Chinese miners get the most out of Bitcoin (BTC)

- Chinese miners control the biggest share of the Bitcoin's hashrate.

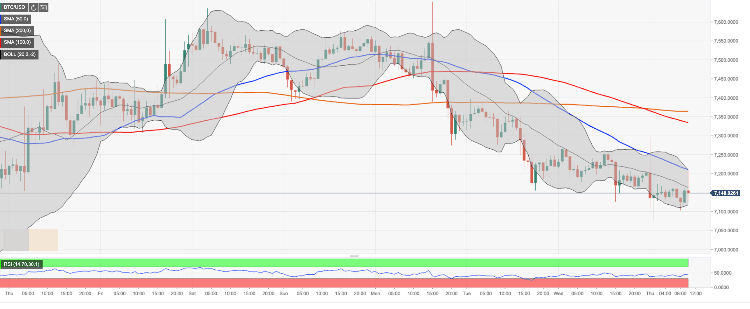

- BTC/USD continues range-bound trading with a bearish bias.

Bitcoin (BTC) is trading at $7,138, having recovered from the intraday low of $7,076. The coin has lost 1.5% on a day-to-day basis and stayed mostly unchanged since the beginning of the day.

Meanwhile, the industry participants are concerned about the centralization of Bitcoin mining. According to the recent research conducted by CoinShares, Chinese miners control about 66% of Bitcoin's hashrate. The experts noted that the centralization has intensified in the past six months as in June, the Chinese share of hashrate was registered at 60%. The increase might have been caused by the deployment of advanced mining equipment by such companies as Bitmain and MicroBT that are considered to be the world's biggest manufacturers of Bitcoin's mining equipment.

Chris Bendiksen, a head of research at CoinShares, noted that At a current Bitcoin's exchange rate of $7,150, Bitcoin miners produce Bitcoins worth of $4.7 billion every year, which is good for the Chinese industry

This is beneficial to the Chinese mining industry. If you are the first to increase your proportion of the hashrate, and you can do that before your competitors, that's generally good.

Bitcoin's technical picture

On the intraday charts, BTC/USD is moving within the downside channel, with the recovery limited by psychological $7,200. This resistance is reinforced by 61.8% Fibo retracement, SMA50 (Simple Moving Average) 1-hour, and the upper line of 1-hour Bollinger Band. Once it is out of the way, the upside is likely to gain traction with the next focus on $7,350 created by SMA200 1-hour.

On the downside, $7,000 remains the critical support in the short run that will define the price direction in the nearest trading sessions. If it is broken, the downside may continue towards $6,550. This barrier is created by the lower line of the weekly Bollinger Band and the lowest level of the previous month.

BTC/USD, 1-hour chart

Author

Tanya Abrosimova

Independent Analyst