Dogecoin price grows a shield against this cohort, even as selling from it hits a historic high

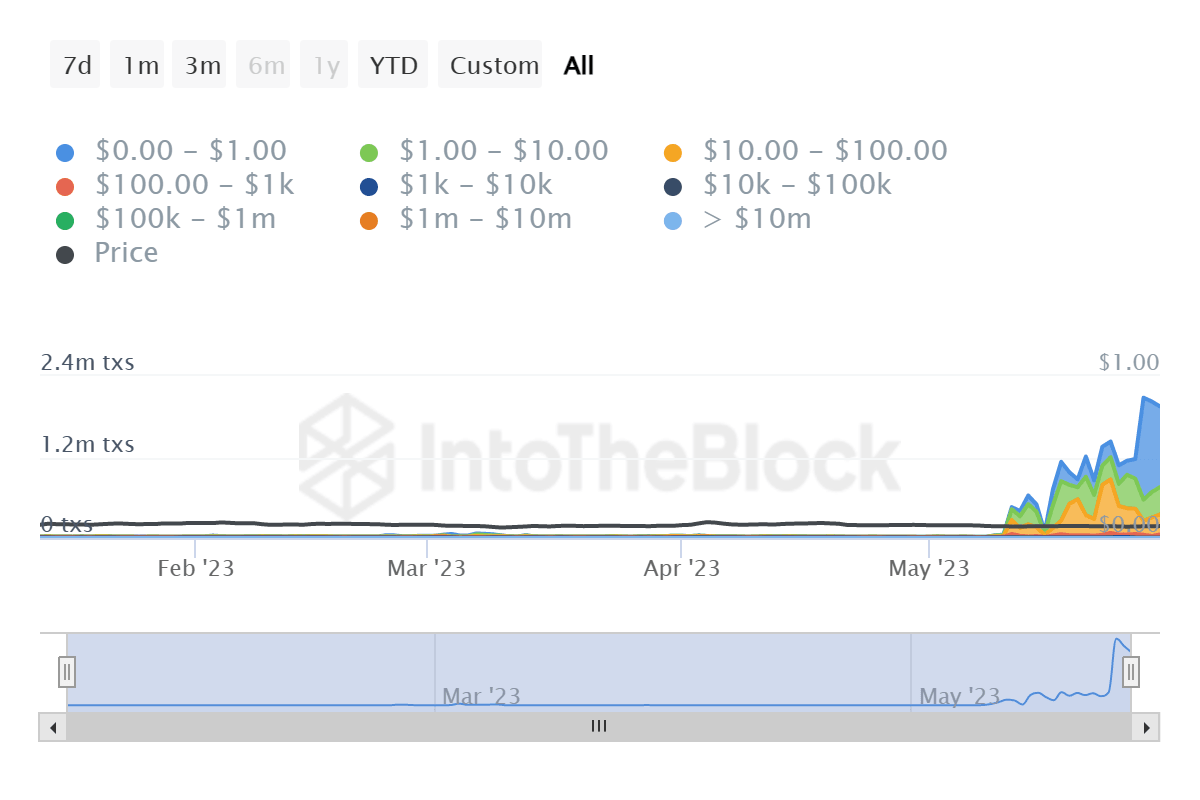

- Dogecoin network noted a sudden uptick in the transactions on the network over the last two days.

- The investors conducting transactions worth less than $1 have the highest concentration of 1.51 million.

- DOGE holders decided to step back from their investment which led to considerable selling with no impact on the price.

Dogecoin price has observed a relatively stable price, in the sense that it is neither marking any recovery nor declining on the charts. While fluctuation in investors’ sentiment is natural during a bear market, DOGE has managed to shield itself significantly.

Dogecoin price stays consolidated

Dogecoin price has been sideways bound since the beginning of the month. Regardless of the change in the macroeconomic conditions, broader market cues and even investors’ behavior, DOGE is keeping above the $0.7 mark.

