for higher high

Ethereum Classic price reclaimed the range low at $39.69 on June 26 and retested it on June 27. This move resulted in a 6.25% rally, which might continue to head higher.

Such a move would result in a retest of the immediate supply barrier at $45.49. Slicing through this area will open the path for ETC to tag the resistance level at $51.45, a 23% ascent from its current position, $41.70.

While this scenario is perfectly valid, investors need to watch out for a brief and minor pullback before Ethereum Classic price ascends.

In the short term, the intended target at $51.45 will lead to a pullback. However, if the conditions are right, ETC might rally toward the 50% Fibonacci retracement level at $61.69.

ETC/USDT 4-hour chart

On the flip side, if Ethereum Classic price slices through the range low at $39.69, it will signal the inability of buyers. This move would further open up an opportunity for bears to keep the price grounded.

A potential spike in bearish momentum that pushes ETC to create a swing low below $37.53 will invalidate the optimistic scenario outlined above.

In that case, the panicking investors might trigger another bearish descent to $34.54, an 8% crash.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.