Crypto markets could see relief rally after six weeks of prolonged negative sentiment

- On-chain metrics like MVRV suggest it is time for sidelined traders to buy Bitcoin ahead of a relief rally.

- Analysts at Santiment identified signs of capitulation in crypto markets, supporting the thesis of a price recovery in Bitcoin and altcoins.

- DePin and airdrop narrative is leading the cycle; altcoins Solana, Toncoin and Cardano started recovering in the past 24 hours.

Crypto market is primed for a relief rally in Bitcoin and altcoins per on-chain metrics from crypto data tracker Santiment. Analysts note in the June Santiment report that the sentiment among market participants has been negative since the last week of May, and it is a sign of “inevitable price rise.”

Traders have likely capitulated and analysts identified the ideal time for sidelined traders to buy Bitcoin and altcoins, ahead of the upcoming recovery in the market.

The two dominant narratives are Decentralized Physical Infrastructure Network (DePin) and airdrops.

Solana, Toncoin and Cardano rank among the top 10 altcoins that noted an increase in their prices in the past 24 hours, per CoinGecko data.

Three signs that a crypto recovery rally is coming

Crypto markets noted a roller coaster in the prices of most altcoins in the top 30, with meme coins, Artificial Intelligence (AI) category of tokens emerging as key narratives yielding the highest gains.

