Can the launch of Crypto.com’s custom EVM network support propel CRO price to $0.1?

- Crypto.com price prints green candle after holding firmly to support at $0.0620.

- Crypto.com launches custom EVM network support to help investors interact with dApps directly from the DeFi Wallet.

- CRO price must break and hold above a critical descending trend line to uphold the optimistic outlook.

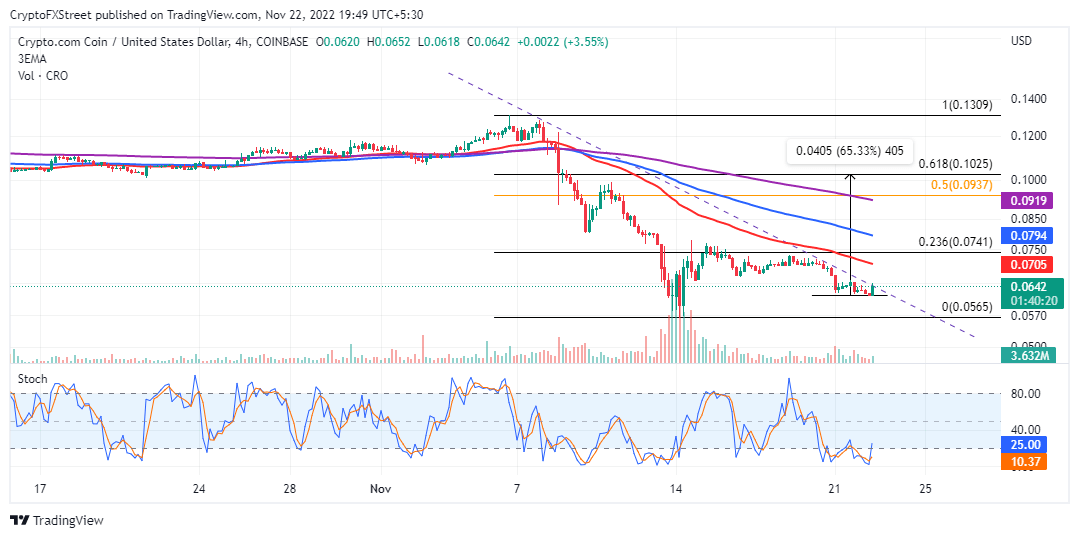

Crypto.com (CRO) price is taking advantage of the bullish wave sweeping across the cryptocurrency market during Tuesday’s American session to print a significant green candle. The native exchange token trades at $0.0641 after ticking up from support at $0.0620.

A break and hold above a three-week falling trend line could push CRO on a 61.8% recovery journey north of its primary support at $0.0565.

Crypto.com’s custom EVM network support goes live

Crypto.com has on Tuesday 22 announced the launch of its new custom EVM (Ethereum Virtual Machine) network support. The new platform will give users more control over their assets by adding preferred networks in the Crypto.com DeFi Wallet.

With the custom EVM network support, users will also be able to send and receive tokens on their custom networks. It simplifies the value transfer process by allowing direct interaction with decentralized applications (dApps) from the network’s DeFi Wallet. Crypto.com has provided detailed instructions in a blog post to guide interested users.

Crypto.com price ready to recommence bullish outlook

The custom EVM network support launch has revived interest in Crypto.com price. After a couple of weeks dominated by overarching declines, CRO has printed a green candle in the four-hour time frame chart.

CRO/USD four-hour chart

Crypto.com price is expected to break above a three-week descending trend line (broken line) in the current and subsequent session, especially now that the Stochastic oscillator is reentering the neutral zone after being oversold – a signal for traders to buy.

If normal market conditions prevail, CRO price could complete a 61.8% recovery to $0.1025 above its primary support at $0.0565. Buyers will gain momentum and confidence as the Stochastic climbs the ladder above the midline (50.00) and hopefully crosses into the overbought region (above 80.00).

A break and hold above the falling trend line at $0.0650 are critical for the resumption of CRO’s uptrend. Buy orders above this level might tap out for profit at the 50-day Exponential Moving Average (EMA) (in red) at $0.0705.

Strong bullish traders could wait until Crypto.com price tags the 100-day EMA (in blue) at $0.0794 and probably the 200-day EMA (in purple) at $0.0919 to book profits. On the other hand, closing the day below the falling trend line may activate short positions ahead of a possible exit at the major support around $0.0565.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren