Decentraland Price Prediction: MANA returns to stable support delaying its 35% rally

- Decentraland price showed a clear trend reversal pattern form on February 24, signaling a 55% uptrend.

- While the upside target remains the same, MANA is currently experiencing a lack of buying pressure.

- A daily candlestick close below $2.20 will invalidate the bullish triple bottom setup.

Decentraland price set up a triple bottom setup between November 2021 and February 24, signaling a full-blown reversal. While optimistic, this uptrend failed to catch traction as MANA consolidates around a support level.

Decentraland price delays its upswing

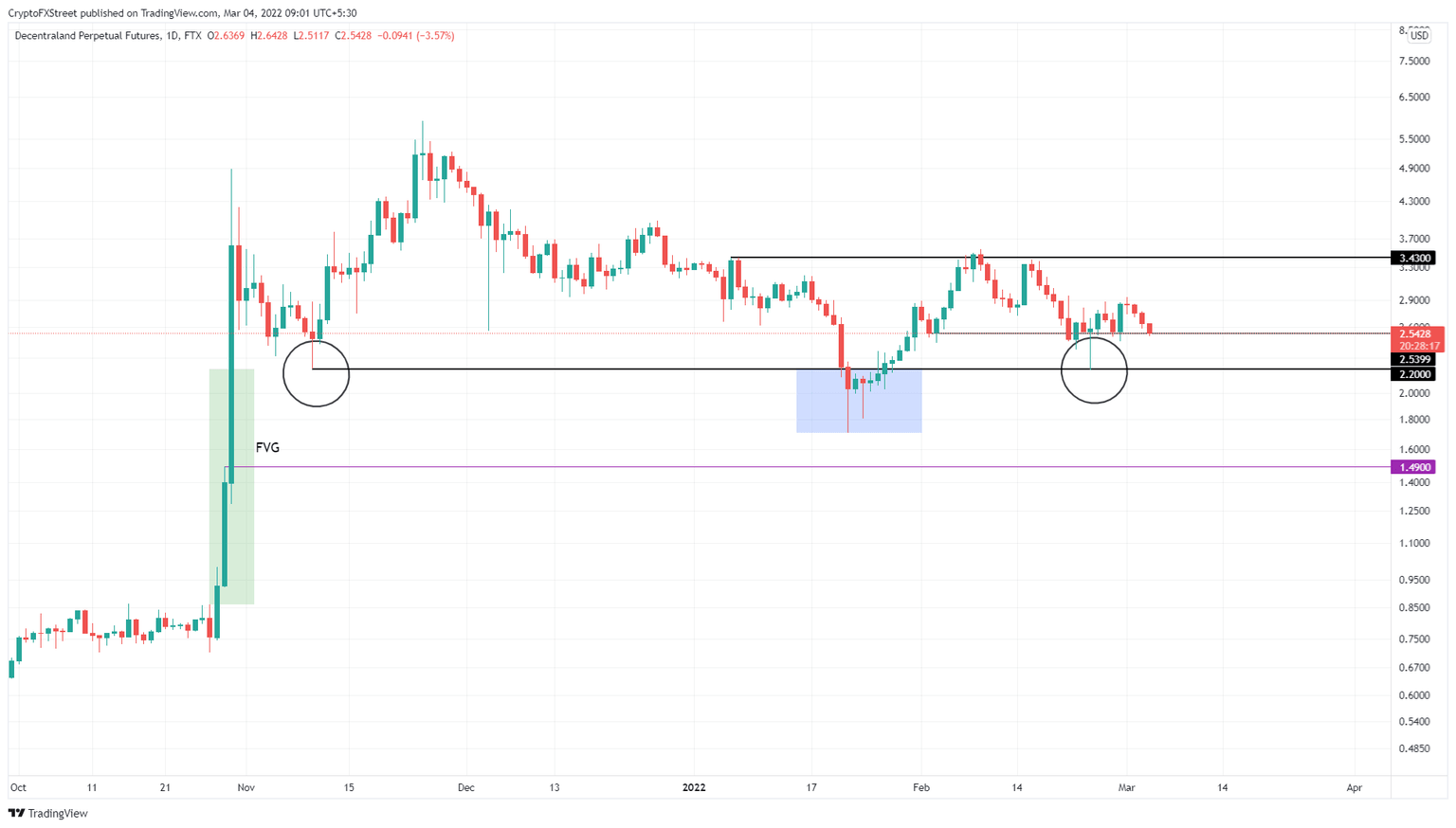

Decentraland price tagged the $2.20 support level for the first time on November 10, 2021, and swept below it on January 22. After a 108% ascent from the latest swing low, MANA retraced to $2.20, tagging the $2.20 barrier for the third time, revealing a triple bottom setup.

This technical formation forecasts a trend reversal. However, the bounce after the last tag failed to catch traction and is consolidating above the $2.54 support level. A resurgence of buying pressure is likely to propel Decentraland price by 35% to retest the immediate resistance barrier at $3.43.

Market makers are likely to push Decentraland price to sweep above $3.43 to collect the sell-stop liquidity resting above it and set a local top.

MANA/USDT 1-day chart

The lack of momentum and the consolidation of Decentraland price can be explained by taking a look at the number of new addresses joining the Decentraland blockchain. Over the past month, the new participants interacting with MANA have remained more or less the same - around 1,000.

This lack of interest but a steady flow of new investors indicates why MANA has been consolidating after the recent retest of $2.20.

MANA new addresses chart

Further adding credence to the lack of demand in Decentraland price is the drop in large transactions worth $100,000 or more from 104 to 99 over the past month. This index serves as a proxy of whales’ investment interests and can be used to time massive surges or local tops.

Since this number has declined by a small amount, it indicates that there is interest among such investors but not to the extent that might cause it to move higher.

Unless these metrics show a quick uptick, MANA will likely continue going sideways.

MANA large transactions

On the other hand, if the Decentraland price breaks down the immediate support level at $2.54, it will indicate a weakness among buyers. However, a daily candlestick close below $2.20 will create a lower low and invalidate the triple bottom setup.

In this scenario, MANA might consolidate here, before establishing a directional bias.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.