Crypto market outlook 2025: PayFI report highlights AI and Memecoins as key sectors to watch

- Crypto market capitalization neared its all time-high valuation of $3.7 trillion following Donald Trump’s inauguration on Monday.

- Foresight Ventures issued a report highlighting AI, consumer payments and memecoins as key areas to watch in 2025.

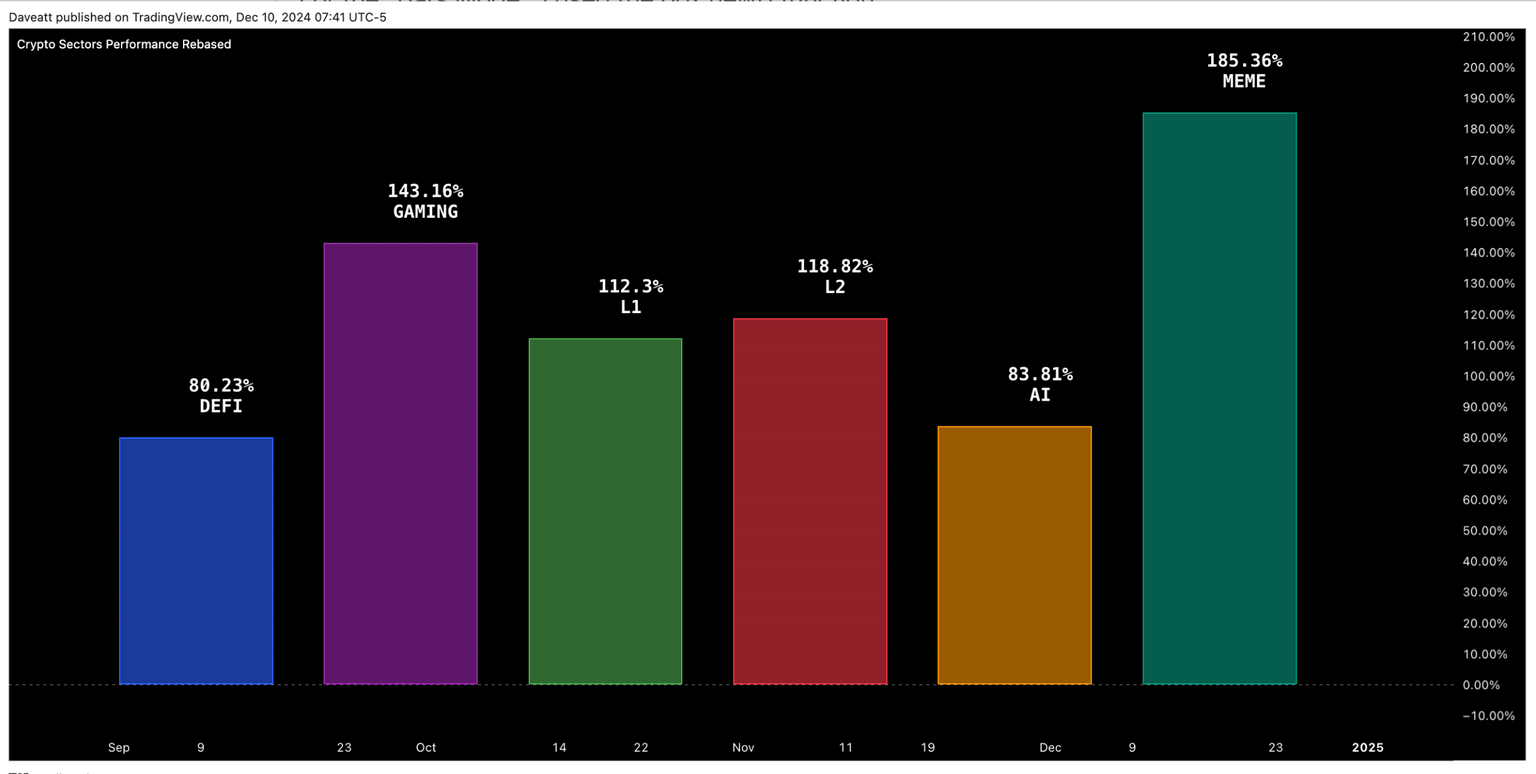

- According to TradingView data, AI and Memecoins sectors scored over 185% gains and 83% gains, respectively, in 2024.

The global cryptocurrency market was sent agog this week as US President Donald Trump’s inauguration triggered a flurry of bullish catalysts. As traders navigate the volatile market trends, a Foresight ventures’ market outlook report shows key sectors to watch in the weeks ahead.

Trump inauguration drives Crypto market capitalization near $3.7 trillion all time-highs

Having delivered a crypto-friendly manifesto, Donald Trump’s Presidential inauguration on Monday, was a key event for digital asset investors globally. Events surrounding Trump’s swearing-in event triggered fresh capital inflows, driving the cryptocurrency market's valuation to record peaks.

