Cryptocurrencies Price Prediction: SafeMoon, ApeCoin & Cardano — Asian Wrap 1 July

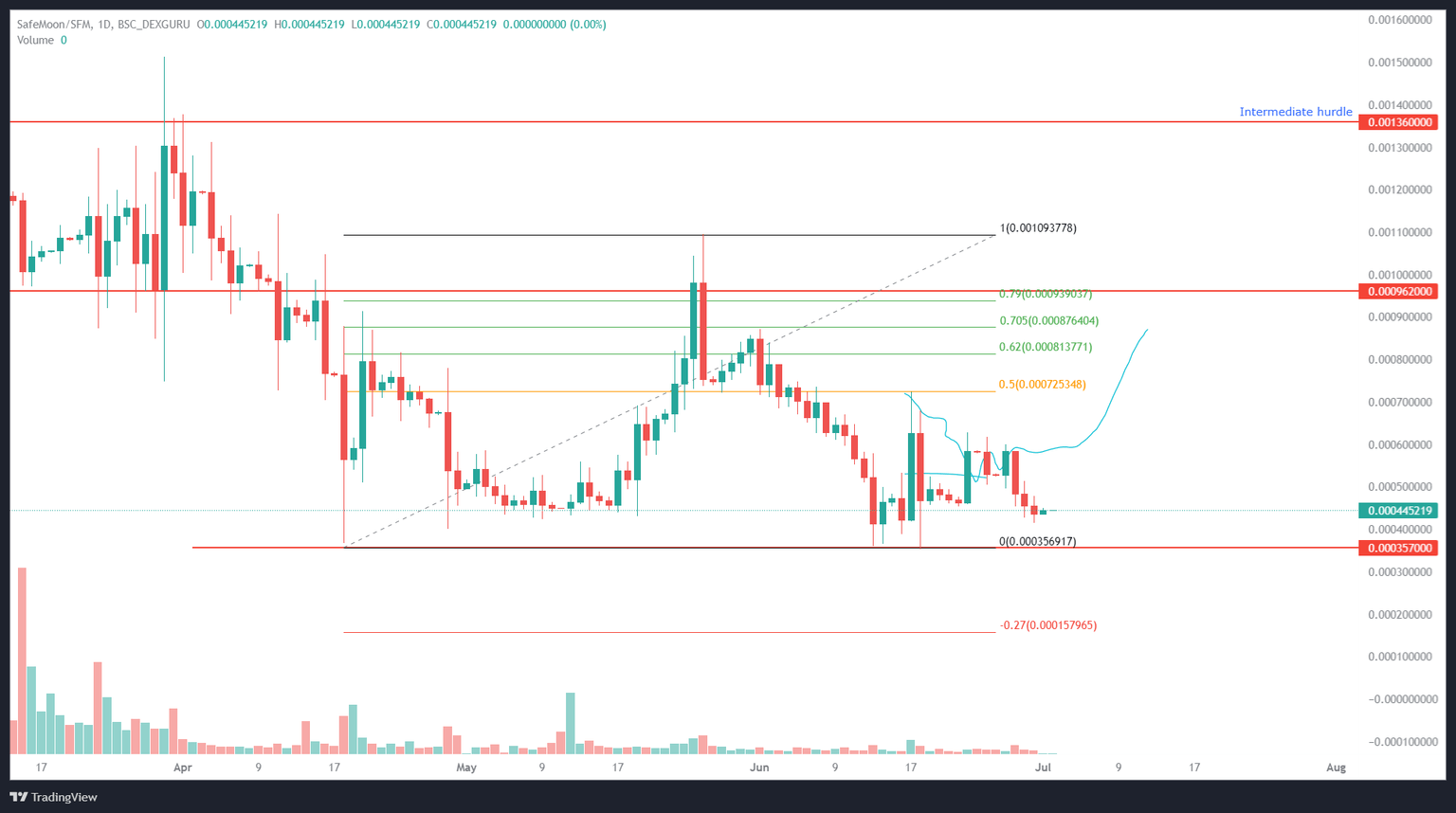

Can the second half of 2022 be kind to SafeMoon price?

SafeMoon price shows a bullish outlook that seems too good to be true. Investors that do not practice proper risk management could get caught off guard.

SafeMoon price consolidated between the $0.000584 and $0.000414 levels since June 19. This coiling up capped the altcoin’s volatility. However, the recent bounce off the lower limit suggests that SAFEMOON is ready for a quick move higher.

Will the ApeCoin price fall to $2 this summer

ApeCoin price shows incoming sell-off signals on the final day of June. It is best to wait for a breach of the invalidation level before counter-trend trading the Ethereum-based NFT Token.

