Cryptocurrencies Price Prediction: Bitcoin, Ripple & Ethereum – Asian Wrap April 21

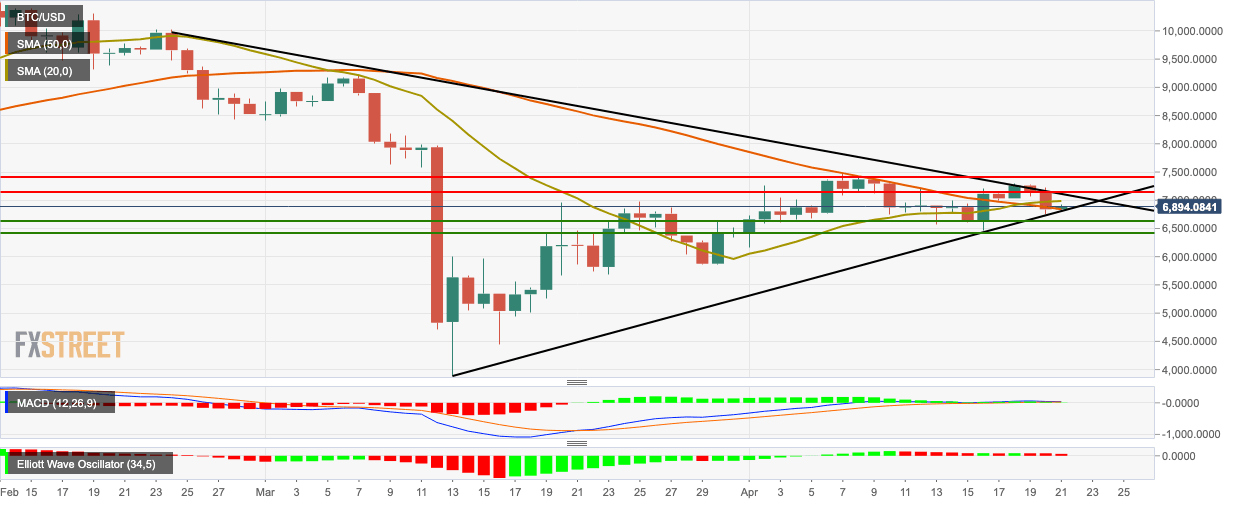

Bitcoin Price Analysis: BTC/USD is sandwiched between the SMA 50 on the downside and SMA 20 on the upside

BTC/USD bounced up from the support provided by the SMA 50 to go from $6,838.84 to $6,897.66 and is consolidating in a triangle formation. The bulls will need to gather enough momentum to break past the resistance at the SMA 20, before testing the downward trending line.

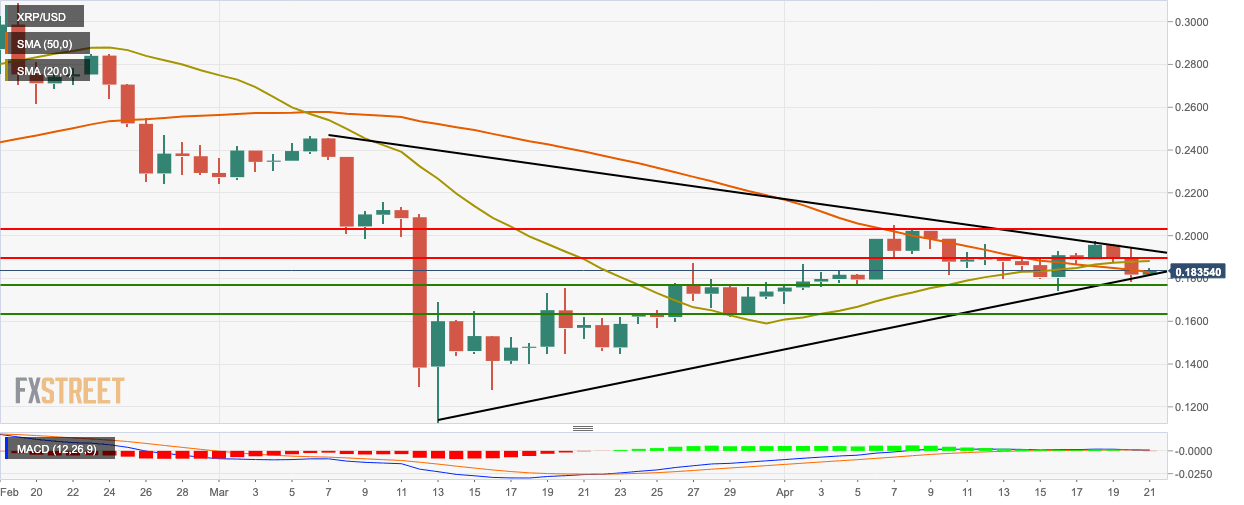

Ripple Price Analysis: XRP/USD bulls stage a comeback following two straight bearish days

XRP/USD found support at the upward trending line and bounced up from $0.1817 to $0.1832. In the process, it broke past resistance at the SMA 20 curve. The bulls will want to next aim for the SMA 50 and then the downward trending line. The MACD indicates a reversal of bullish momentum.

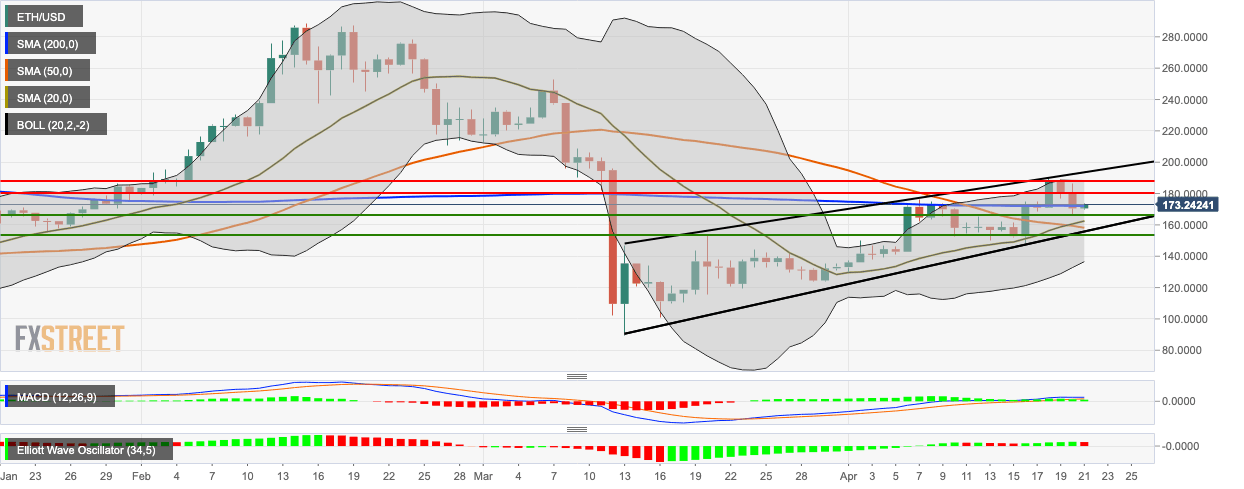

Ethereum Price Analysis: ETH/BTC bulls take over, breaks past SMA 200

ETH/USD went up from $170.50 to $173.43 in the early hours of Tuesday. The price broke past the resistance offered by the SMA 200. The SMA 20 has crossed over the SMA 50 to chart the bullish cross pattern. The price is presently charting in an upward channel formation.

Author

FXStreet Team

FXStreet