Crypto Today: Bitcoin takes a roller-coaster ride ahead of Christmas

Here's what you need to know on Thursday

Markets:

The BTC/USD is currently trading at $7,157 (+7% on a day-to-day basis). The coin has recovered strongly from the recent low and hit $7,300 during early Asian hours. However, the upside momentum is losing traction after a failed attempt to move above this barrier, which served as an upper boundary of the recent consolidation range.

The ETH/USD pair is currently trading at $128.61 (+4)% on a day-to-day basis). The Ethereum recovered to the area above $134.00 during early Asian hours; however, the growth proved to be unsustainable. The second-largest coin resumed the decline and lost over 3% since the beginning of Thursday.

XRP/USD topped at $0.1963 and slipped back below $0.1900 to trade at $0.1877 by press time. The coin is down 4/4% since the beginning of the day, though it is still positive on a day-to-day basis.

Among the 100 most important cryptocurrencies, the best of the day are Aidos Kuneen (ADK) $1.69 (+54%), Energi (NRG) $2.2 (+16.4%) and TomoChain (TOMO) $0.5453 (+14.4%). The day's losers are Centrality (CENNZ) $0.1216 (-6.6%), Fetch.ai (FET) $0.4800 (-6%), LUNA (LUNA) $0.2080 (-4%).

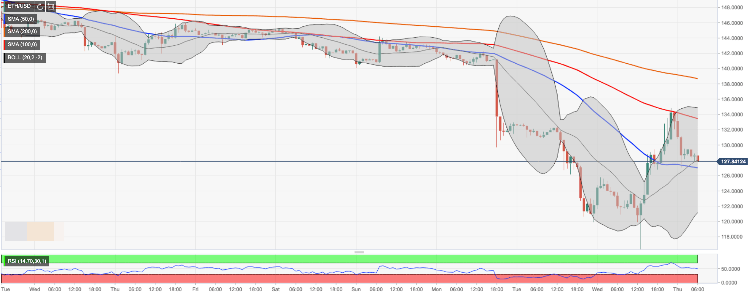

Chart of the day:

ETH/USD, 4-hour chart

- Cryptocurrency traders note a strange built-up of Bitcoin long orders on Bitfinex that coincided with the sharp price collapse. The experts suggested that Bitcoin whales might have been accumulating long positions before a large-scale pump.

- A co-founder of Coingecko, Bobby Ong believes that Bitcoin's halving in May 2020 will lead to the price growth as ASIC miners have a strong incentive to support the prices as it is a matter of survival for many of them.

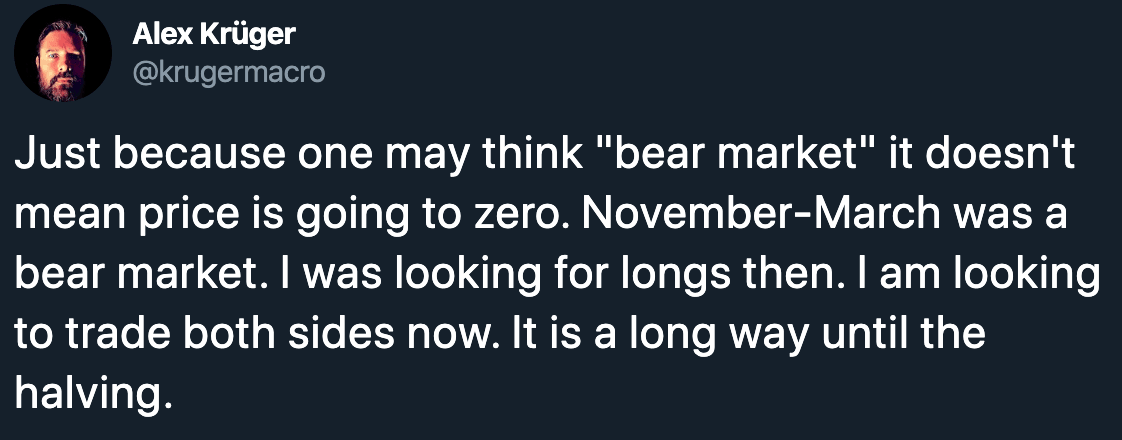

- Prominent technical analyst and cryptocurrency trader Alex Krüger noted a large-scale movement on Bitmex charts. Basically, Bitcoin dropped by 6% and then recovered all the losses in a matter of ten seconds. Such a roundtrip is a rare event even for notoriously volatile cryptocurrency markets.

Industry:

- Taiwanese electronics manufacturer HTC announced staff layoffs as the company wants to streamline its operations and focus on innovations and "selected products, including its blockchain-backed EXODUS smartphones". EXODUS offers access to decentralized exchanges and functions as a hardware cryptocurrency wallet. Exodus 1, a cheaper version of the flagship product, can run a full bitcoin node.

- Bitcoin SV (BSV) miners lost over $13 million due to their irrational behavior, the recent Binance research shows. The experts found out that "Bitcoin SV (BSV) was mined at a significant opportunity cost in the first half of 2019." While the reasons for such discrepancies are mostly unknown, they cost BSV miners $13 million of lost profit.

Regulation:

- The US Securities and Exchange Commission (SEC) has proposed a change to the definition of accredited investor. The regulator wants to assess the professional knowledge experience or certifications of the investors before they can oblate the status of an accredited investor. Currently, only income is taken into consideration. Notably, in the US, investments in cryptocurrency-related products are available only for accredited market participants.

- The Income Tax Department of India is trading its employees on how to reveal tax evasion cases that involve cryptocurrency. Currently, digital assets are mainly in a grey zone in India as the government doesn't consider them as legal tender, but it also doesn't ban them altogether. This situation creates many controversies when it comes to paying taxes on cryptocurrency-related income.

Quote of the day:

Author

Tanya Abrosimova

Independent Analyst