ApeCoin price shows concerning signals to end the month of June. On June 18, the bulls managed to rally an impressive 75%. The expected profit-taking consolidation saw additional weighted pressure from bearish breakout traders . APE price has fallen 22% since the 75% rally at the time of writing. The technicals portray the potential for more downside as the bears are snowballing the bearish momentum.

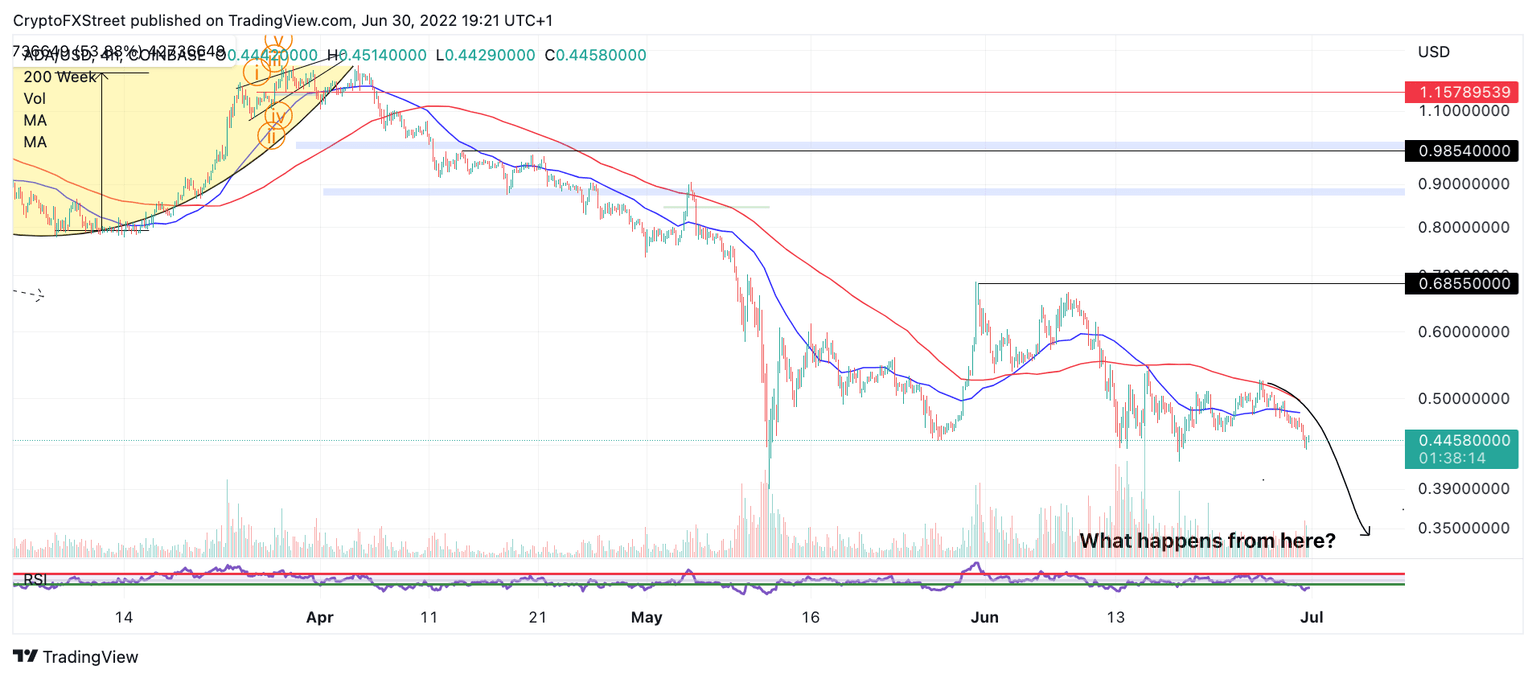

Cardano price has fallen beneath $0.45, here’s what to expect in July

Cardano price shows no evidence to believe in a trend reversal. Expect calamity.

Cardano’s ADA price shows the continuation of the bearish trend is likely underway. Since June 25, what first appeared to be a simple consolidation within two coiling simple moving averages, quickly turned into a bearish blitzkrieg as traders came out to suppress the Cardano price. The ongoing downtrend could become increasingly powerful as the bears aim to besiege the liquidity levels under the June 18 swing low at $0.42. A breach of this low could be devastating for bulls in the market as the Cardano price could plummet an additional 50% into the $0.20 price level.

Author

FXStreet Team

FXStreet