Dogecoin prices rally by 21% in one day as Elon Musk makes a presence at Twitter HQ

- Dogecoin prices noted a strong uptick on Wednesday, rising by 14.52% during intra-day trading.

- Elon Musk’s Twitter acquisition deal is expected to be closed by October 28.

- Dogecoin whales have been keeping their heads low for about nine months now.

Dogecoin price noted an unexpected rise on Wednesday, following a green candle from the day before. Two reasons played a crucial role in this rally, the first being the broader market cues and Elon Musk, aka “DOGEfather,” being the second. This bullishness is expected to revive the performance of a crucial cohort of DOGE holders.

Dogecoin price takes a leap

Dogecoin price shot up by 14.52% on Wednesday, bringing the 24-hour rise to 21.22%, with DOGE trading at $0.072. The crypto market cap rising and crossing the $1 trillion mark during the intra-day trading was a factor in DOGE’s rise.

Another factor that contributed to Dogecoin’s rise was Elon Musk’s advancement in the Twitter acquisition. The billionaire made a presence at the Twitter HQ, and while the tweet does not have any correlation with Dogecoin, his influence on the asset’s price in the past justifies this rise.

The deal is reportedly nearing a close and could be done as close as October 28, Friday, bringing the six-month-long ordeal to an end.

Dogecoin price increase also helped the meme coin rise through two major resistances, the 50-day (red) Simple Moving Average (SMA) and the 100-day (blue) SMA. These levels form solid supports and have sustained DOGE’s price rise in the past.

However, since the buying pressure resulted in the asset being overbought, Dogecoin price could see a cooldown. Should the Relative Strength Index (RSI) return to the bullish zone without DOGE falling, the 21% rally would sustain.

Dogecoin whales could be triggered

Dogecoin price whales have considerable domination over the supply, which makes their movement critical to a price rise. However, following the bearish market conditions, these whales have been quiet for the last few months.

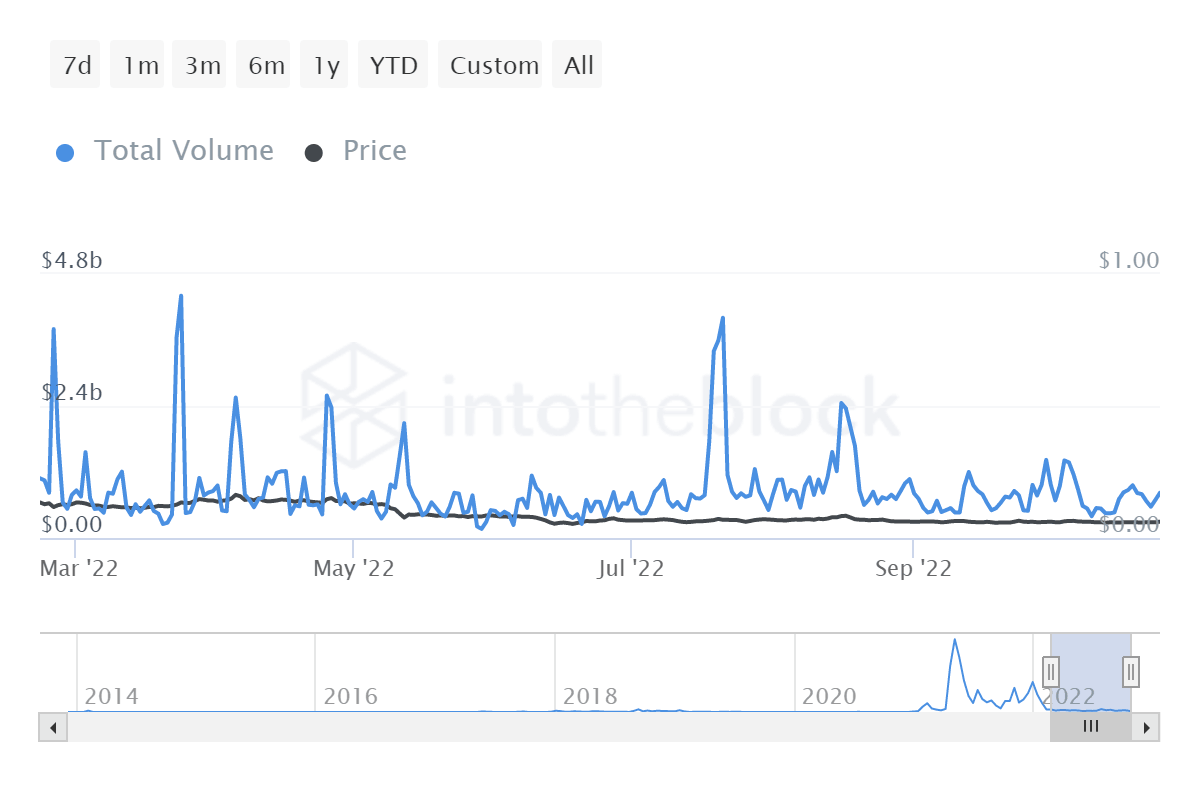

Since Wednesday’s price rise is the biggest since April, whales are expected to become active again, provided Dogecoin price does not slip on the charts. This is crucial for DOGEsince its whale transaction volume has been averaging at $1 billion, with a few spikes every now and then.

Dogecoin whale transaction volume

If Dogecoin’s price maintains its current heading, it might even rise above $0.08, a price level that has not been tested as support in almost five months.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.