HYPE drops 6% amid Eyenovia plans to establish Hyperliquid treasury

- Eyenovia announced that it has entered into a sales agreement for a $50 million PIPE offering to establish a Hyperliquid treasury.

- The company intends to purchase up to 1 million HYPE from the proceeds of the offering.

- HYPE declined 6% in the past 24 hours despite the announcement.

Hyperliquid (HYPE) sustained a 6% decline on Tuesday despite Nasdaq-listed Eyenovia's (EYEN) announcement that it entered a securities purchase agreement to offer up to $50 million of its shares to establish a HYPE treasury.

HYPE declines despite Eyenovia's plan to establish a Hyperliquid reserve

Digital ophthalmic technology company Eyenovia plans to become the first publicly traded company to implement a Hyperliquid treasury strategy.

The company announced that it has entered into a securities purchase agreement for a $50 million private placement in public equity offering (PIPE) with accredited investors. The company plans to use the funds to establish its Hyperliquid treasury.

Eyenovia's offering will include the issuance of over 30 million shares of its common stock, which it expects will generate proceeds of approximately $150 million "if the warrants are exercised in full."

The offering, expected to close on June 20, could enable the company to purchase up to 1 million HYPE to "become one of the top globally active validators for Hyperliquid."

Eyenovia also plans to launch a HYPE staking initiative to safeguard its digital assets through a collaboration with Anchorage Digital.

Following the close of the offering, the company plans to rebrand to Hyperion DeFi and also change its ticker to HYPD. However, Eyenovia will maintain its current line of business, which includes developing a Gen-2 Optejet User-Filled Device (UFD).

In line with the changes, Eyenovia has appointed Hyunsu Jung as its Chief Executive Officer and a member of the Board.

"I am honored and excited to join the Eyenovia team to help lead this pioneering cryptocurrency treasury strategy built around what we believe to be the most robust digital asset, HYPE," Jung stated in the press release.

The company is the latest in an expanding list of public companies to adopt a cryptocurrency treasury strategy. It also joins the likes of Strategy and DeFi Development Corporation, who did a restructuring of their business models to reflect their new crypto-focused reserve plan.

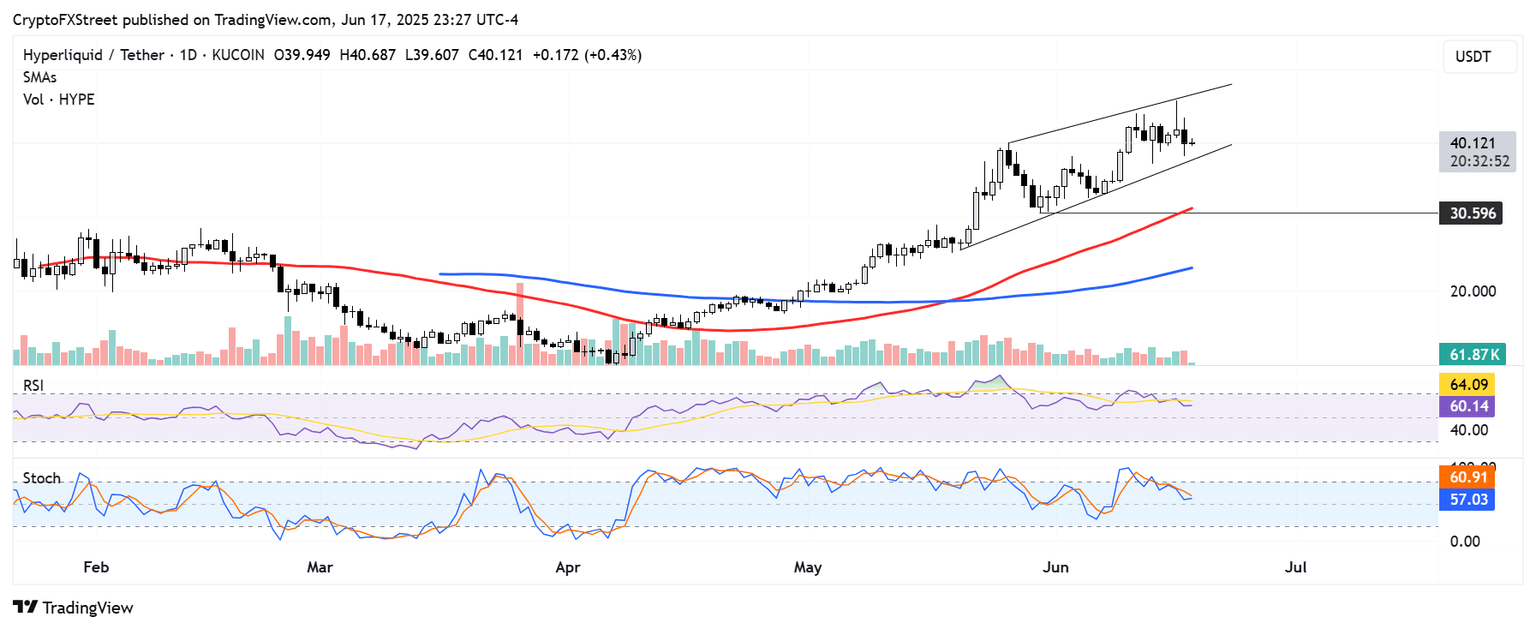

HYPE is down nearly 6% in the past 24 hours despite the announcement. The altcoin could find support near the lower boundary of a key channel if the decline continues. A move below the key channel could see HYPE find support at $30.5.

HYPE/USDT daily chart

On the upside, HYPE has to cross above the upper boundary of the channel and hold it as support to resume its uptrend.

The Relative Strength Index (RSI) and Stochastic Oscillator (Stoch) are above their neutral levels but trending downward. A successful crossover below will accelerate the bearish momentum.

Author

Michael Ebiekutan

FXStreet

With a deep passion for web3 technology, he's collaborated with industry-leading brands like Mara, ITAK, and FXStreet in delivering groundbreaking reports on web3's transformative potential across diverse sectors. In addi