Cryptocurrencies lose steam after monday's bounce

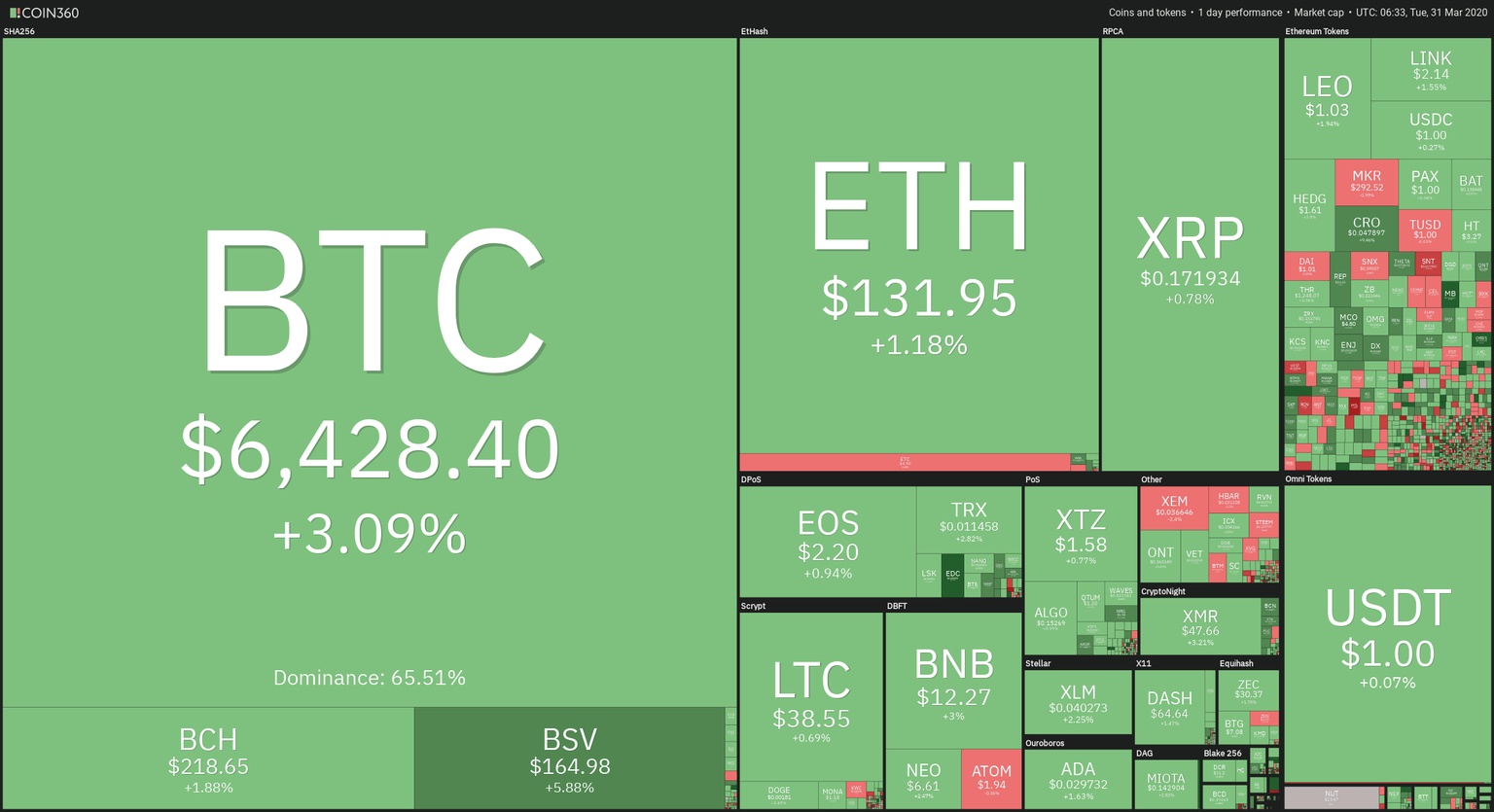

On Monday, cryptocurrencies experienced a nice bounce from the short-term bottom made during the weekend, but the volume was low, meaning a lack of conviction by the buyers. In the last hours, the volatility almost halted as a consequence of the lack of volume. Thus, cryptocurrencies are drifting since then, even losing some ground. Bitcoin (+2.85%) and Bitcoin SV(+5.12%) are the currencies that held most of the 24-hour gains. On the Ethereum-based section, REP (+5.22%) and CRO (+9.1%) lead the gains of the most capitalized tokens.

