Here's what you need to know on Tuesday

Markets:

-The BTC/USD is currently trading at $8,500 (+4.9% since the beginning of the day). The coin has been moving within a strong bullish trend and hit a new 2020 high at $8,587.

-The ETH/USD pair is currently trading at $148.9 (+3.74% since the beginning of the day). The Ethereum retreated from the intraday high of $150.99; now, it is moving within a short-term bearish trend amid shrinking volatility.

- XRP/USD settled at $0.2171 after a spike to $0.2191 during early Asian hours. The coin is up 2% in recent 24 hours.

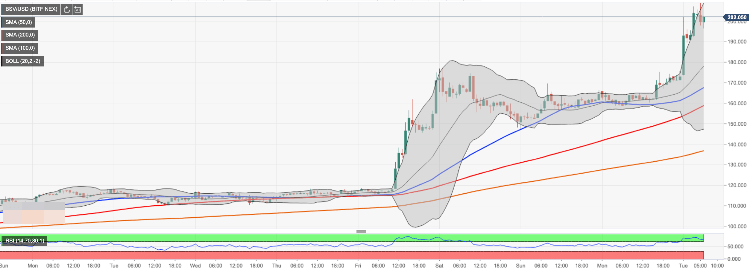

- Among the 100 most important cryptocurrencies, the best of the day are BlockStamp (BST) $1.6 (+45.5%), Bitcoin SV (BSV) $204 (+26.7%) and Zcoin (XZC) $4.4 (+21.3%), The day's losers are, Nexo (NEXO) $0.1094 (-6.5%), Verge (XVG) $0.0033 (-3.42%) and LUNA (LUNA) $0.1935 (-3.02%).

Chart of the day:

BSV/USD, 1-hour chart

Market:

- Bitcoin's network difficulty may increase by 9% due to the upcoming adjustment that is going to become one of the largest increases ever. This parameter is adjusted every 2016 blocks, depending on the difficulty of the previous set of blocks. This procedure is necessary to keep Bitcoins in check and counterbalance the influence of various factors such as price fluctuations, number of miners and technological progress. The increased difficulty could force miners to sell their coins and thus drive prices down.

- Bitcoin rallied by nearly 4% during early Asian hours after a successful launch of CME options on Bitcoin futures. According to the recent reports, the new contracts surpassed the rivaling Bakkt options by trading volume on the first day of trading. The experts believe thee trading volumes are driven by the interest of institutional investors who seek new risk management tools.

Industry:

- The world's largest platform for trading cryptocurrency derivatives, BitMEX, questions the efficiency of the overhyped lightning network. The recent research conducted by BitMEX revealed that the privacy and scalability benefits of Bitcoin’s network protocol still leave much to be desired. The researchers found 60,000 non-cooperative is channel closures, which is twice as much as expected. The large figure raises questions about the sidechain efficiency as each closure costs over 1,000 BTC

“There is already some data and analysis on lightning network usage, often used to assess its growth. However, most of this data is based on figures reported by lightning network nodes that participate in the lightning P2P gossip network.”

- According to LinkedIn research, blockchain is going to be one of the most well-paid industries in 2020. The DLT (distributed ledger technology) specialists will earn even more than experts in artificial intelligence and cloud computations.

Regulation:

- Binance blocked the user's account by the request of the Ukrainian police. The user is sure that the ban followed after they had bought USDT for cash. The seller's account was also blocked after the deal. Notably, speaking to the Russian media outlet, the user said that he was a citizen of Russia and had never been to Ukraine. Binance representative confirmed the ban and asked not to spread FUD.

- The Chinese regulators aim to tighten the grip over the cryptocurrency industry in the country, Huo Xuewen, director of the financial regulator in Beijing said that digital currencies could be issued only by the People's Bank of China. No private company would get a license to do that. He also added that it was illegal to issue, sell or trade cryptocurrency in China, no matter whether was done by a local or overseas company.

“China does not allow cross-border cryptocurrency transactions. No institution can sell overseas cryptocurrency to Chinese, and no institution can provide the exchange of cryptocurrency to CNY. For this, we will closely monitor and crackdown on it.”

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Ripple wipes out weekly gains, experts comment on role of Ripple stablecoin

Ripple declined to $0.52 on Thursday, erasing all gains registered earlier this week. Ripple SVP Eric van Miltenburg’s comments on the firm’s stablecoin, and how it is expected to benefit the XRP Ledger and native token XRP have raised concerns among crypto experts.

Hedera HBAR slips nearly 10% after air is cleared on mistaken link with giant BlackRock

HBAR price is down nearly 10% on Thursday, partly erasing gains inspired by the misinterpreted link with BlackRock. Despite the recent correction, Hedera’s price is up 44% in the past seven days.

The reason behind Bonk’s 105% rise and if you should buy now Premium

Bonk price has shot up 105% in the past five weeks. A retracement into $0.0000216 or the $0.0000152 to $0.0000186 imbalance would be a good buying opportunity. Patient investors can expect double-digit gains from BONK that could extend up to 70%.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price. Coupled with broader market gloom, INJ token’s doomed days may not be over yet.

Bitcoin: BTC post-halving rally could be partially priced in Premium

Bitcoin (BTC) price briefly slipped below the $60,000 level for the last three days, attracting buyers in this area as the fourth BTC halving is due in a few hours. Is the halving priced in for Bitcoin? Or will the pioneer crypto note more gains in the coming days?