-

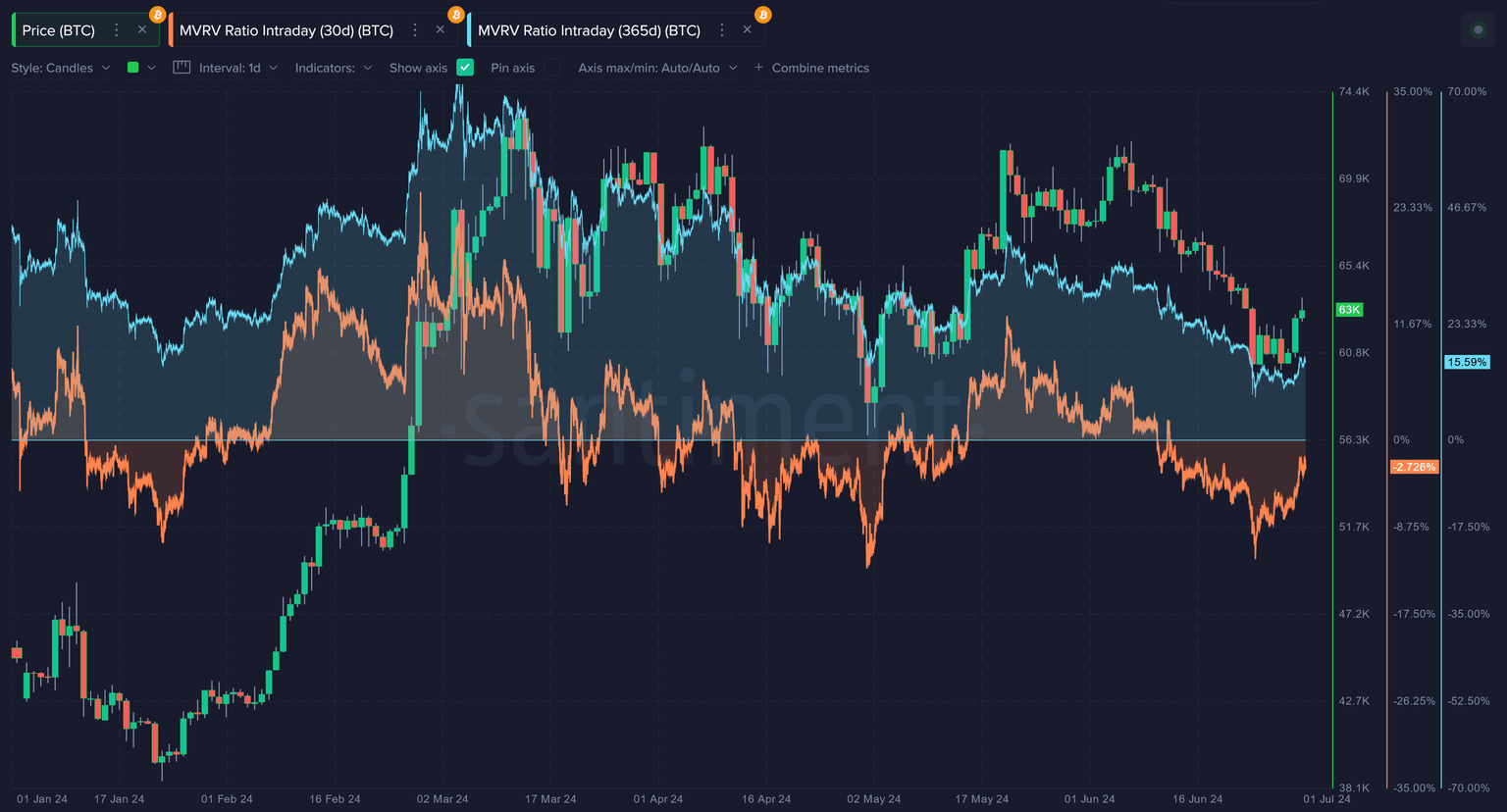

30-day MVRV and 365-day MVRV

Market Value to Realized Value (MVRV) is a key on-chain indicator used to identify the peaks and bottoms of crypto assets. The 30-day MVRV (orange line in the chart below) has dropped into negative territory.

Analysts at Santiment consider it the ideal time for sidelined traders to buy Bitcoin, or add to their position in Bitcoin or altcoins, ahead of a recovery rally. MVRV 30-day is currently at -2.72% and the risk associated with adding to trading positions is lower than usual.

365-day MVRV is dropping closer to 0%, however it is likely to take longer than expected for Bitcoin to hit $70,000. Either way, a recovery is most likely in the cards for Bitcoin, in July 2024.