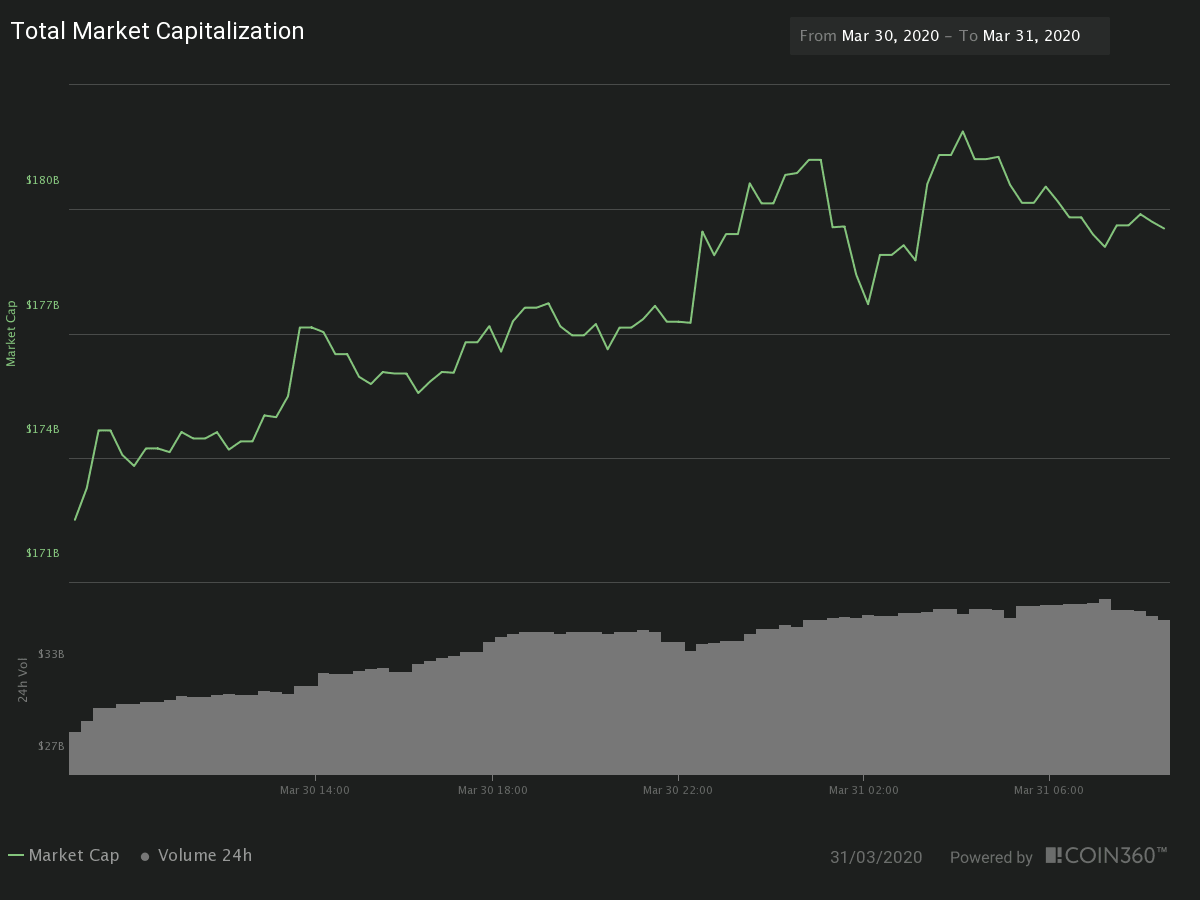

The market cap of the crypto sector is currently $179.536, about 7 billion up from its previous 24-hour value, a 4 percent increment. The traded volume in the last 24 hours was $37.2 billion (+18%), 7 billion higher than on Sunday, and the dominance of Bitcoin has stabilized at 65.5 percent.

Hot News

Binance has announced today the launch of Binance KR, a new crypto exchange for the Korean customers. The new exchange will be powered by Binance Cloud, a framework for Binance partners and customers to help them launch digital asset exchanges using "Binance's technology, security, and liquidity."

