Cryptocurrencies Price Prediction: Bitcoin, ImmutableX, ApeCoin – European Wrap 28 July

Grayscale advocates for spot BTC ETF approvals on behalf of customers but wants its GBTC added to the mix

Grayscale asset management has submitted a comment letter to back its Grayscale Bitcoin Trust’s (GBTC) pending 19b-4 filing, adding to the list of the seven who have already submitted Spot BTC ETF filings to the US SEC for consideration.

Grayscale, which boasts up to $7 billion in assets under management, has written a comment piece to the US Securities and Exchange Commission (SEC). Through its legal team led byDavis Polk, the asset manager attempts to convince the financial regulator why approving all the spot BTC Exchange Traded Funds (ETF) applications would be the better decision.

ImmutableX price rallies 16% while Bitcoin, Ethereum and Ripple consolidate

ImmutableX (IMX) price saw a massive surge in buying pressure after a huge uptick in interest from traders. This outlook comes as Bitcoin price continues to trade sideways, hugging the $30,000 psychological level. Considering the way altcoins are pumping and dumping, this uptick could also be short-lived, with the possibility that these gains are undone quickly.

ImmutableX (IMX) price rallied 16% in less than three hours on Friday, increasing from $0.722 to $0.842. This uptick can be attributed to the massive 248% upswing in Open Interest. The number of contracts saw an increase to $21 million.

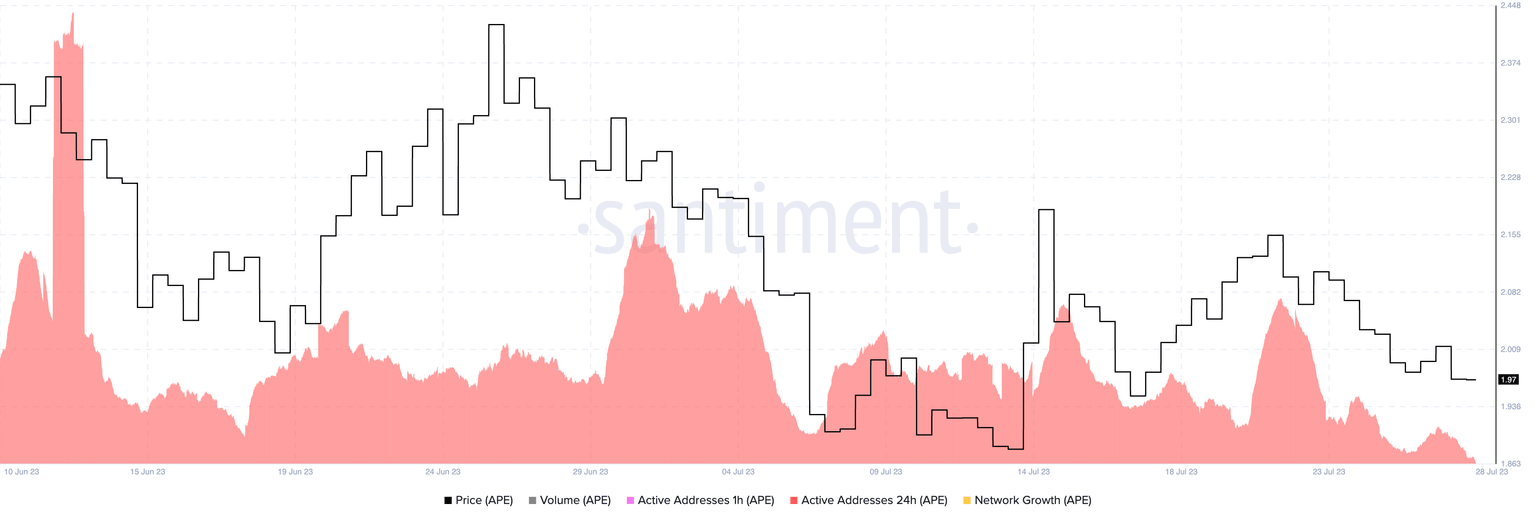

ApeCoin price likely to pull back as on-chain metrics flip bearish

ApeCoin, one of the largest metaverse tokens in the ecosystem, is struggling to recover as the selling pressure on the asset seems to be on the rise. The ERC-20 governance and utility token’s on-chain metrics have flipped bearish this week, signaling that a further pullback in APE price is likely.

On-chain metrics like daily active addresses, social dominance and supply on exchanges have turned bearish for APE this week. This is key for APE holders and market participants as changes in on-chain metrics are likely to influence sentiment among traders.

Author

FXStreet Team

FXStreet