Ethereum Classic Price Forecast: Chances of 21% correction wane on bullish market momentum

- Ethereum Classic price formed a double-top reversal pattern that hints at a 21% decline.

- Price indicators highlight the potential of the pattern failing due to bullish broader market cues.

- The anticipated spot Bitcoin ETF approvals will likely have a bullish impact on altcoins, benefiting ETC.

Ethereum Classic price was seemingly adhering to the micro bearish reversal pattern, which failed despite the recent correction in the crypto market. The short-term outlook ahead of the spot Bitcoin ETF approval is now looking bullish as ETC is bouncing back from the crucial support of $19.33.

Ethereum Classic price notes a bearish reversal pattern

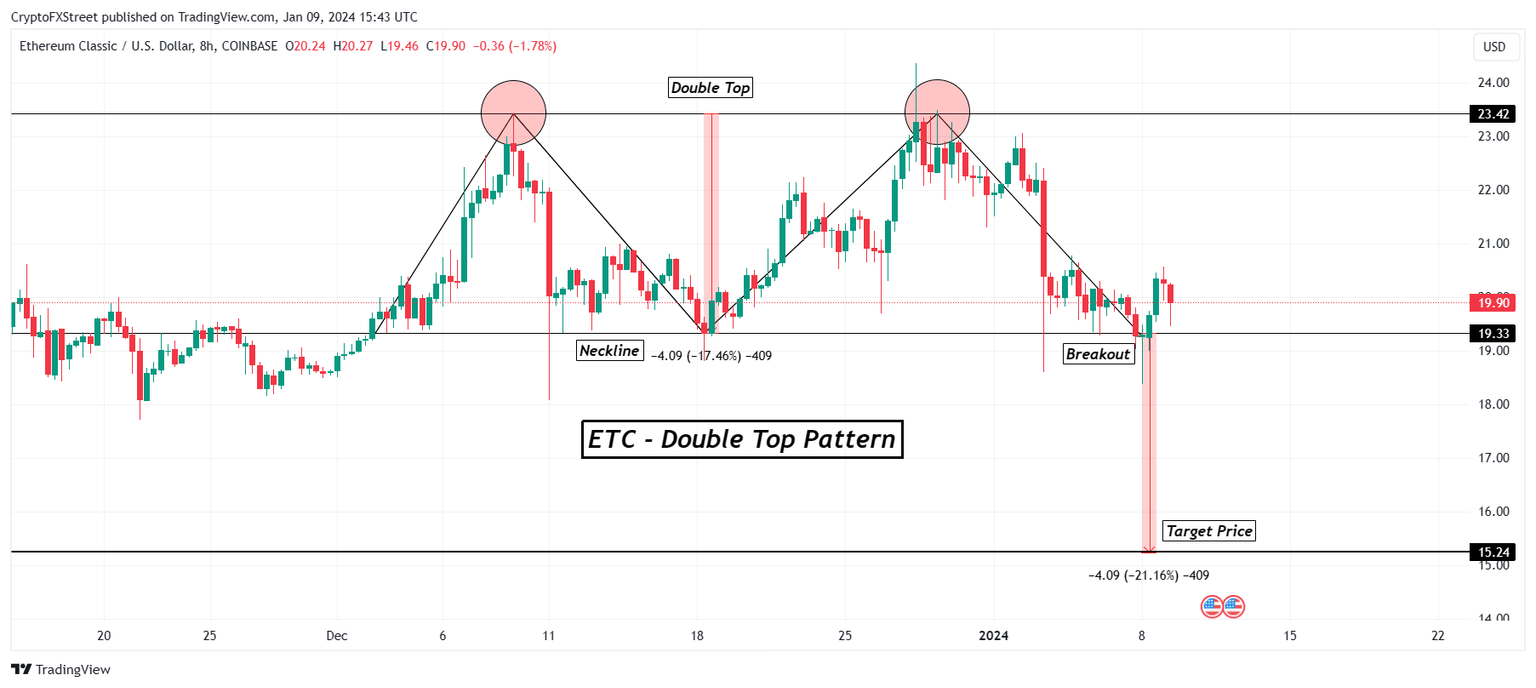

Ethereum Classic price on the 4-hour scale invalidates the double-top bearish reversal pattern that has been observed in the past four weeks. This pattern consists of two peaks or tops of nearly identical height positioned closely together, with a trough in between. It suggests a possible shift in market direction.

The potential trend reversal is indicated by the price encountering a resistance level on two separate occasions without successfully surpassing it. This is often interpreted as a sign to consider selling or initiating short positions as further declines in the market.