The Opera web browser has expanded crypto services in the EU countries through Wyre collaboration. Wyre is a US-based crypto remittance platform. The result is that now Opera offers seamless crypto buying, meaning users do not need to go to an exchange to purchase crypto assets. "Being able to acquire cryptocurrencies without having to go through an exchange, directly from the wallet makes the process easy for our users. Expanding this feature to more regions is key to driving blockchain-adoption. " (Source: btcmanager.com)

Technical Analysis - Bitcoin

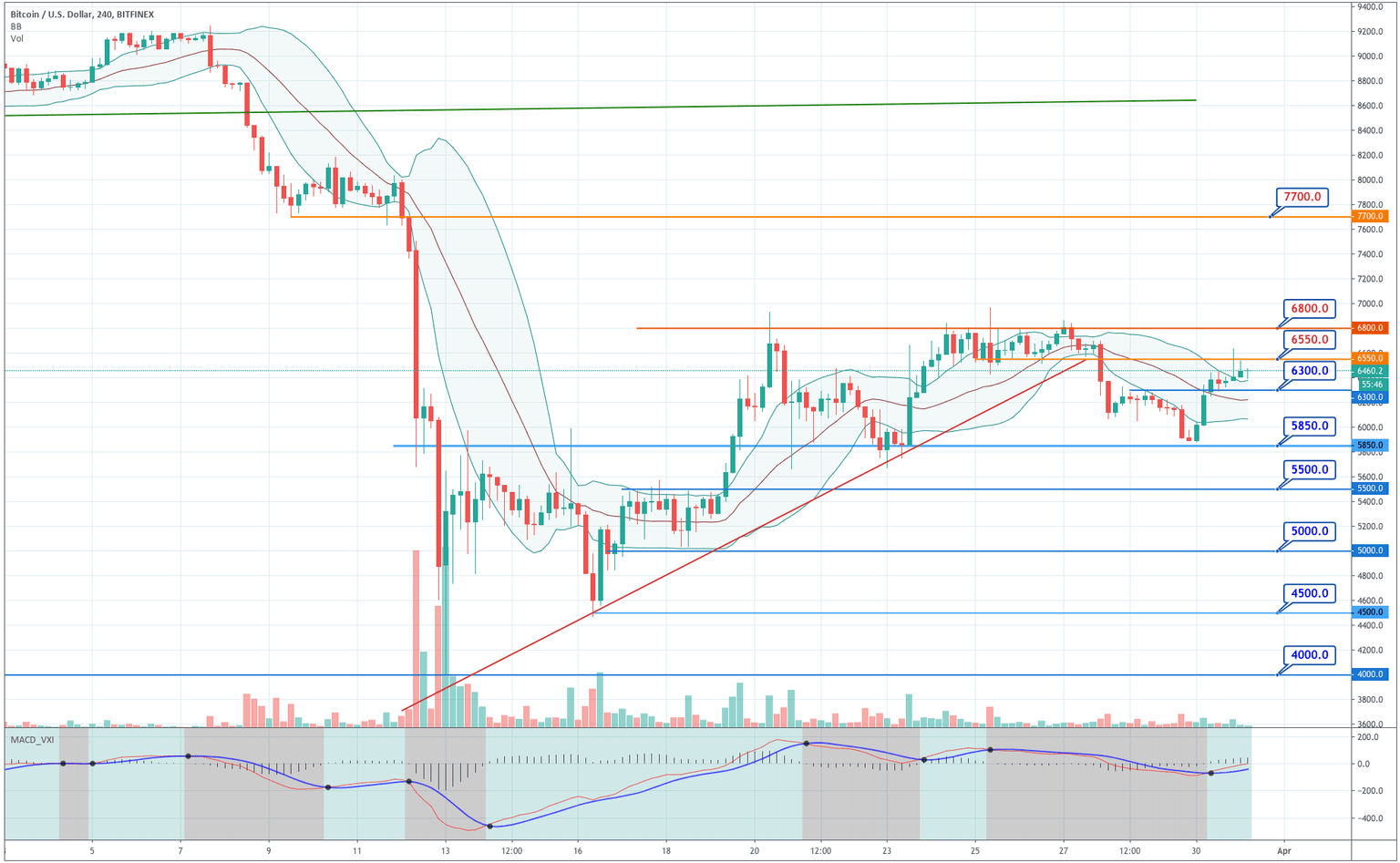

Bitcoin is moving slightly up with low volume. The MACD and the price moving above the +1SD line shows the bullish bias, but it is finding resistance at $6,550. If it is not pierced soon, it may find sellers to drive it southwards. The other critical level is $6,300. A break with a close below it could make it visit $5,850 again.

