EOS Price Analysis: EOS/USD conquers $3.00, more upside ahead

- EOS/USD moved above critical support and gained over 6%.

- The short-term correction will be followed by a new bullish wave.

EOS is the 11th largest digital asset with the current market capitalization of $2.82 billion and an average daily trading value of $2.5 billion. The coin has gained over 6% on a day-to-day basis and became one of the best-performing digital assets out of top-10. At the time of writing, EOS/USD is changing hands at $3.14, marginally lower from the intraday high of $3.16, which is also the highest level since March 8.

EOS/USD: Technical picture

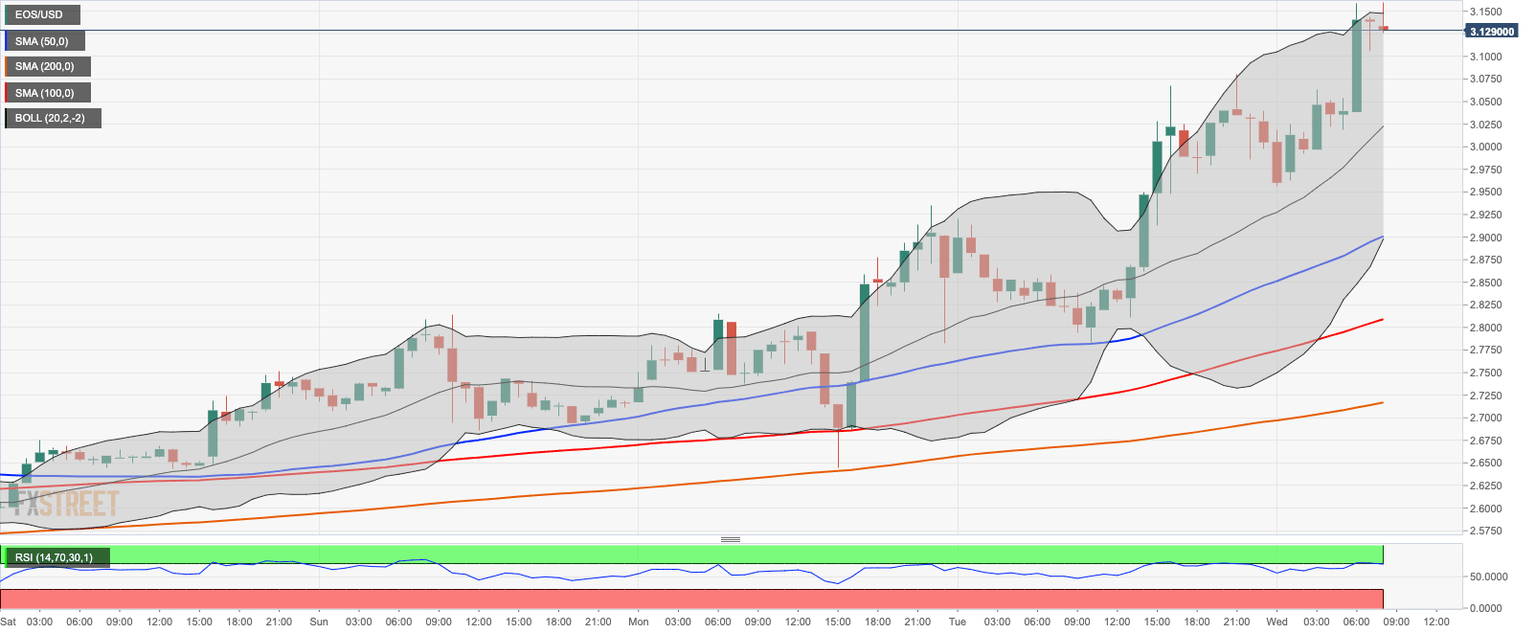

On the daily chart, a sustainable move above psychological $3.00 reinforced by daily SMA200 and weekly SMA50 created strong bullish momentum and pushed the price towards the multi-month high. The RSI on the long-term time frames points upwards, which means that the price has not exhausted its bullish potential yet. However, the daily RSI has entered the overbought territory, while 1-hour RSI has started the reversal, indicating that the coin is vulnerable to the short-term correction.

EOS/USD daily chart

The critical support is created by the above-said psychological $3.00. A combination of strong technical barriers clustered around this level will make it a tough target for the bears and may serve as a starting point for a new bullish wave. If it is broken, the sell-off may be extended to $2.90, which is reinforced by a combination of 1-hour SMA50 and the lower line of the 1-hour Bollinger Band.

EOS/USD 1-hour chart

Author

Tanya Abrosimova

Independent Analyst

-637316082520805557.png&w=1536&q=95)