Notably, things heated up when Trump launched the TRUMP and Melania meme tokens just hours before the inauguration kicked off. Both assets drew a combined peak valuation of $9.2 billion on Monday before retracing. More so, wallets linked to Trump-backed crypto investment firm, World Liberty Financial (WLFI) were spotted buying large amounts of cryptocurrencies, mainly Chainlink, Ethereum (ETH), and Tron (TRX).

Amid the market frenzy, capital inflows from investors piggybacking on the Trump-fuelled euphoria, drove the crypto market capitalization to $3.7 trillion on Monday, just $300 million shy of the all-time high recorded back mid-December, when crypto traders reacted to the announcement of Gary Gensler’s imminent exit.

PayFi report highlights AI and Memecoins as Key Sectors to Watch

However, while the global crypto market received major inflows amid Trump’s inauguration, the gains were not spread out evenly.

While tokens like Hyper Liquid and Solana have rallied by double-digits, prominent projects like Shiba Inu and PEPE have declined as a commensurate measure.

When prominent mega-cap assets decline during a broader market uptrend, it signals that traders are selectively allocating capital.

Taking a bird’s eye view of current trends, Foresight Ventures, a global leader in Web3 investments, issued a report highlighting AI, Consumer payments and memecoins as key areas to watch in 2025.

“We firmly believe that the intersection of AI and crypto payments holds immense market potential. AI payments are poised to disrupt multiple industries beyond traditional finance, including data annotation, model training, and content creation.”

- Foresight Ventures Co Founder, Forest Bai, January 2025.

Validating this outlook, a recent TradingView snapshot on December 10, 2024 showed that, AI and Memecoins sectors scored over 185% and 83% gains respectively in 2024.

The AI and Memecoin sectors initially evolved as two distinct non-correlated sectors, with separate target markets. However, in recent months, the advent of Crypto AI agents has opened up a new frontier of decentralized finance, where AI agents can autonomously establish a marketplace and execute economically viable transactions.