|

Support |

Pivot Point |

Resistance |

|

6,000 |

6,300

|

6,550 |

|

5,850 |

6,800 | |

|

5,500 |

7,000 |

Ethereum

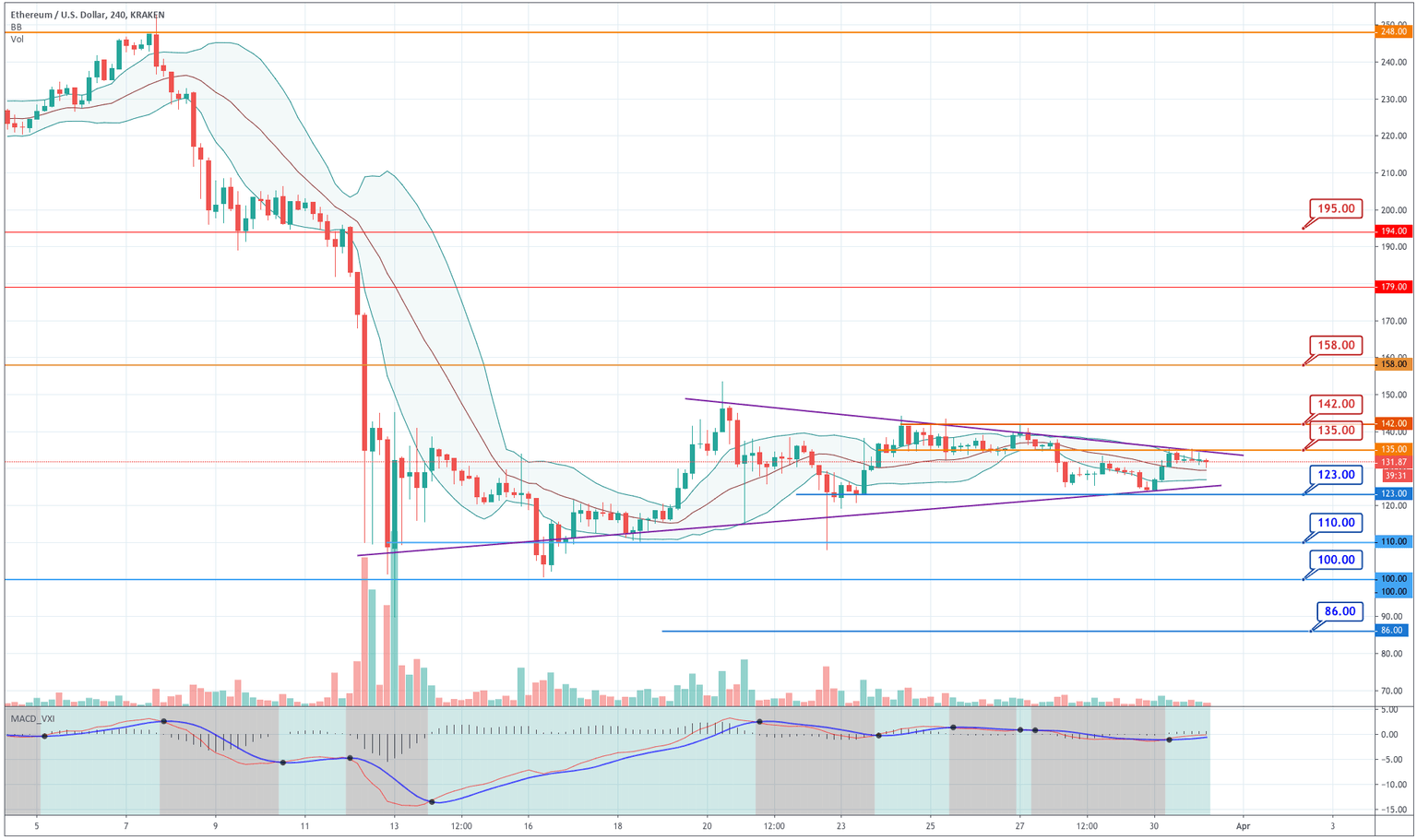

With the latest movements, Ethereum is displaying a horizontal wedge. The price is currently near the top trendline, showing resistance to more price increments. On the technical side, the MACD and the price above its +1SD Bollinger line show bullish bias. ETH needs to close above $135 to convince buyers of a new leg up. Volume is thinning as is usual in sideways triangular formations. So, traders should need to wait for direction. A close below $123 will signal another leg down. Whereas, above $142 will find buyers to push it higher to $158 and beyond.

