Crypto investment products post outflows for fourth straight week despite ETFs debut in Hong Kong

- Digital asset investment products noted outflows of $251 million in the week ending May 5.

- CoinShares report shows Bitcoin outflows weighed as Ethereum, Avalanche, Cardano, Solana, Polkadot and Litecoin saw inflows.

- The launch of spot-based ETFs in Hong Kong resulted in $307 million inflows in the first week of trading.

Crypto investment products have seen consistent capital outflows for the past four weeks, according to weekly data tracked by CoinShares. The European alternative asset management firm’s latest report shows that overall outflows came due to Bitcoin, but it also notes positive inflows in altcoin investment funds, notably Ethereum (ETH), Avalanche (AVAX), Cardano (ADA), Solana (SOL), Polkadot (DOT) and Litecoin (LTC).

Crypto investment products lose $251 million in a week

Data from the May 7 edition of CoinShares’ fund report, which tracks data from the week ending May 5, shows that US-based Spot Bitcoin ETFs, combined with other digital asset investment products, noted an overall outflow of $251 million. Crypto-based funds have suffered outflows for four consecutive weeks. This could be driven by a decline in demand among market participants and the recent correction in Bitcoin price, resulting in a negative sentiment among traders.

A positive event was the launch of spot-based ETFs in Hong Kong. CoinShares report says that these funds registered $307 million in inflows, although these failed to offset the measurable outflows of crypto investment products in the US.

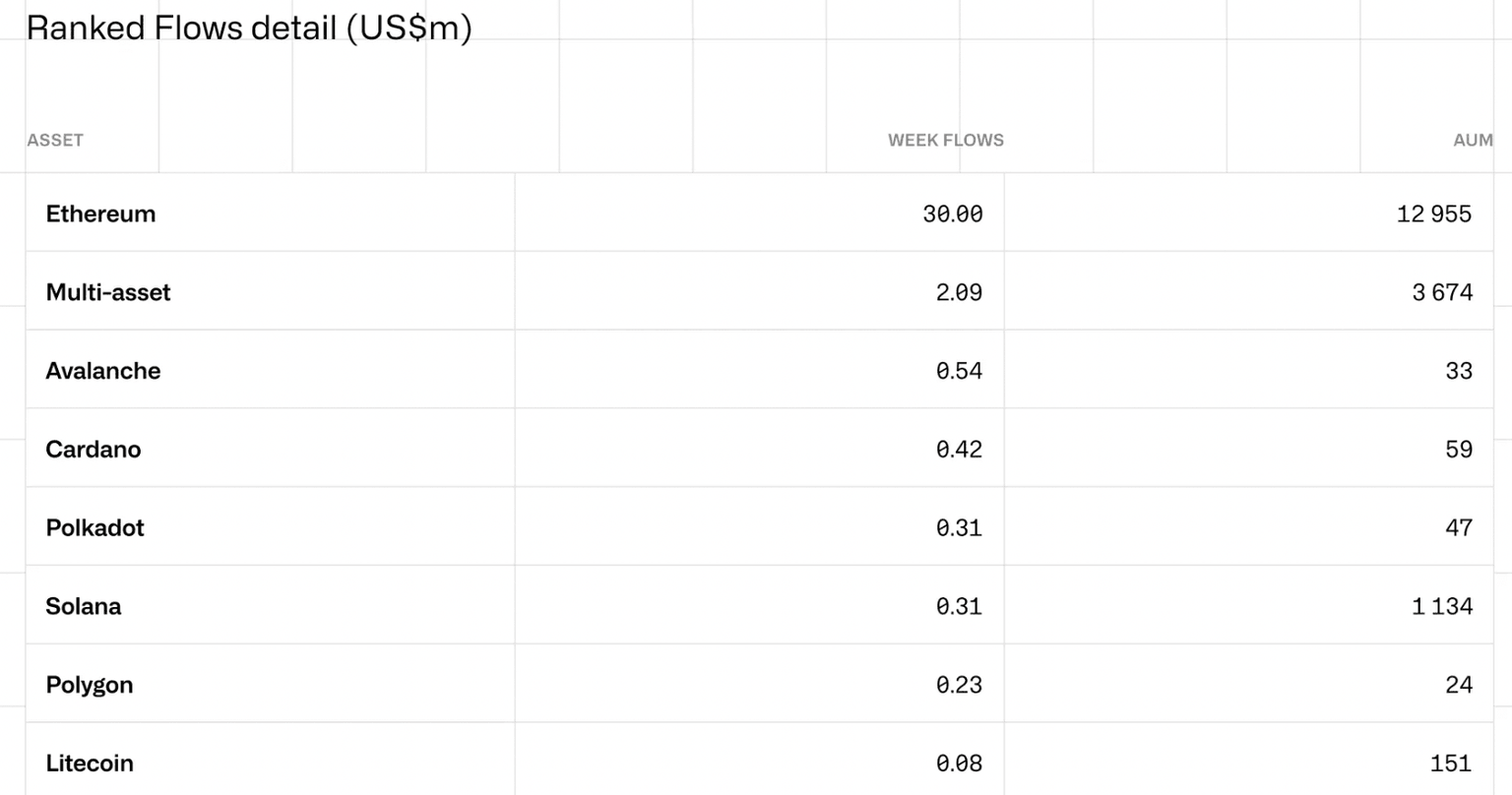

Altcoin-based funds, specifically ETH, AVAX, ADA, SOL, DOT and LTC observed positive inflows, signaling a revival of interest among traders.

Bitcoin may have been a primary focus for institutional traders for the past four weeks, but the positive flows to altcoin funds could break this streak if they consistently record new capital inflows.

Fund flows for the past week

Ethereum noted the highest inflows ($30 million), while multi-asset funds, Avalanche, Cardano, Polkadot, Solana, Polygon and Litecoin followed far behind, with small but significant inflows in the past week despite the market-wide correction in crypto.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.