DOGE/USD 1-day chart

The meme coin is strengthening its ability to prevent being disconcerted to the point where even investors’ selling is not doing much to the price. This becomes more evident over the last couple of days when small transactions hit a historic high. Between May 26 and the time of writing, transactions worth less than a Dollar increased from 290k to 1.19 million transactions.

Dogecoin transaction distribution by value

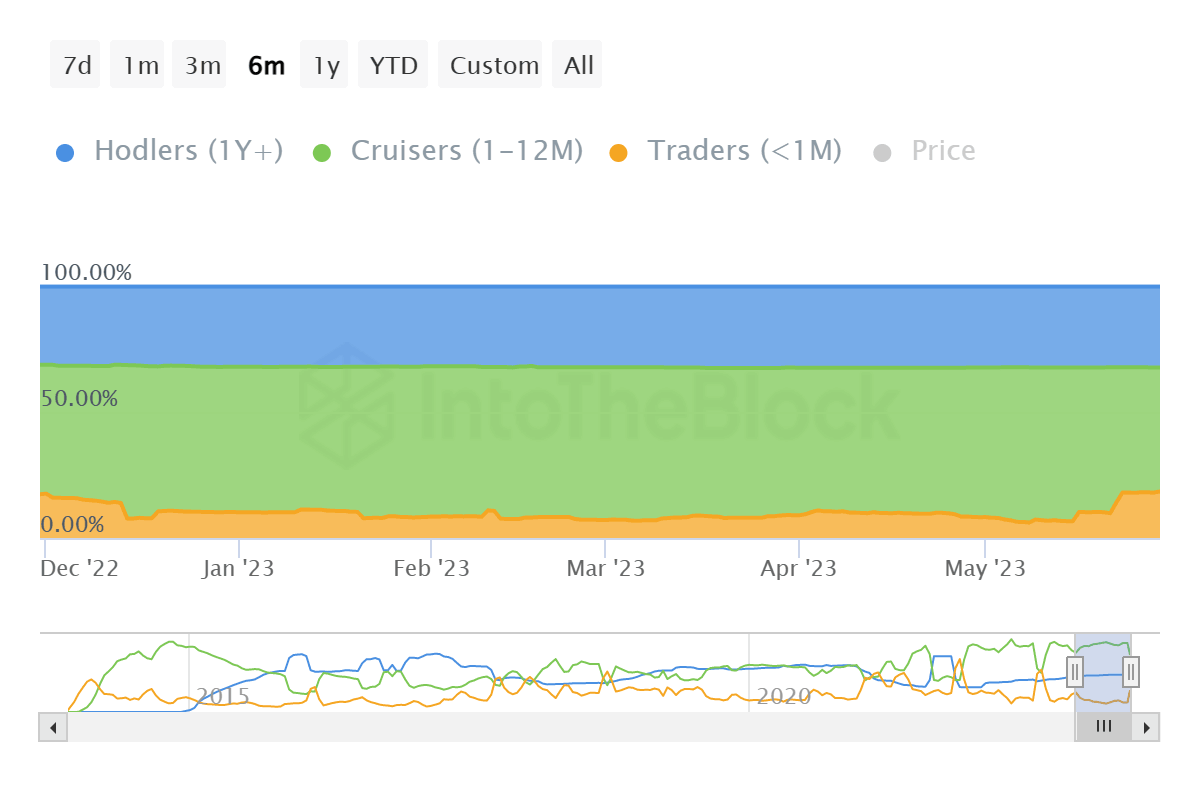

This can also be seen in the change in supply distribution by time held. Cruisers or mid-term holders are addresses holding assets between a month and a year, and Traders (Short-term holders) have only held their tokens for less than a month. The supply held by the latter cohort nearly doubled over the last week.

Short-term holders now hold above 18% of the entire circulating supply, while mid-term holders dominate about 49% of the supply, down from 57% in the same duration.

Dogecoin supply distribution by time held

This is a positive sign for Dogecoin price as it reveals that the impact of smaller transactions is diminishing to the point where even historic highs are not an important factor for price action.

The only selling or buying that holds/can have any effect on price action is that of whales, i.e., investors conducting transactions worth more than $100,000.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.