Crypto.com Coin price is hanging by a thread as a 40% decline is at risk by New Year

- Crypto.com Coin price is tanking for a third day as markets cannot tie up with gains.

- CRO sees the changes for a Christmas rally turn into dust as markets roll over.

- As investors pull their cash out of all asset classes, expect a violent reaction in the coming weeks on the back of the central banks.

Crypto.com Coin (CRO) price is taking yet again in the ASIA PAC session as the sentiment has been handed over into Europe as a snowball effect is making casualties in all asset classes of the markets. Investors are fleeing the scene as it dawns that the Fed and the ECB will not stop hiking until that inflation target has been brought down. With inflation still very much elevated and earlier this week several indicators showing a pickup in activity, which feeds inflation, the Fed and ECB will need to bring out more ammunition to kill the inflation ghost.

CRO will see cash drained quicker than a vampire can suck blood

Crypto.com Coin price is thus not in good shape to close out these last few weeks of 2022. Several market participants have thought that a Christmas rally would be kicking in by now, and as the days pass, that chance looks to become highly unlikely. With the selloff in all asset classes, it becomes clear that more and more traders are starting to get convinced that a) a recession is unavoidable, b) there will be slaughter in the layoffs and restructurings, and finally, c) the Fed will keep hiking regardless of this to reach its objective why it is here: to tame inflation and bring it back around 2%.

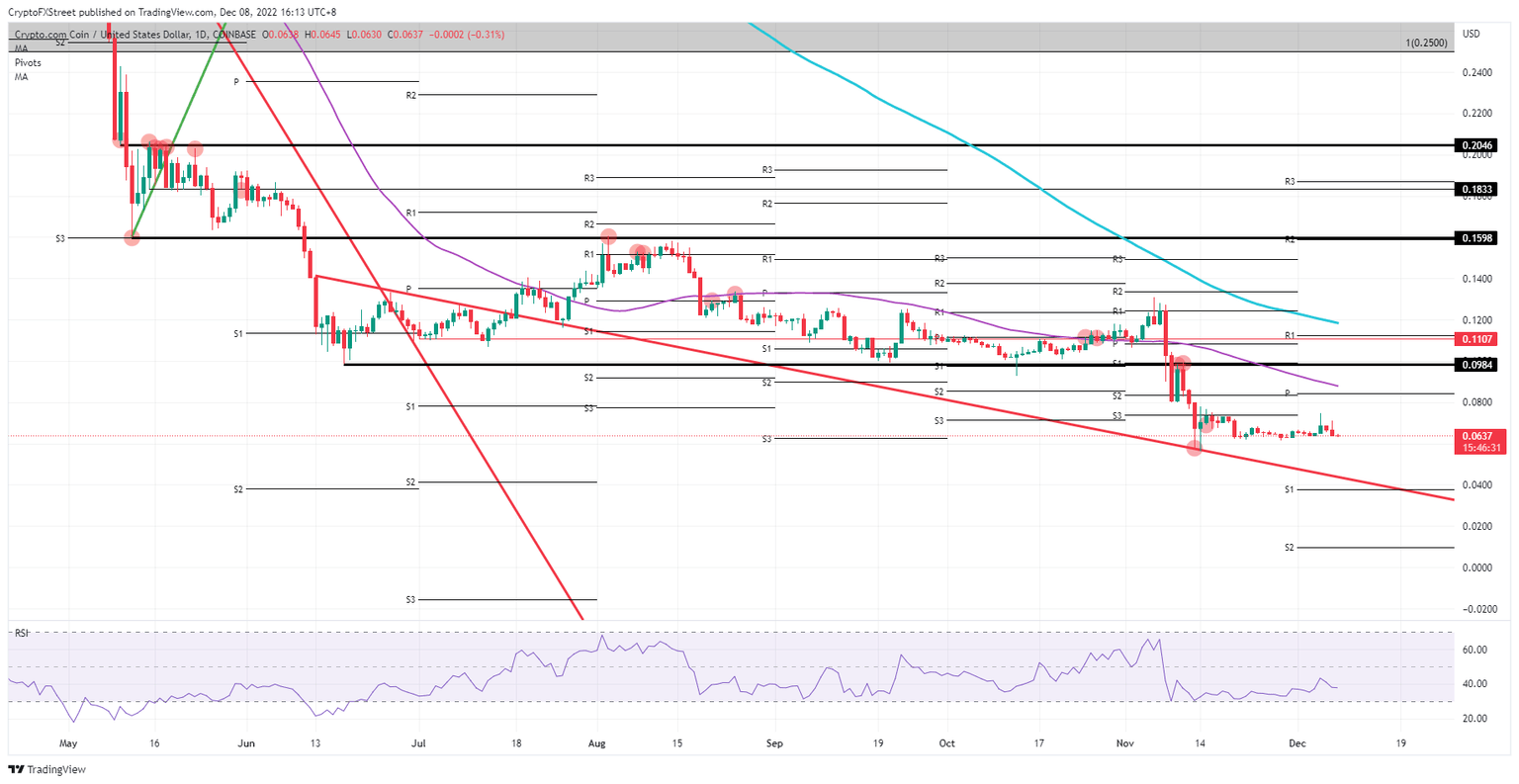

Thus, CRO will be in the crosshairs of the Fed and the ECB trying to reach that goal and will be among the casualties with more declines and losses. More and more analysts are starting to pull their forecasts and call it too difficult to tell where the right levels are at the moment. From a technical point of view, the best level for support is at $0.0400, with the monthly S1 support level and the red descending trend line from June as supportive measures to at least slow down any falling knives.

CRO/USD daily chart

Some upside could come with dovish comments from any central banker that sees inflation measures coming down more quickly and could point to a less aggressive stance. That would not mean that CRO would pop higher and rally, it is not that binary. Rather expect a slow grind higher as it simply gets revalued against the new information coming out, towards $0.1107 to the upside with the 200-day Simple Moving Average (SMA) as the cap on the topside.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.