Cardano Price Forecast: What does $90M Open Interest surge mean for ADA price

- Cardano price rebounds above $1 on Wednesday as Trump-fueled bullish tailwinds intensified across the crypto markets.

- ADA open interest increased by $90 million in the last 24 hours, suggesting more upside potential ahead.

- ADA price moved above the Volume Weighted Average Price (VWAP), indicating demand currently outpaces selling pressure.

Cardano (ADA) price edges higher and rebounds above $1 on Wednesday as bullish speculation around Trump’s upcoming inauguration boosts markets after a volatile start to January. Market data shows that speculative demand for ADA outpaces current spot market gains, signalling the potential for more upside. Will ADA price breach $1.20 resistance in the coming trading days?

ADA price tests $1 as Trump’s upcoming inauguration lifts market momentum

Cardano price has been subject to intense volatility in January, mirroring the crypto market’s shaking start to the month.

After reeling under an uncertain macroeconomic landscape over the past week, the momentum flipped positive on Monday as investors switched focus to US President-elect Donald Trump’s upcoming inauguration.

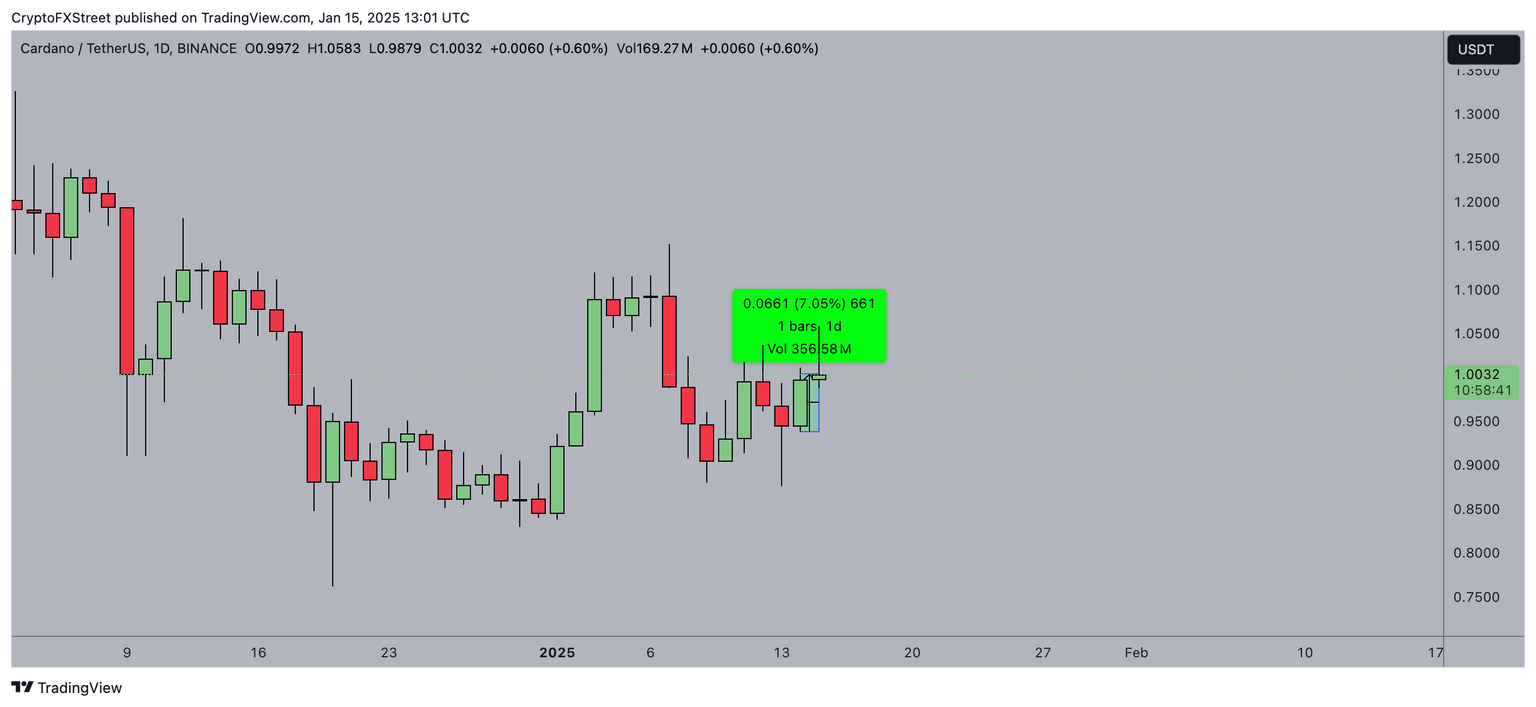

Since the market rebound began on Monday, ADA’s price has mustered near a 15% surge, moving from a weekly low of $0.87 to hit the $1 mark at the time of writing on Wednesday.

