Cryptocurrencies Price Prediction: Hyperliquid, Bitcoin & Ethereum — Asian Wrap 18 June

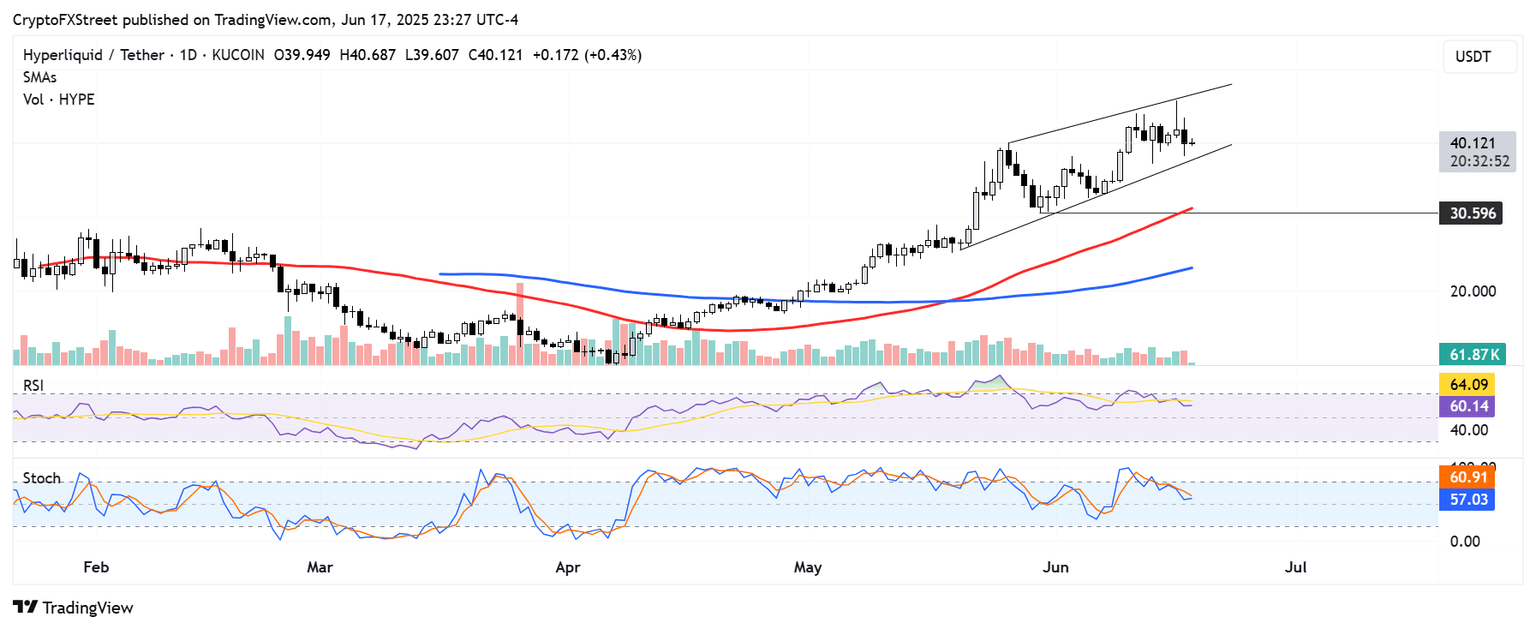

HYPE drops 6% amid Eyenovia plans to establish Hyperliquid treasury

Hyperliquid (HYPE) sustained a 6% decline on Tuesday despite Nasdaq-listed Eyenovia's (EYEN) announcement that it entered a securities purchase agreement to offer up to $50 million of its shares to establish a HYPE treasury. The company announced that it has entered into a securities purchase agreement for a $50 million private placement in public equity offering (PIPE) with accredited investors. The company plans to use the funds to establish its Hyperliquid treasury.

