Civic Price looks at a potential pullback as Coinbase listing’s hype fades away

- CVC price exploded by 340% after the announcement of Coinbase listing.

- It seems that the digital asset could be topping out as a strong sell signal has been presented.

CVC was trading sideways for the majority of October until November 5, when Coinbase announced the upcoming listing of the digital asset. The price of Civic exploded by 62% within the next 24 hours and 344% after five days. Many indicators are now showing that CVC’s price is poised for a pullback in the short-term.

Civic price facing stiff resistance ahead after a major rally

On the 4-hour chart, the TD Sequential indicator has presented a sell signal while the RSI continues climbing into the overbought zone. Selling pressure keeps mounting for Civic which seems to be poised for a pullback.

CVC/USD 4-hour chart

Validation of the sell signal can quickly drive the price of CVC towards $0.08 and lower as there aren’t too many clear support levels on the way down. The 50-SMA is currently established at $0.04 which would be the lowest bearish price target.

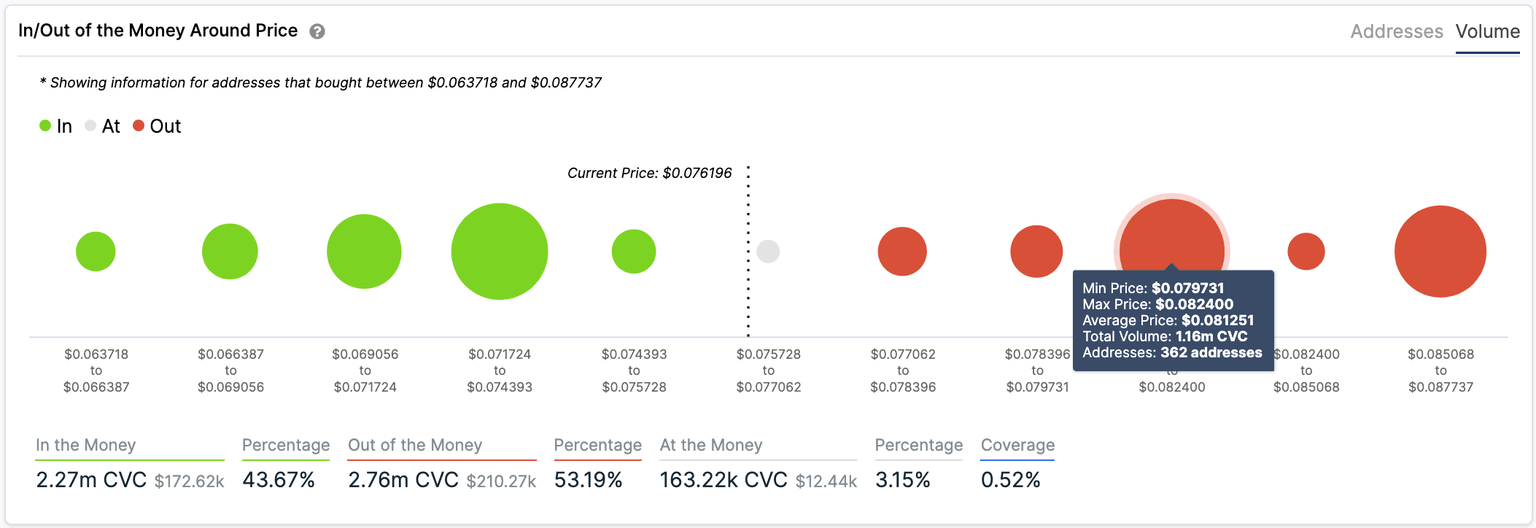

CVC IOMAP chart

However, despite the current selling pressure, the In/Out of the Money Around Price chart shows a lot of support below $0.09 compared to the resistance ahead. The area between $1.02 and $1.05 seems to be the strongest with a volume of 356,000 CVC. A breakout from this point will most likely push CVC’s price to a new two-year high above $0.111

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.