Cathie Wood’s ARK adheres to $1 million Bitcoin price prediction by decade end as BTC nears $25,000

- ARK Investment Management’s strategists stuck with their notion of Bitcoin being a long-term opportunity.

- In order for Bitcoin price to touch $1 million by the decade's end, the king coin would need to rise by more than 4,200%.

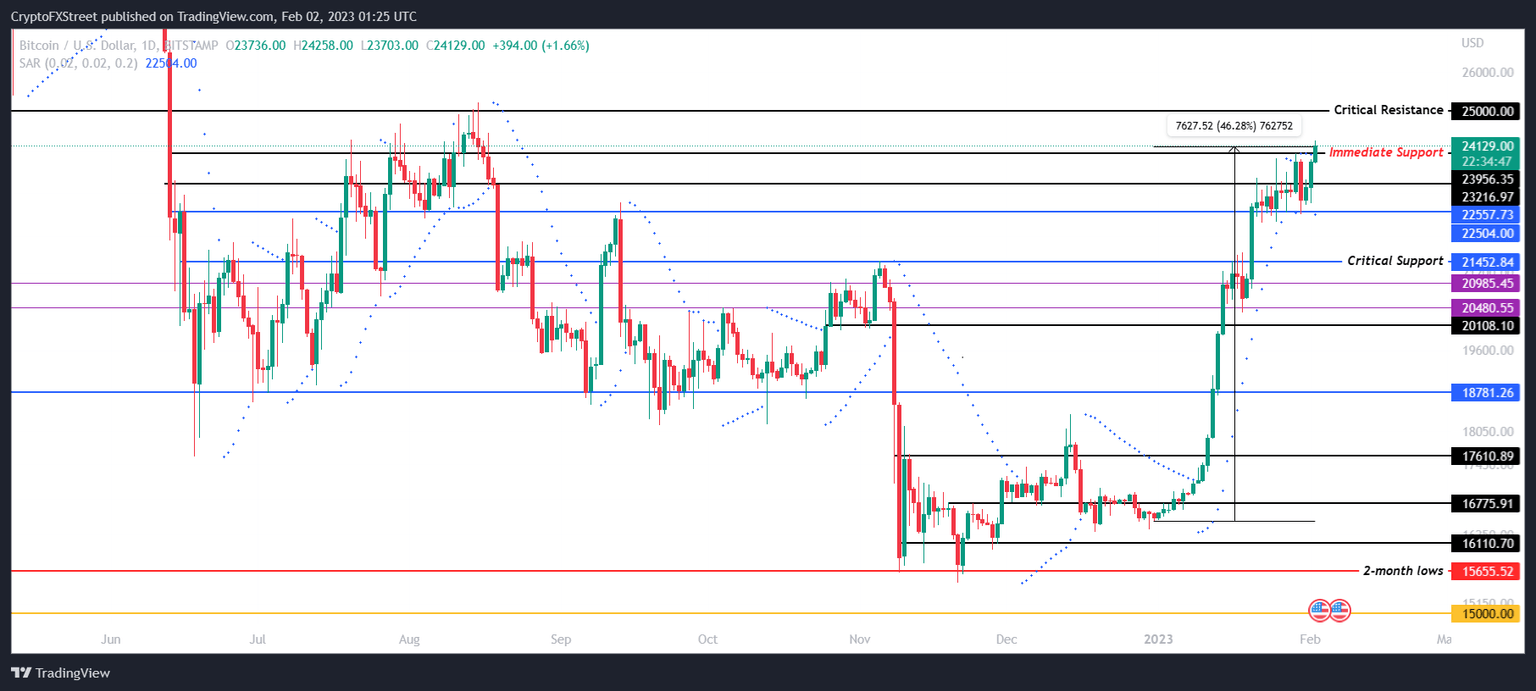

- Bitcoin price is fluctuating around the $24,000 mark, which also represents a critical support level, reclaiming which will strengthen BTC’s presence near $25,000.

Bitcoin, the leader of the crypto market, has had a fairly turbulent year in 2022, but starting this year, the cryptocurrency has proved to be far better. This has imbued confidence in BTC investors and traders, which could, in return, increase interest in the asset, leading to an increase in price and profits, essentially proving ARK Investment Management is likely.

Cathie Wood’s ARK Investment believes in Bitcoin

Cathie Wood’s investment management company ARK Investment’s strategist team is one of the most optimistic bunch of people in the world at the moment. Despite Bitcoin slipping from its highs of $67,000 in November 2021 to trade at $24,000 at the time of writing, ARK Investment remains confident.

This has led the team led by Yassine Elmandjra to reaffirm their faith in the future value of the king coin. Publishing in the company’s annual “Big Ideas” paper on Monday, the strategists' team stated,

“Bitcoin’s long-term opportunity is strengthening. Despite a turbulent year, Bitcoin has not skipped a beat. Its network fundamentals have strengthened and its holder base has become more long-term focused.”

ARK Investment is hung on the belief that Bitcoin price by the end of 2030 would reach $1.48 million, and in the worst case, the bearish outlook places BTC at $258,500. While the former is a 6066% increase from the current price of $24,000, the latter would also need BTC to note a 977% rally in the next seven years.

The company’s Innovation ETF - ARKK is also following the king coin’s cue as the exchange-traded fund rallied by nearly 39% in the span of a month. Recording one of the best months since its inception, ARKK’s premium to Net Asset Value (NAV) since its inception lies at 6.84%.

Bitcoin price rally continues

Bitcoin price has been hovering around the $24,000 mark over the last few hours as the king coin noted a 46.28% rally in the month of January 2023. The cryptocurrency is well on its way to tagging the next critical resistance at $25,000, provided it can maintain its current heading.

The Parabolic Stop and Reverse (SAR) indicator is highly suggestive of consistent green candles, which is essential for a rise. The presence of the blue dots of the indicator below the candlesticks highlights an uptrend.

If this uptrend persists, the immediate support level at $23,956 will be strengthened into a support floor. This would enable BTC to breach the critical resistance at the $25,000 mark and initiate a recovery rally.

BTC/USD 1-day chart

However, if the bullish narrative fails and the king coin loses its ground, it would slip to $23,216. Bitcoin price would have the opportunity to bounce off the support level at $22,557 before hitting the critical support at $21,452. A daily candlestick close below this level would invalidate the bullish thesis, pushing the price below $21,000.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.