Top 3 Price Prediction: Bitcoin, Ethereum, Ripple – BTC, ETH, and XRP dips as US involvement in Israel-Iran conflict looms

Bitcoin price declined sharply, falling from the June 10 open of $110,274 to the June 11 close of $105,671, creating a Fair Value Gap (FVG) at approximately $108,064. This bearish FVG marks a key resistance zone, meaning that once Bitcoin collects liquidity, it is likely to continue its correction. On Monday, BTC retested and faced a slight pullback from this FGV zone, closing the day up by 1.14%. However, it declined by 2.10% the next day and retested its 50-day Exponential Moving Average (EMA) around $103,070. At the time of writing on Wednesday, it hovers at around $105,000.

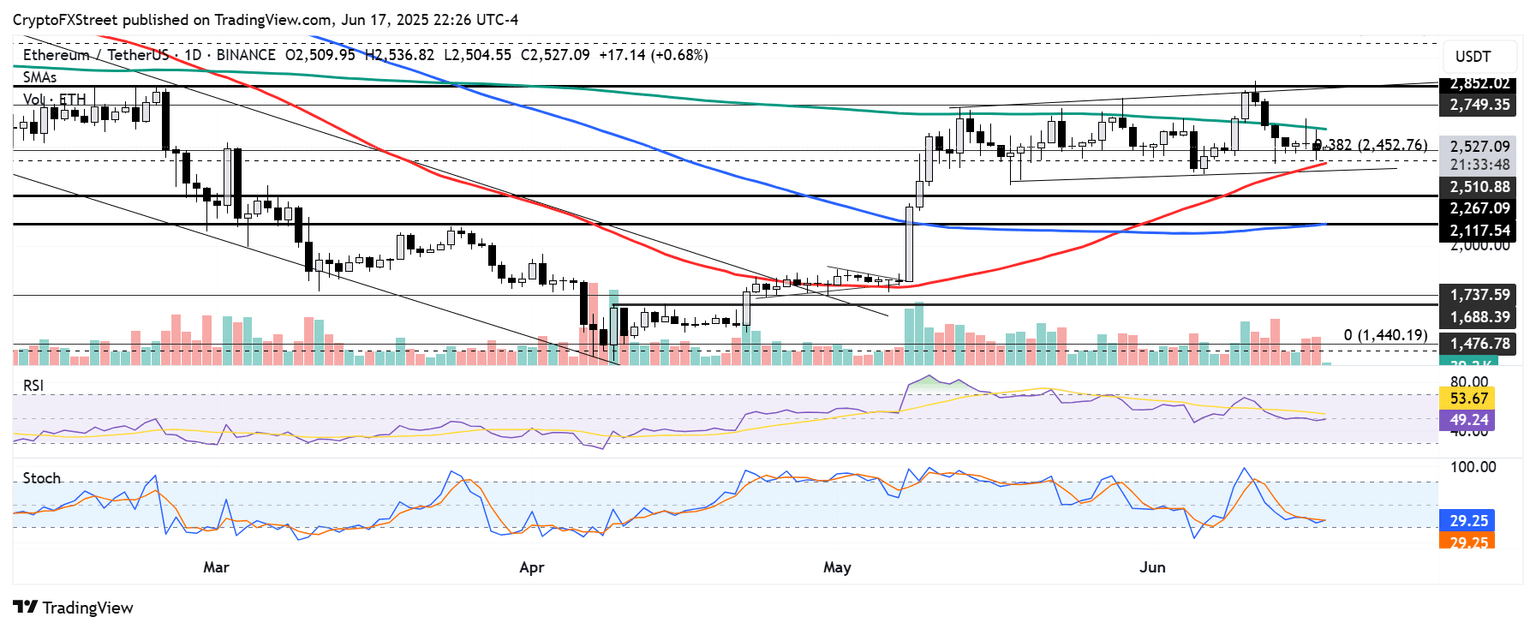

Shorts weigh on Ethereum amid whale accumulation and strong ETH ETF inflows, and experts reveal why

Ethereum (ETH) is down 2% on Wednesday amid a simultaneous growth in accumulation and short positioning across ETH futures. The divergence follows investors leveraging a delta-neutral play to scoop yield. Ethereum whales expanded their holdings in the past week, scooping about 800K ETH daily, with the balance of 1K-10K wallets surpassing 14.3 million ETH, per Glassnode data.

Author

FXStreet Team

FXStreet