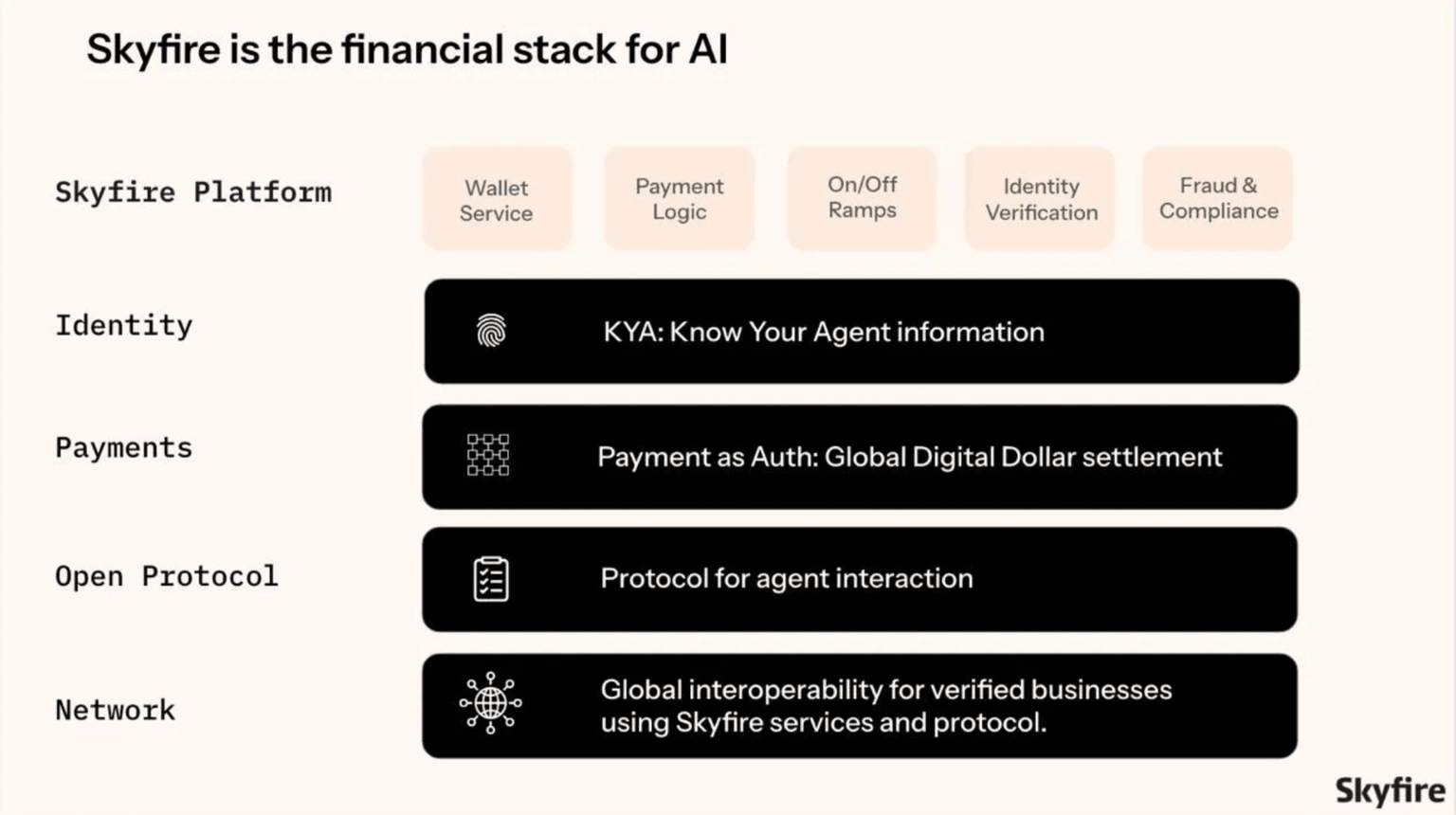

Notably, the PayFi report, a case study involving the Skyfire tool, showed AI Agents and AI service providers combining marketplace and payment layers to attract users and while enabling revenue generation. More so, consumer-oriented crypto micropayments, combined with innovative models like Moonshot (for buying and selling meme coins) and Sidekick (a Web3 payment gateway for streamers), showcasing the potential of instant global settlement and decentralized protocols.

If this crypto market outlook plays out, a fresh sector could emerge at the intersection between AI technologies and memecoin culture, potentially driving fresh value propositions and capital inflows.

Crypto AI Tokens to Watch in 2025

Crypto AI tokens like Render (RNDR), NEAR Protocol, and Internet Computer Protocol (ICP) have delivered positive performances in January 2025. Looking ahead, Virtuals Protocol (VIRTUAL) emerges as the standout performer in the AI token space for 2025.

VIRTUAL is an AI agent protocol designed to facilitate autonomous decision-making in blockchain ecosystems, enabling on-chain smart assistants to optimize tasks like portfolio management, trading, and governance participation.

Virtual Protocol (VIRTUAL) Price Forecast: $5 breakout ahead if $2.5 support holds

Virtual Protocol (VIRTUAL) price paints an optimistic outlook, after facing downward volatility over the last two weeks.

As seen in the chart below, Virtual price maintains a precarious balance near the $2.5 support zone, which aligns with the lower Bollinger Band at $2.1. This level is critical for determining VIRTUAL's next directional move.

A bounce off the $2.5 support could mark the start of a renewed rally. The RSI currently reads 46.17, hinting at potential oversold conditions.

If VIRTUAL sustains above the $3.1099 midline Bollinger Band, it could catalyze a breakout toward the $5.1450 resistance.

Increased trading volumes near key levels would confirm the bullish momentum, targeting a 95% move from current levels.

Conversely, failure to hold $2.5 would expose VIRTUAL to further downside, possibly retesting $2.2 support.

The RSI showing bearish divergence below 50 raises concerns about fading momentum. If bearish pressure persists, VIRTUAL risks extending losses to $2.0, a critical psychological level.

Memecoins to watch in 2025

The memecoin sector has remained resilient, with tokens like $TRUMP, $MEME, and Dogecoin (DOGE) attracting considerable attention in early 2024. $TRUMP and $MEME saw strong capital inflows amid the inauguration euphoria, fueled by their association with cultural and political events.

Meanwhile, Dogecoin rallied as the Bitwise ETF filed the DOGE spot ETF just hours after Trump signed the D.O.GE Act into law. These catalysts indicate that social and political events ahead could serve as powerful drivers for memecoin sector demand.

Ai16z, an AI-driven memecoin, stands out as the top contender to watch in 2025. As the convergence of AI and memes has opened new growth avenues, Ai16z’s current $2 billion valuation could grow significantly in 2025 .

Ai16z Price Forecast: All eyes on $1.5 rebound target

A1i6z trades at $0.8546, maintaining a fragile stance above the lower Donchian Channel support at $0.7278. This level serves as a crucial floor for short-term price action, while $1.5456, the midline resistance, acts as the key upside target.

The current position of the Williams %R at -86.06 indicates extreme oversold conditions, which often precede a corrective rebound. If Ai16z can sustain above $0.8546 and break through the $1.5456 resistance, the upper Donchian Channel boundary at $2.3634 becomes the next logical target.

A rebound above $1.5 would signal a potential 75% upside, especially if supported by increasing volume and improved market sentiment.

On the downside, failure to hold the $0.8546 support exposes Ai16z to further downside toward $0.7278. Persistent bearish momentum indicated by Williams %R could drive prices lower, invalidating the rebound scenario. A breakdown below $0.7278 might trigger panic selling, targeting psychological support at $0.50.

Author

Ibrahim Ajibade

FXStreet

Ibrahim Ajibade is an accomplished Crypto markets Reporter who began his career in commercial banking. He holds a BSc, Economics, from University of Ibadan.