Enjin Coin price explodes 70% after becoming Japan’s first gaming token

- Enjin Coin price surged 70% after Japan approved it as the first gaming token.

- The digital asset has been approved by the JVCEA (Japan Virtual Currency Exchange Association).

According to a new article released by Enjin, the digital asset has become the first ever gaming token authorized for use in Japan approved by the JVCEA. Additionally, Enjin will be listed on Coincheck on January 26, which only supports a handful of cryptocurrencies in Japan.

Projects that want to be traded on Japanese exchanges must pass a rigorous examination process, which is why only 15 currencies are currently listed on Coincheck—the first Japanese exchange to list ENJ, and one of the largest Japanese exchanges by volume.

Enjin Coin price surges but could experience short-term selling pressure

Enjin touched $0.443 in the past 24 hours, rising by more than 280% since December 2020. The digital asset had a massive breakout on January 8 followed by a consolidation period right into another colossal breakout thanks to the recent announcement.

ENJ Holders Distribution

However, the number of whales holding at least 10,000,000 coins plummeted from 13 on January 11 to only nine currently, which indicates large holders are taking profit on their holdings.

ENJ Supply on exchanges

Similarly, the number of Enjin coins inside exchanges spiked massively in the past 48 hours which is another indication that investors are selling.

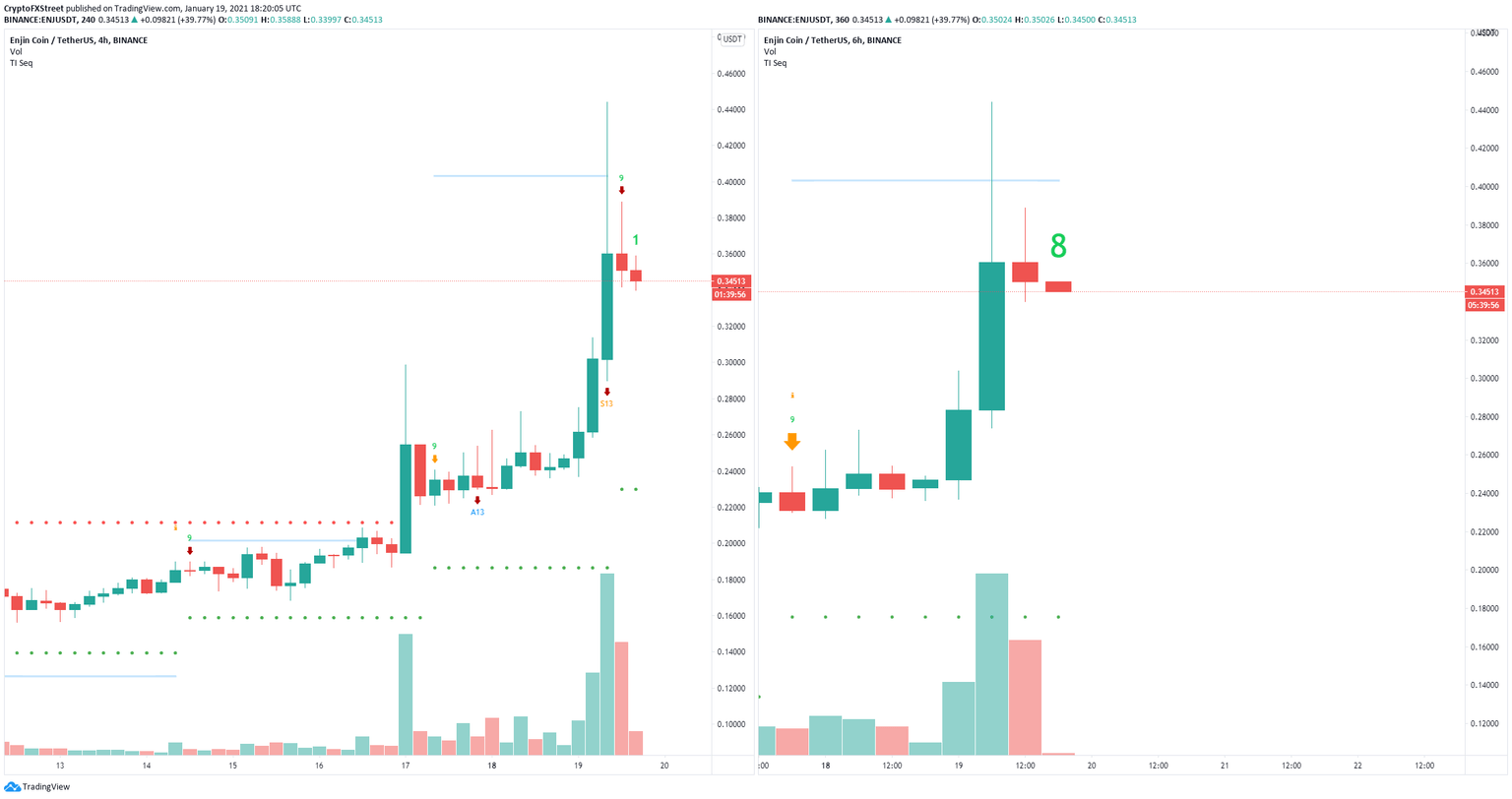

ENJ Sell signals

Additionally, on the 4-hour chart, the TD Sequential indicator has presented a sell signal in the form of a green ‘9’ candlestick and it’s about to do the same on the 6-hour chart. The validation of both signals would be a notable bearish sign.

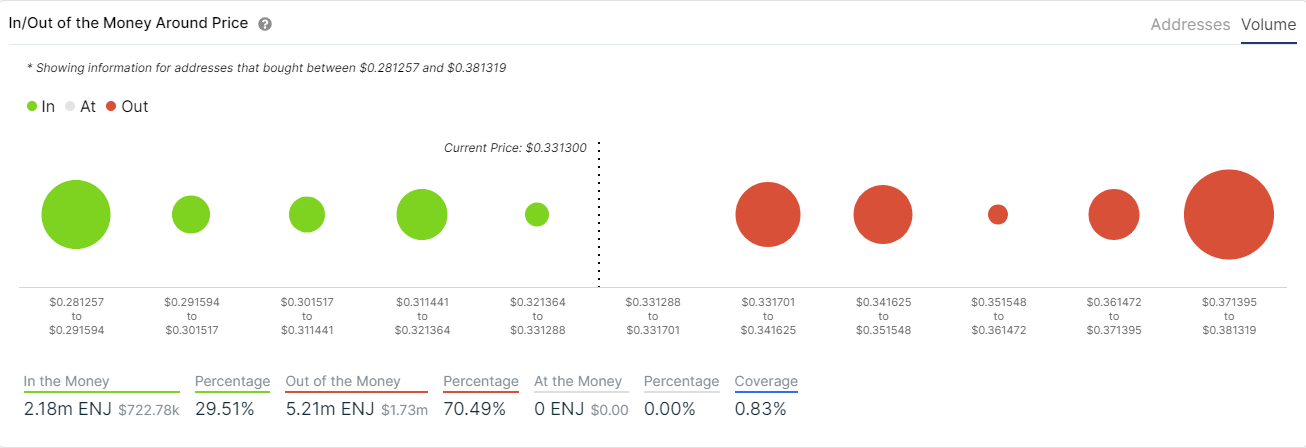

ENJ IOMAP

The In/Out of the Money Around Price (IOMAP) chart shows very weak support on the way down with the most significant area between $0.28 and $0.29 which means Enjin Coin price can rapidly fall towards that range.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.

%2520%5B19.15.44%2C%252019%2520Jan%2C%25202021%5D-637466773626763155.png&w=1536&q=95)

%2520%5B19.16.12%2C%252019%2520Jan%2C%25202021%5D-637466773663639233.png&w=1536&q=95)