Chainlink Price Analysis: LINK moves back below pivotal level, on-chain metrics support bearish scenario

- LINK/USD has attempted a recovery above the daily SMA.

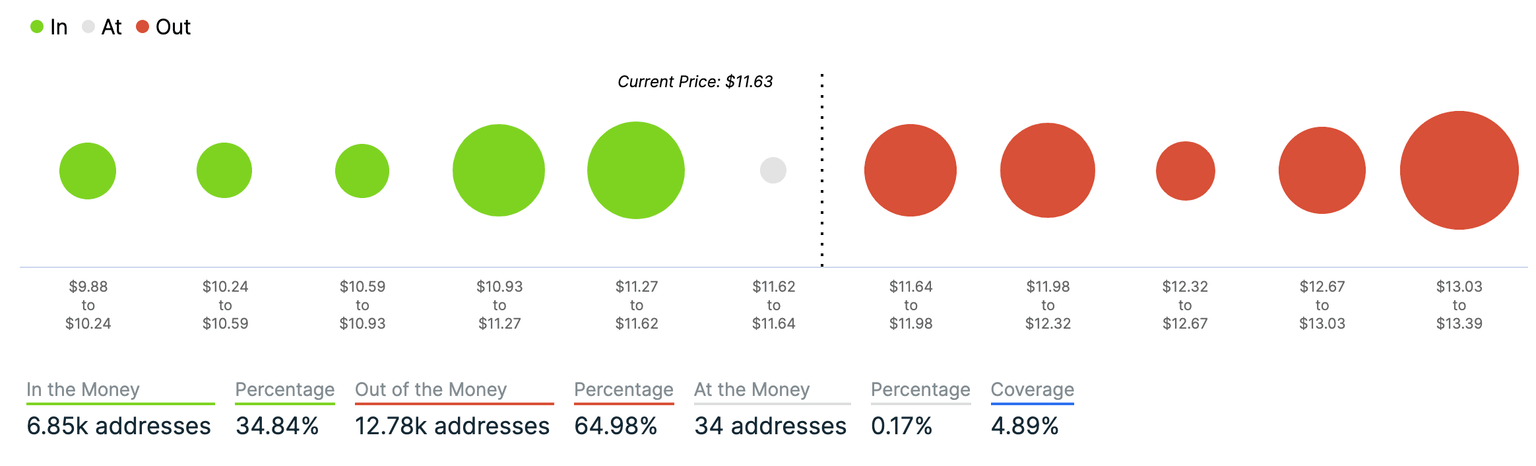

- A cluster of LINK addresses with the breakeven point above $12.00 discourage the bulls.

-637336005550289133_XtraLarge.jpg)

Chainlink (LINK), the fifth-largest digital asset with the current market capitalization of $4.1 billion, dropped back below the critical technical level after a short-lived recovery attempt. At the time of writing, LINK/USD is changing hands at $11.60, down nearly 2% since the start of the day. Chainlink's average daily trading volume settled at $1.8 billion, in line with the current values.

LINK/USD: The technical picture

LINK topped at $20.00 on August 16 and has been declining steadily ever since. The coin broke below the daily SMA50 on September 3 and bottomed at $9.22 on the following day. While the price managed to regain the ground, but the recovery impulse faded away on approach to $13.00. LINK failed to settle above the daily SMA50 (currently at $12.58), increasing the bearish sentiments on the market.

LINK/USD daily chart

LINK on-chain metrics

The on-chain statistics provided by Intotheblock also imply that LINK bulls may have a hard time pushing the price above $12.00-$12.50. Two significant clusters of LINK addresses (2.5 million and 2.7 million) have their breakeven price around those levels. As traders may choose to cash out once the price reaches their breakeven, the increased supply will prevent the price from moving higher.

Source: Intotheblock

However, once the above-said area is cleared, the recovery may gain traction towards $13.00. The lower boundary of the previous consolidation channel creates the next resistance at $14.00. A sustainable move above this area will allow for an extended upside towards $17.00, followed by the recent high of $20.00.

On the other hand, LINK/USD may resume the sell-off with the net critical barrier created by the daily SMA100 at $8.78. This MA supported the LINK's price since the beginning of April, and the chances are that it will stop the sell-off and trigger a new bullish wave.

Author

Tanya Abrosimova

Independent Analyst

-637350819396013442.png&w=1536&q=95)