|

Support |

Pivot Point |

Resistance |

|

123.00 |

129.00

|

135.00 |

|

119.00 |

142.00 | |

|

100.00 |

150.00 |

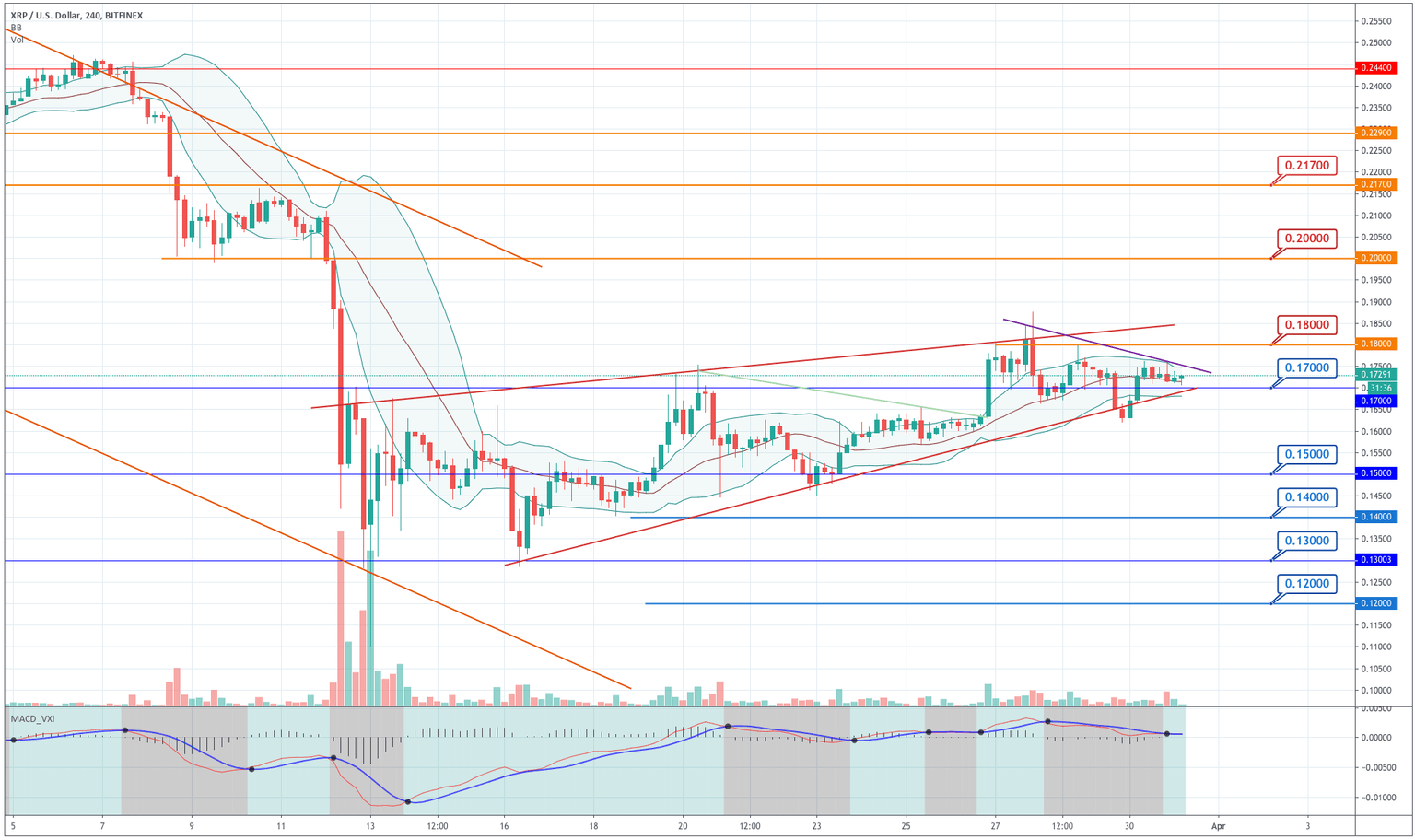

Ripple

Ripple still moves inside its ascending wedge. Its price is making a series of lower lows, which make a triangular formation with the lower ascending trendline. That means there is indecision among traders on which direction it should move. The volume is thin, and it grows on the bearish candles, which is not favorable for the price. As with Ethereum, traders should wait for direction. The crucial levels to keep an eye on are, $0.17 for downward movements, and $0.18 for bullish breakouts.

|

Support |

Pivot Point |

Resistance |

|

0.1630 |

0.1700

|

0.1800 |

|

0.1500 |

0.1850 | |

|

0.1400 |

0.1900 |

Author

EagleFX Team

EagleFX

EagleFX Team is an international group of market analysts with skills in fundamental and technical analysis, applying several methods to assess the state and likelihood of price movements on Forex, Commodities, Indices, Metals and