EOS price analysis: EOS/USD defies gravity with 7% growth

- EOS has been growing strongly since the beginning of the week..

- The next strong resistance awaits us on approach to $3.64

EOS, the 7th largest digital asset with the current market value of $3.3 billion hit $3.61 high on Tuesday is driven by a strong upside momentum/ At the time of writing, EOS/USD is changing hands at $3.58 with over 7% of gains on a day-to-day basis. The coin is the best-performing digital asset out of top-20.

EOS/USD, the technical picture

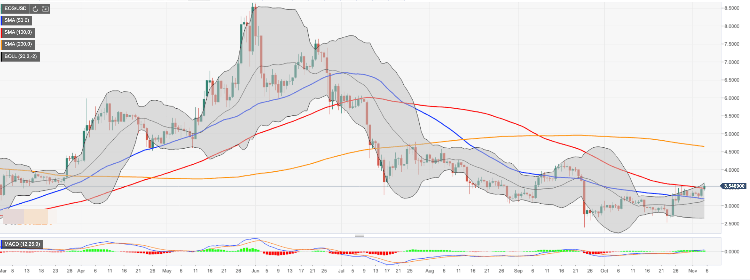

On a daily chart, EOS/USD broke above SMA100 (Simple Moving Average) at $3.48, which is a positive signal for the bulls. The coin bottomed at $2.53 on October 23 and has been moving in a range limited by $3.15-$3.50. The next resistance is created by the upper line of the Bollinger Band on a daily chart at $3.64. Once it is out of the way, the upside is likely to gain traction with the next focus on psychological $4.00 and September 17 high at $4.24.

On the downside, the correction may be limited by the above-said SMA200 daily. A sustainable move below this handle will open up the way to the lower border fo the previous consolidation channel at $3.15. It is strengthened by SMAA50 and the middle line of the Bollinger Band on a daily chart.

EOS/USD, the daily chart

Author

Tanya Abrosimova

Independent Analyst