In the case of Ethereum Classic, this double top was formed at $23.42, with the neckline or support level of the pattern being marked at $19.33. This is also the breakout level, and an extended decline below this line would confirm the bearish reversal pattern. Furthermore, a successful pattern would only be observed when ETC falls to the target price of $15.24, which, according to the pattern, would register a 21% decline on the 4-hour chart.

However, Ethereum Classic price took the other route and, instead of falling through the neckline, bounced off it to note minor recovery, trading at $19.90 at the time of writing. Although this does not rule out the potential for decline, the price indicators do suggest invalidation of the pattern is likely, too.

ETC/USD 4-hour chart

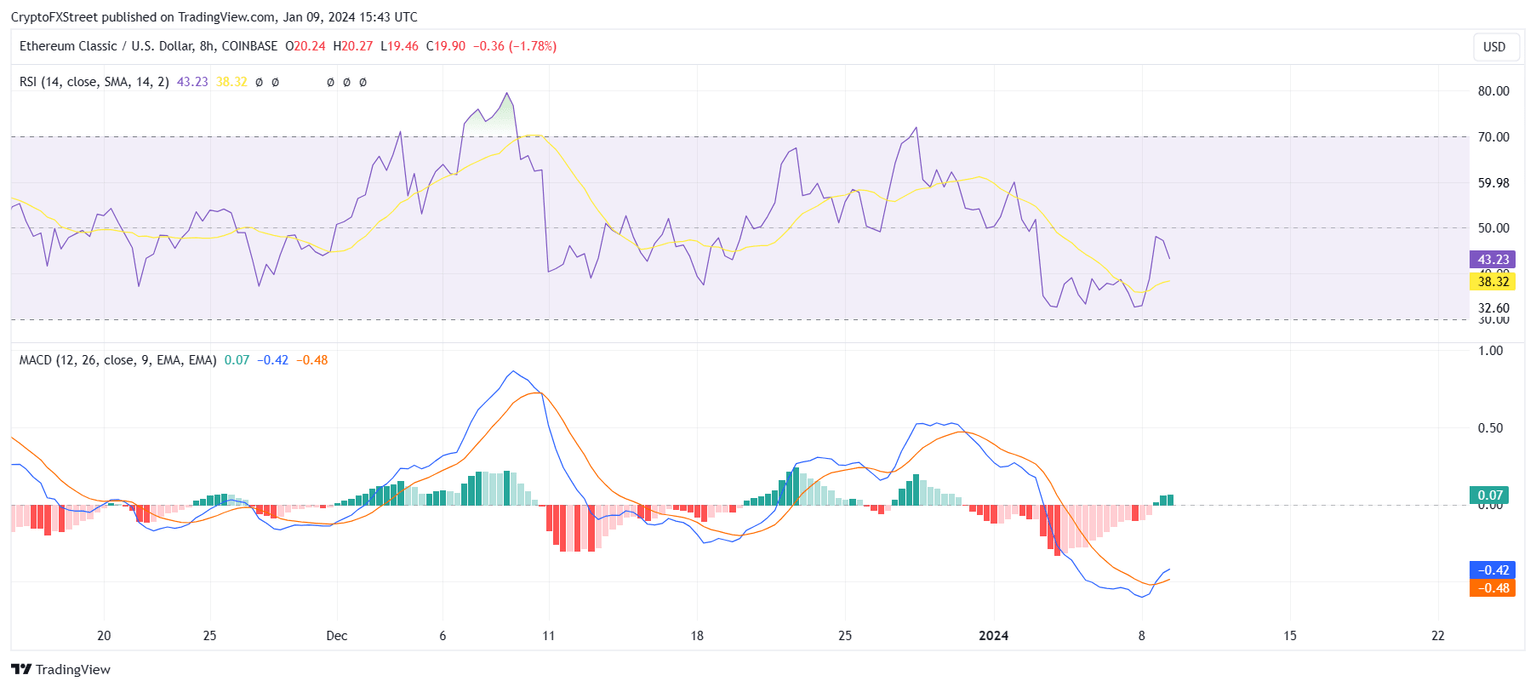

The Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD) indicator are giving out mixed signals, with the former still sitting in the bearish zone and the latter noting a bullish crossover.

Ethereum Classic RSI and MACD

If Ethereum Classic price continues the current path and broader market bullish cues kick in, ETC could move sideways or upwards beyond $20 and invalidate the bearish pattern.

On the other hand, if the Ethereum namesake falls through the neckline and falls below $19, the bullish thesis would be invalidated, and the reversal pattern could be deemed mildly successful since absolute success would warrant a 21% correction.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.