Bitcoin price and MVRV 30-day, 365-day as seen on Santiment

-

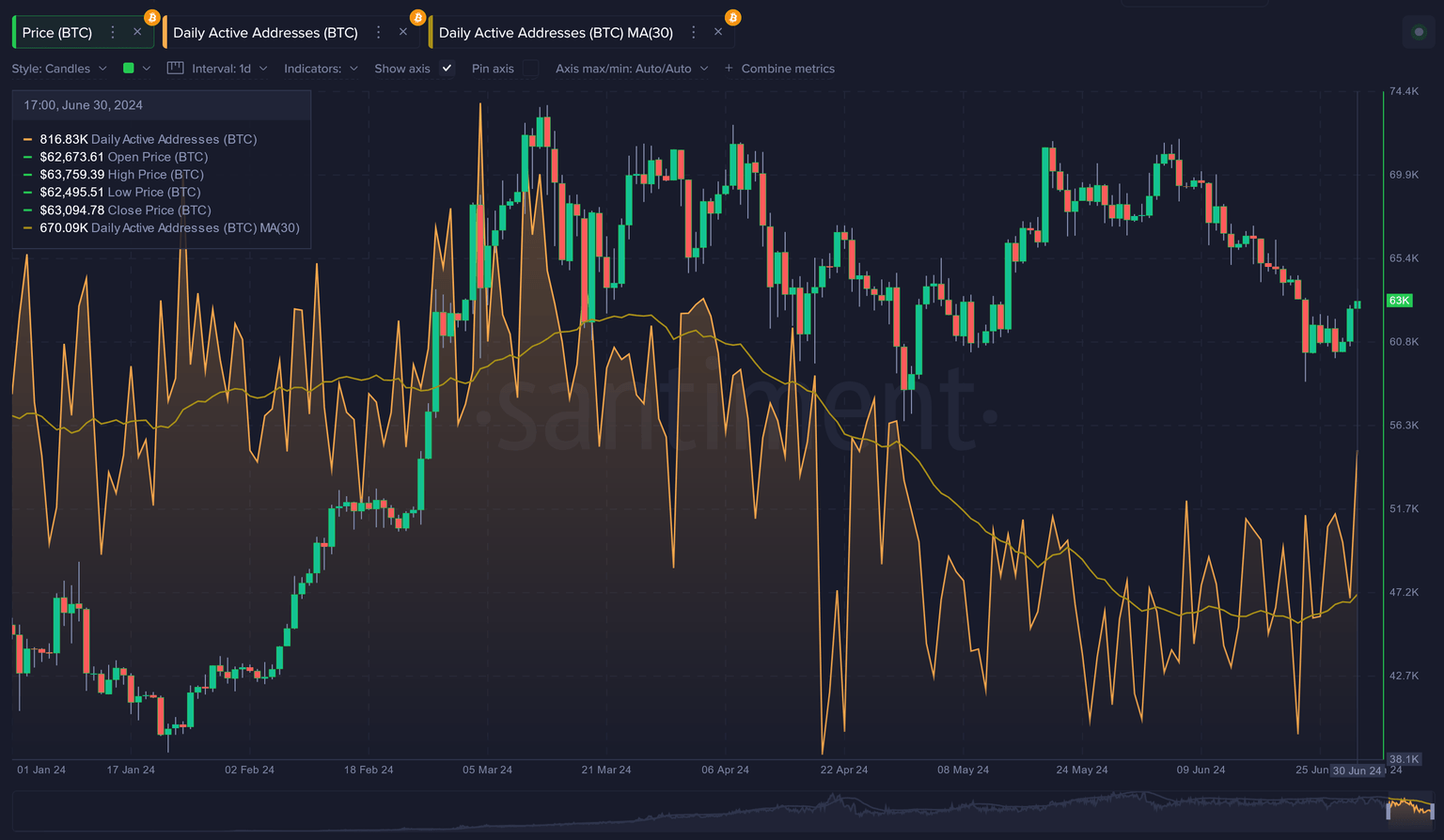

Daily active addresses

Bitcoin’s network has noted an increase in the volume of interacting addresses. Santiment data shows that June ended with its highest day of active addresses in nine weeks.

While Bitcoin network activity dropped off post its March 14 all-time high, signs of recovery show that it is trending back towards the peak.

Higher activity is associated with relevance of the asset and demand for it among traders across crypto exchange platforms.

