Crypto.com token may hit $0.40 before CRO continues uptrend

- Crypto.com price continues to slide lower with little support in sight.

- CRO is close to making new two-months lows.

- A price drop of over 20% may be necessary before buyers take interest.

Crypto.com price was one of the best performing cryptocurrencies of the last quarter of 2021. Buoyed by solid fundamentals like the Staples Center being renamed the Crypto.com Arena, Crypto.com saw significant mainstream attention to the CRO token. However, pressure from a sell-the-news event continues to plague CRO’s current price action.

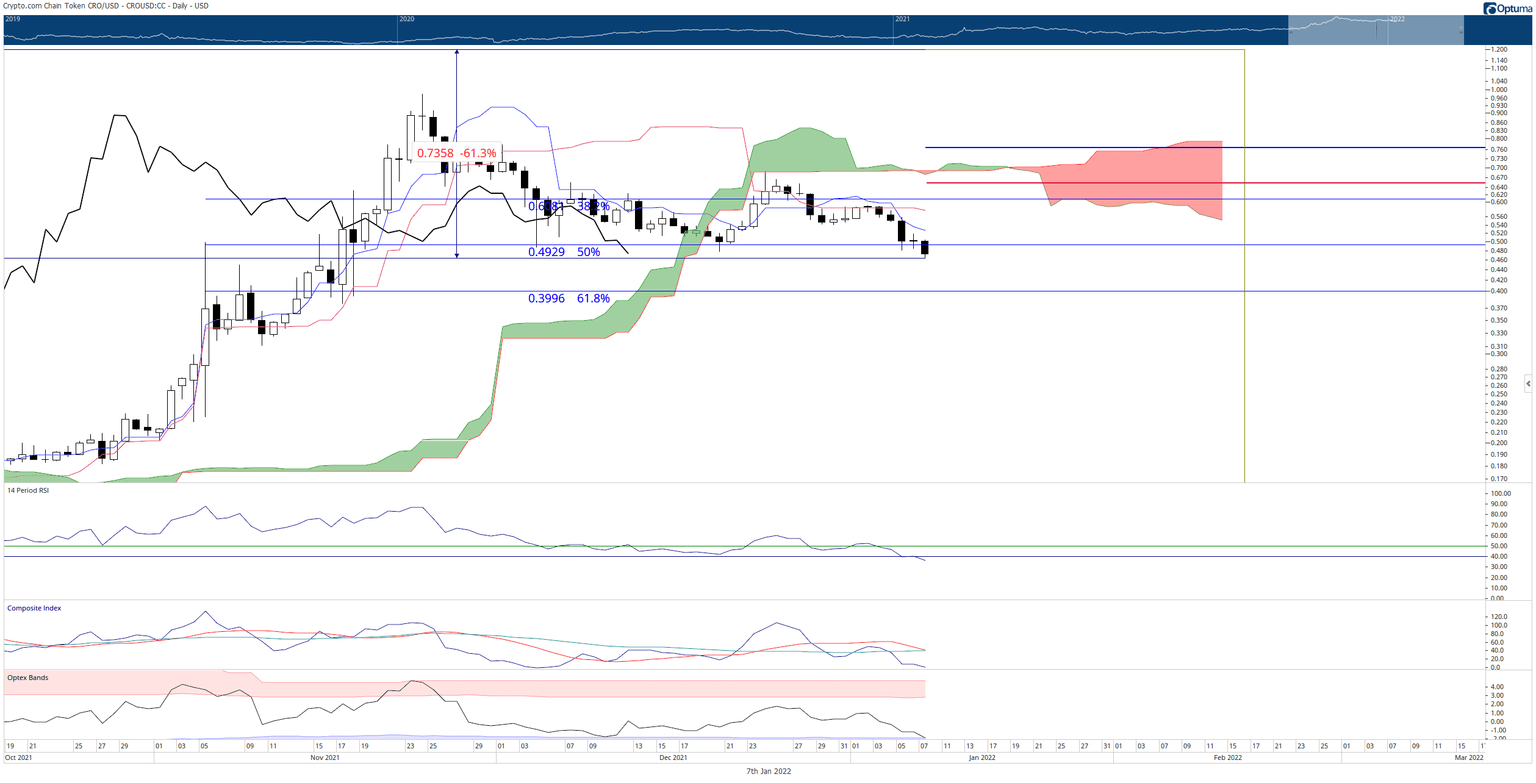

Crypto.com price off more than 60% from all-time highs made on November 27

CRO price action is in a clear bearish drive south. CRO is facing extreme pressure from responsive selling off of an Ideal Bearish Ichimoku Breakout entry within the Ichimoku Kinko Hyo system. Unfortunately, no Ichimoku support exists until the $0.40 value area.

The Chikou Span is the final component on the daily Ichimoku chart that can provide some reprieve from further selling pressure. However, that reprieve will likely come in the form of support at the top (Senkou Span A) of the Cloud directly below the Chikou Span within the $0.40 value area. Consequently, CRO price would test the 61.8% Fibonacci retracement at $0.40 at the same time.

CRO/USDT Daily Ichimoku Chart

If Crypto.com bulls want to invalidate the current bearish outlook, buyers need to push Crypto.com to a close at least above the Tenkan-Sen at $0.53. Ideally, buyers would push CRO to a close above the Tenkan-Sen, Kijun-Sen, and 38.2% Fibonacci retracement around the $0.62 value area. That would also position the Chikou Span above the candlesticks and into open space, limiting the majority of any further threats to the downside.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.