Dogecoin Price Prediction: Rebound expected as 60,000 new traders buy the dip

- Dogecoin price reclaims the $0.40 mark on Wednesday, up 10% from the 20-day low of $0.36 seen on Tuesday.

- The number of wallets holding DOGE increased by 60,000 between December 2 and December 11, signalling an influx of new entrants buying the dip.

- The Volume Delta technical indicator shows the DOGE rebound is supported by a significant increase in market liquidity.

Dogecoin price reclaimed the $0.40 territory on Wednesday as bulls staged a 10% rebound within the last 24 hours. DOGE on-chain data trends shows that a large number of new entrants capitalized on the crypto market correction phase to buy the dip.

Dogecoin price reclaims $0.40 as crypto market enter recovery phase

After a volatile start to the week, Dogecoin price has joined other top ranked crypto assets on a rapid recovery phase on Wednesday. Based on recent market reports, the crypto market rebound appears linked to traders reacting positively to the latest consumer inflation report released by US regulators on Wednesday.

While Bitcoin price led the rebound, as it reclaimed the $101,000, Dogecoin also made giant strides reversing a considerable portion of the losses recorded during the crypto market crash on Monday.

The chart above shows how the DOGE price has surged 10.2% as it rose as high as $0.41 Wednesday. This impressive rebound effectively reverses nearly half of the 21.8% losses recorded when prices plunged to a 20-day low of $0.36 on Tuesday.

60,000 new wallets acquired DOGE amid crypto market dip

Investors betting on another imminent Fed rate cut after the latest US CPI data released have evidently propelled Dogecoin and the rest of the crypto market into sharp rebound. However, a closer look as the underlying on-chain trends shows strategic traders capitalizing on the market dip also played a pivotal role in DOGE’s 10% resurgence.

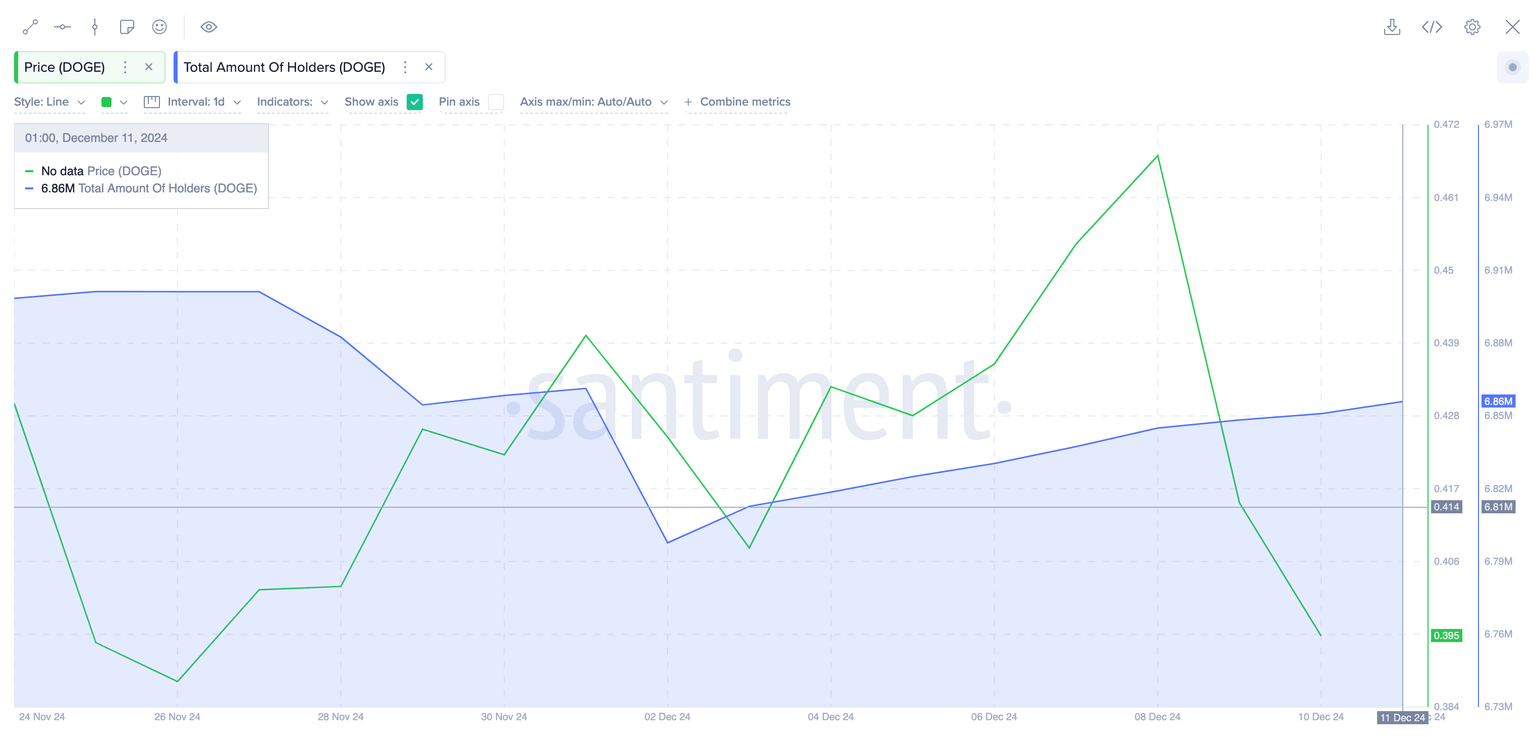

Validating this outlook, Santiment’s chart below monitors real time changes in the number of active funded wallets on the Dogecoin blockchain network. This serves as a proxy for measuring new-user acquisition rate around critical market events.

The blue-shadded portion in the chart above shows that only 6.8 million wallets existed on the Dogecoin network as of December 2. But as crypto markets succumbed to downward volatility over the past week, 60,000 new-user wallets acquired DOGE, bringing the total holder addresses to 6.86 million at press time on December 11.

When a large number of new wallets are created during a market dip, it often signals an influx of new strategic traders capitalizing on the falling prices to enter the fray. Fresh capital inflows from these 60,000 new DOGE wallets effectively increases short-term demand.

Evidently this contributed to setting the stage for the 10.2% DOGE price rebound observed as market sentiment flipped bullish after the US CPI report released on Wednesday.

Dogecoin Price Forecast: $0.50 breakout in focus?

Dogecoin (DOGE) has shown resilience with a 10.2% rebound following the recent market dip, bolstered by bullish momentum after the U.S. CPI report. The daily chart illustrates key technical indicators aligning for a potential extended recovery, yet resistance and support levels demand close attention.

Dogecoin price forecast

The primary resistance to monitor is the $0.46 level, marked by the upper Bollinger Band, which represents a critical psychological threshold.

A breakout above this zone could pave the way toward the next target of $0.50, a level last tested during earlier bullish sentiment waves.

Volume Delta data supports a scenario where consistent buying pressure might push DOGE into new short-term highs, but traders should watch for profit-taking near $0.50.

On the downside, immediate support is found at $0.38, aligned with the lower Bollinger Band.

Breaching this level could invalidate the bullish outlook, exposing DOGE to further corrections. A drop below $0.38 would open the floor to retest $0.36, where stronger support lies.

Author

Ibrahim Ajibade

FXStreet

Ibrahim Ajibade is an accomplished Crypto markets Reporter who began his career in commercial banking. He holds a BSc, Economics, from University of Ibadan.