Daily active addresses and Bitcoin price

-

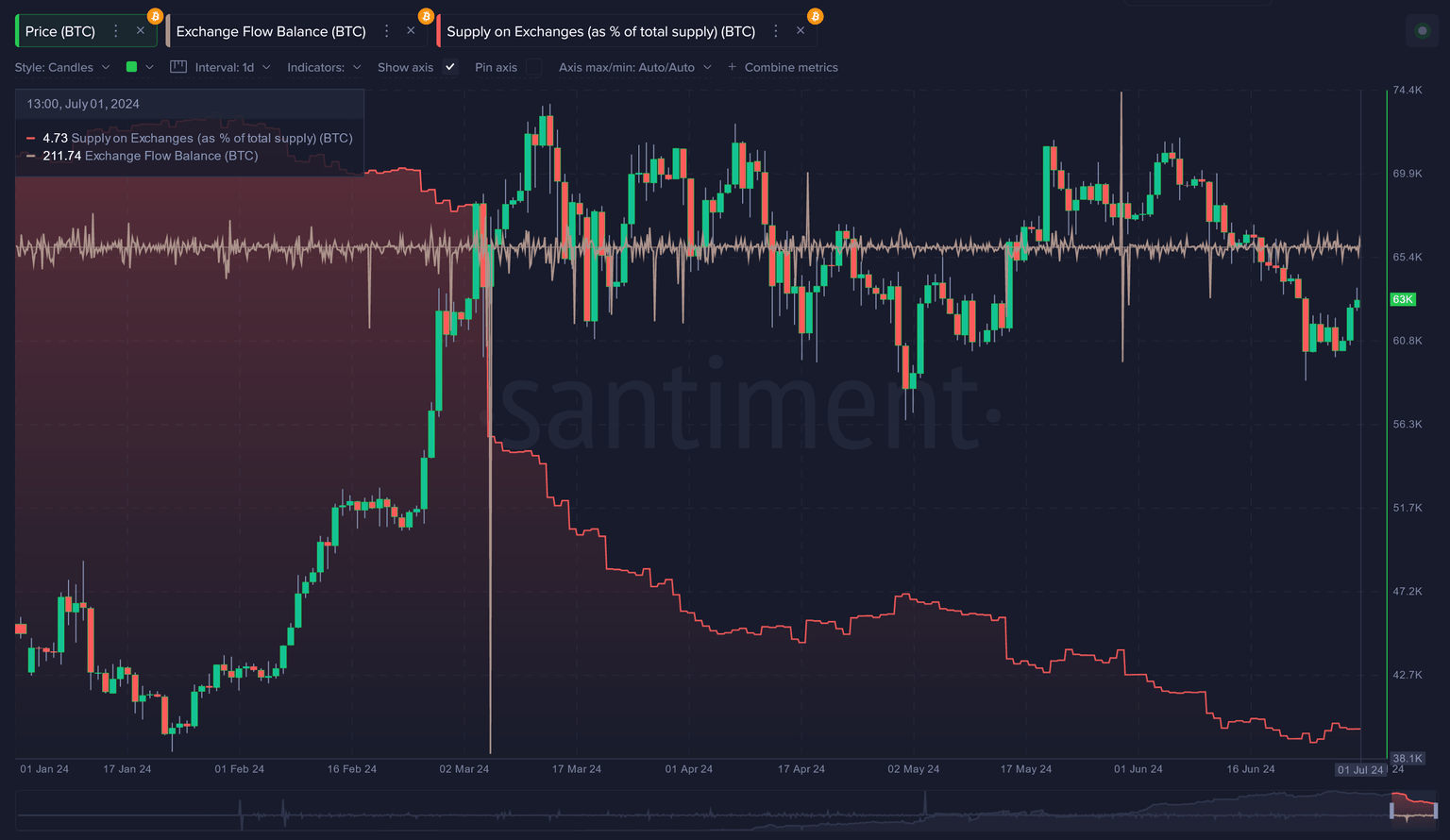

Supply of Bitcoin on exchanges

The supply of Bitcoin on exchanges is at a relatively low level compared to the highs observed in March, as seen in the Santiment chart below. Relatively low supply equates to lower selling pressure on Bitcoin and higher chances of a recovery in the asset’s price.

