CME Group launches options on Ethereum futures ahead of the Merge

- The CME group's ETH futures have witnessed a 43% increase in the daily average volume from last year.

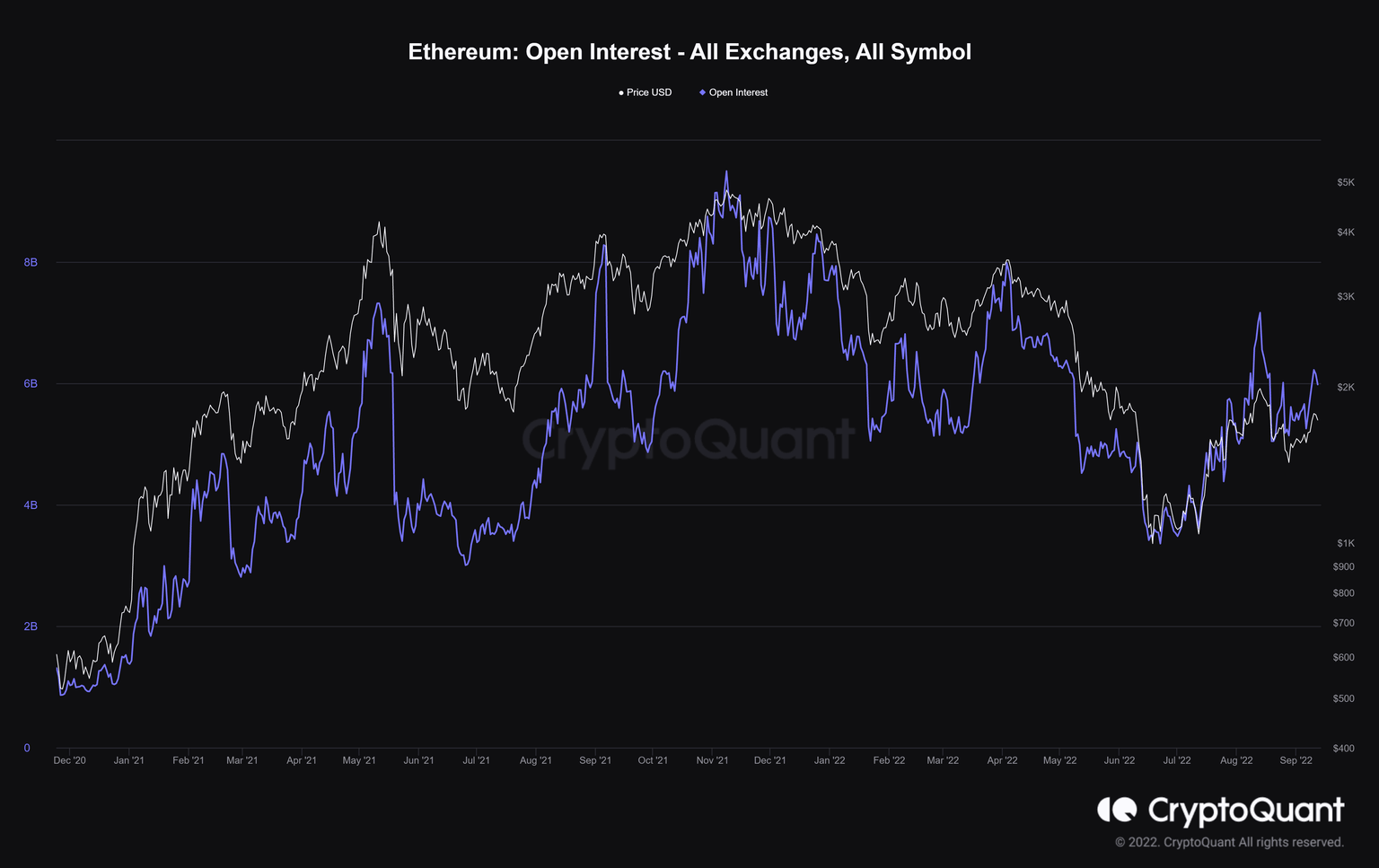

- Ethereum's options market is currently engaged in recovery since June, with the open interest touching $6.2 billion.

- ETH is retesting its critical support range, which will set the altcoin for a rally beyond $2,000.

The derivatives market is a constantly growing investment front for people looking for gains beyond traditional investment methods.

With cryptocurrencies being one of the most talked about investment vehicles, it only makes sense for the crypto derivatives market to note consistently rising demand. And to cater to it, the likes of the CME Group are coming up with innovative options.

CME brings options on Ethereum futures

On September 12, the Chicago Mercantile Exchange (CME), known to be a leader in the derivatives marketplace, launched options on ETH futures. The second biggest cryptocurrency in the world is currently preparing for the biggest overhaul in its history, ahead of the Merge, which is expected to trigger a positive reaction in its price.

Calling the Merge a "game-changing update", the Global Head of Equity and FX Products, CME Group Tim McCourt, stated that the derivates market is noting a surge in interest in ETH-based products due to the event. Adding to the same, McCourt said,

"The launch of our new Ether options contracts is particularly well-timed to provide the crypto community with another important tool to gain access to and manage exposure to ether. Our new options contracts will also complement CME Group's Ether futures which have seen a 43% increase in average daily volume year over year. (sic)"

These new contracts deliver one Ether futures and are sized at 50 ETH per contract.

Ethereum in the options market

Over the last few months, the spot market's changing stance has also impacted the derivatives market, as noted in the fluctuating open interest (OI) of Ethereum options contracts. After falling to $3.36 billion back in June this year, the open interest rose to $7.1 billion in August. But the recent dip brought the open interest down to $5.9 billion again.

The same could go up when the prices start recovering, and ETH prices are fortunately heading right in that direction. As per previous analysis, ETH is holding well at the $100 critical support range between $1,669 and 1,761, trading at $1,730.

As the indicator line (blue) took over the signal line (red), a bullish crossover was executed on the network. This is evidence of investors' anticipation ahead of the Merge, which might be able to push ETH's price to $2,000.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.