- Crypto.com price is hovering inside a symmetrical triangle setup that forecasts a 35% breakout.

- The recent downswing has pushed CRO to favor a bearish move that could trigger a 35% crash to $0.26.

- A daily candlestick close above $0.47 will create a higher high and invalidate the bearish thesis.

Crypto.com price is at the end of an ongoing pattern and indicates that a breakout could be due soon. However, if buyers make a comeback, there is a good chance for CRO to recover and trigger a bullish breakout.

Crypto.com price is in a tough spot

Crypto.com price is getting squeezed between two converging trend lines creating lower highs and higher lows. Such market behavior is known as a symmetrical triangle. The technical formation forecasts a 34% move, which is determined by adding the distance between the first pivot high and low of the triangle to the breakout point.

Assuming a further sell-off for the big crypto, CRO is likely to breach the lower trend line at $0.263, triggering a bearish move. In such a case, the symmetrical triangle forecasts a 35% crash to $0.26. In a highly bearish case, investors can expect Crypto.com price to even retest the $0.22 support level before stabilizing.

CRO/USDT 1-day chart

Supporting the bearish breakout is the recent decline in optimism in the crypto space. Moreover, the drop in Bitcoin’s price has caused altcoins, including Crypto.com price, to suffer a bearish fate.

A daily candlestick close above $0.47 will create a higher high and invalidate the bearish thesis and kickstart an uptrend. In such a case, the symmetrical triangle setup forecasts a 35% upswing to $0.644 for Crypto.com price.

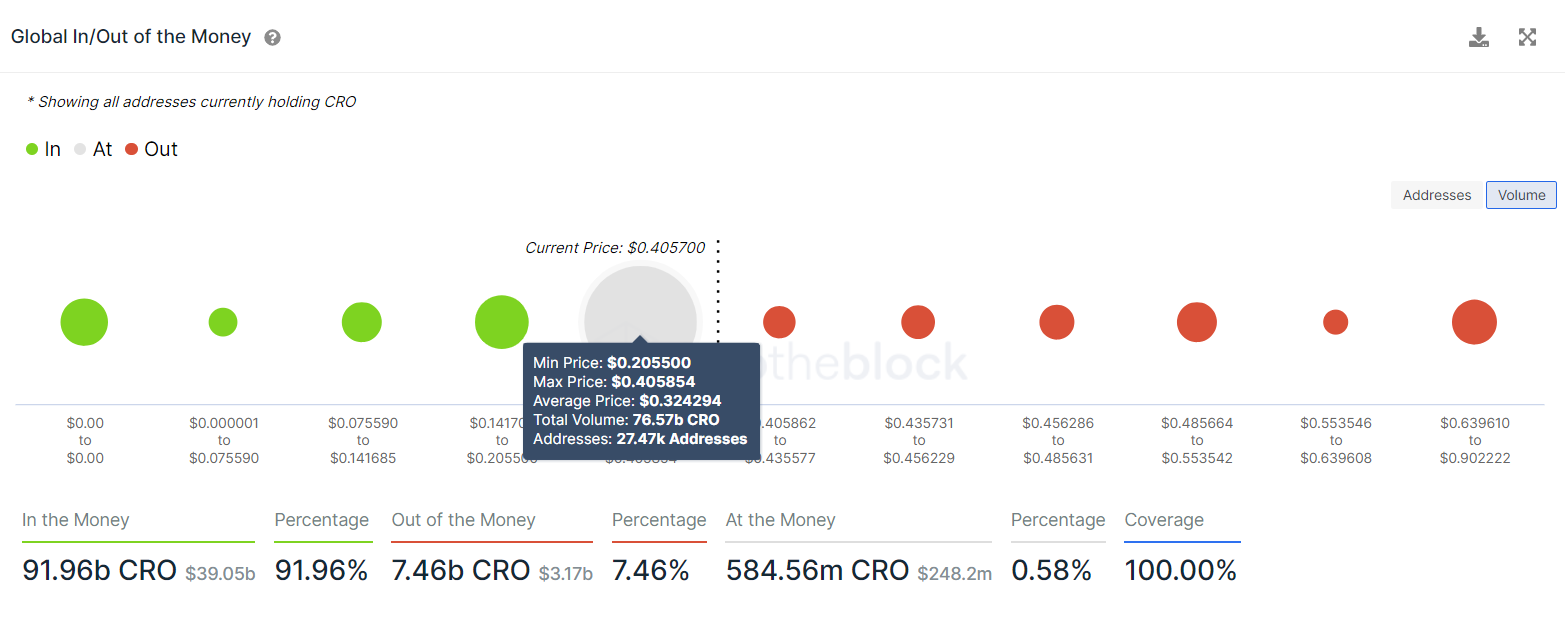

IntoTheBlock’s Global In/Out of the Money (GIOM) model shows that the immediate support level, extending from $0.405 to $0.205 is already being tagged. Here roughly, 27,000 addresses that purchased roughly 76.57 billion CRO tokens have moved from being profitable to breakeven. A further spike in buying pressure could see many of these investors going underwater. Interestingly, the levels forecasted from a bearish breakout are present inside the immediate support level shown by the IntoTheBlock, making it a high probability outcome.

CRO GIOM

This move will cement its position by setting up a higher high and suggest the start of an uptrend.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

TRON gains 10% in 2024, supply of stablecoins reaches over $50 billion in Q1

TRON, a blockchain-based digital platform, has seen positive growth in the first quarter of 2024, as seen in a Messari report. TRON noted gains across several metrics like market capitalization, revenue and total value locked.

XRP hovers near $0.50 as Ripple CTO addresses concerns related to stablecoin launch

XRP is hovering near $0.53 on Friday, spending nearly all week below $0.55. Ripple CTO David Schwartz addressed concerns on stablecoin and XRP utility on Thursday.

Terraform Labs set to restrict access for users in the US after recent ruling in SEC lawsuit

Blockchain company Terraform Labs said Thursday that it will restrict access to some of its products and services for US-based users as it expects to receive a court order soon in light of its legal battle against the US Securities and Exchange Commission (SEC).

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s (BTC) recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Bitcoin: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s (BTC) recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.