Bitcoin supply on exchanges as a % of total supply vs. price

Price increases likely for Bitcoin and altcoins

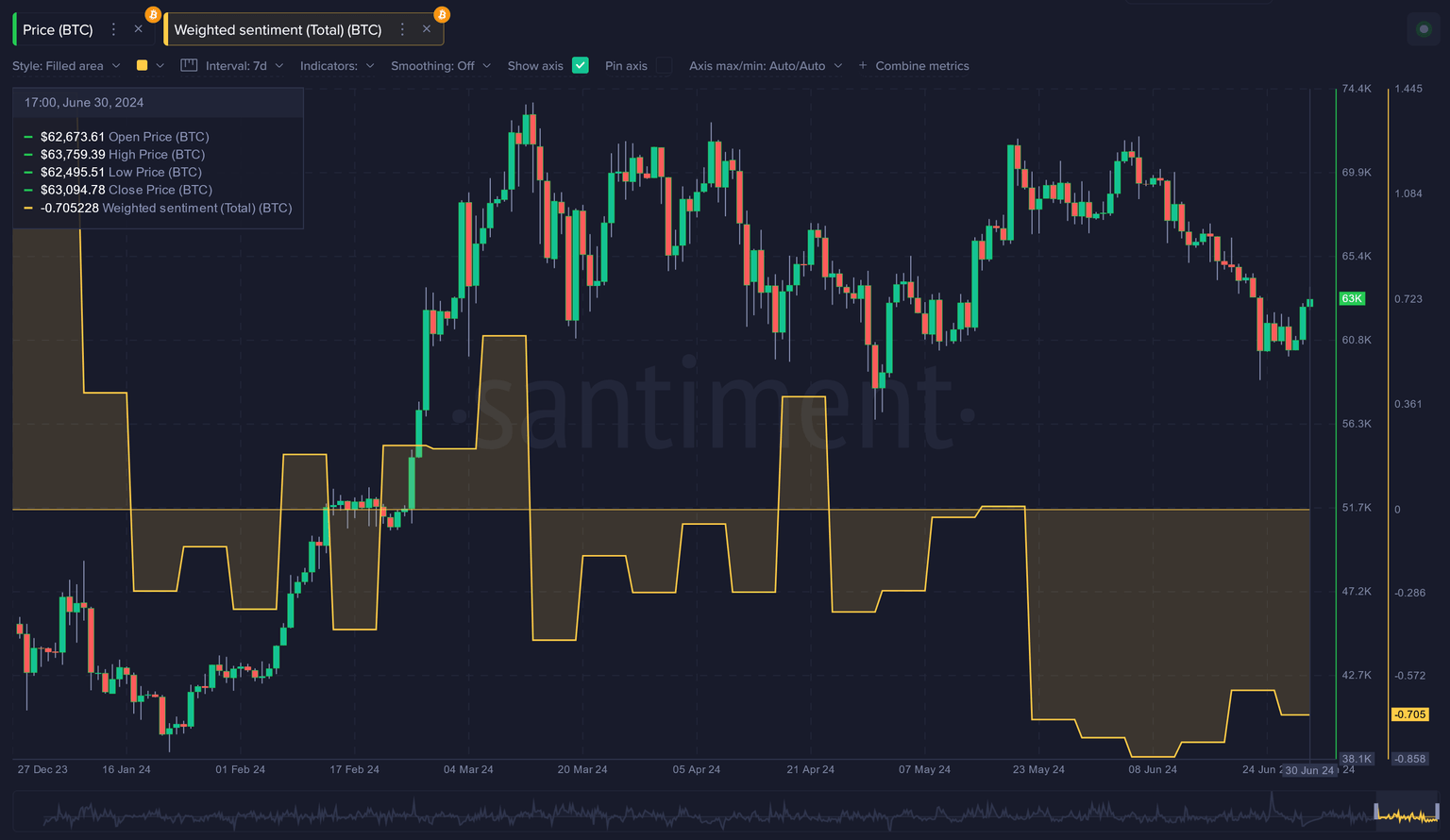

Data on sentiment among traders shows that for almost six weeks the sentiment has been negative. Santiment has noted that consistently negative sentiment from traders nearly always leads to a price rise.

The current stretch of negative sentiment among traders is the longest one in over two years.

Weighted sentiment total (BTC)

The crypto data tracker has noted a surge in the mentions of “buy the dip” across social media platforms. With traders fueling demand for Bitcoin and altcoins, a rebound rally in the largest asset by market capitalization is likely.

Santiment analysts note in their report that the decline in BTC and altcoin prices at the end of June, specifically June 28 is likely the real bottom for crypto prices.

The leading narratives in the cycle are DePin and airdrops, however Solana (SOL), Toncoin (TON) and Cardano (ADA) in the top 10 altcoins have started their recovery with 1% to 2% gains in the past 24 hours.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.