Notably, ADA has been one of the most in-demand altcoins in recent weeks.

Along with the likes of XRP, DOGE and BTC particularly, many investors anticipate that ADA could benefit significantly from the Trump administration.

Speculative traders bet another $90 million on ADA in the last 24 hours

Cardano has seen a surge in market activity following notable developments and speculation surrounding its future. Charles Hoskinson, the project’s founder, has made headlines with comments aligning with the incoming Trump administration and speculation about a potential partnership with the US government for blockchain-based voting solutions.

This narrative has sparked increased interest in ADA, which has outperformed other Trump-linked altcoins like XRP and DOGE, both of which have similarly bullish associations.

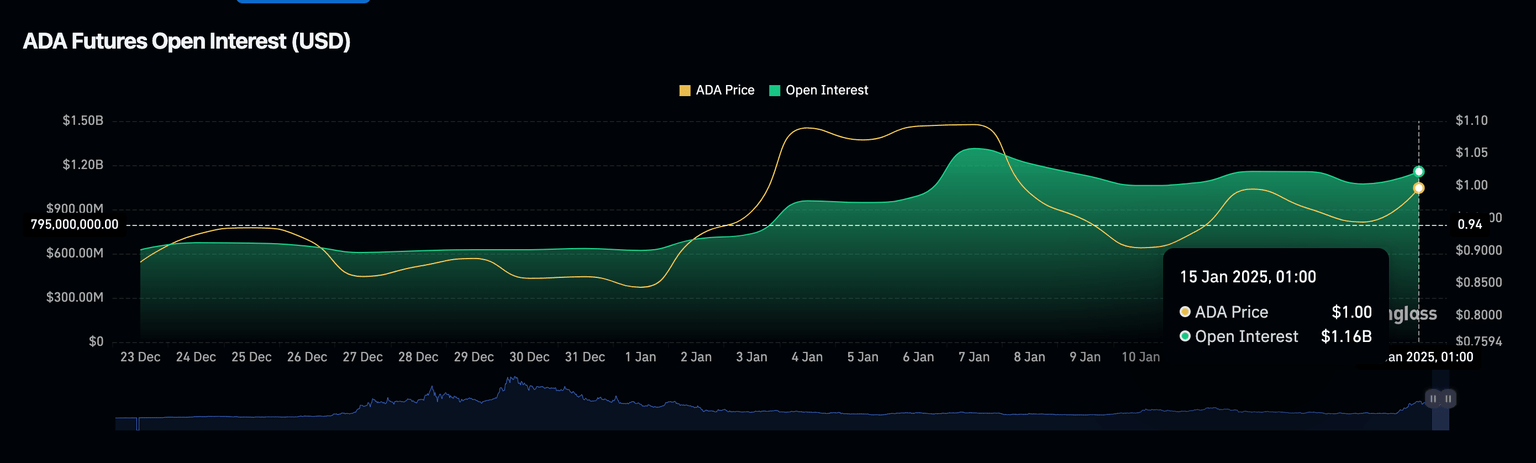

This renewed focus on Cardano appears to have driven significant speculative demand. According to data from Coinglass, the daily capital inflows into the ADA perpetual futures market have climbed sharply, underscoring this heightened activity.

The chart above illustrates a notable increase in open interest for ADA. Between Tuesday and Wednesday’s press time, Open Interest rose from $1.07 billion to $1.16 billion.

This $90 million inflow within 24 hours represents a 9% increase in open interest, outpacing ADA’s price gains of 7% during the same period.

This trend is bullish, as it suggests that speculative interest in ADA derivatives is accelerating faster than its spot market price.

This divergence indicates that ADA may still have considerable upside potential in the spot market, especially given the intensifying bullish speculation surrounding Donald Trump’s crypto-friendly policies.

Cardano Price Forecast: Volume spike could trigger $1.20 breakout

After a sharp recovery from the weekly low on Monday, Cardano’s price appears positioned for another leg-up.

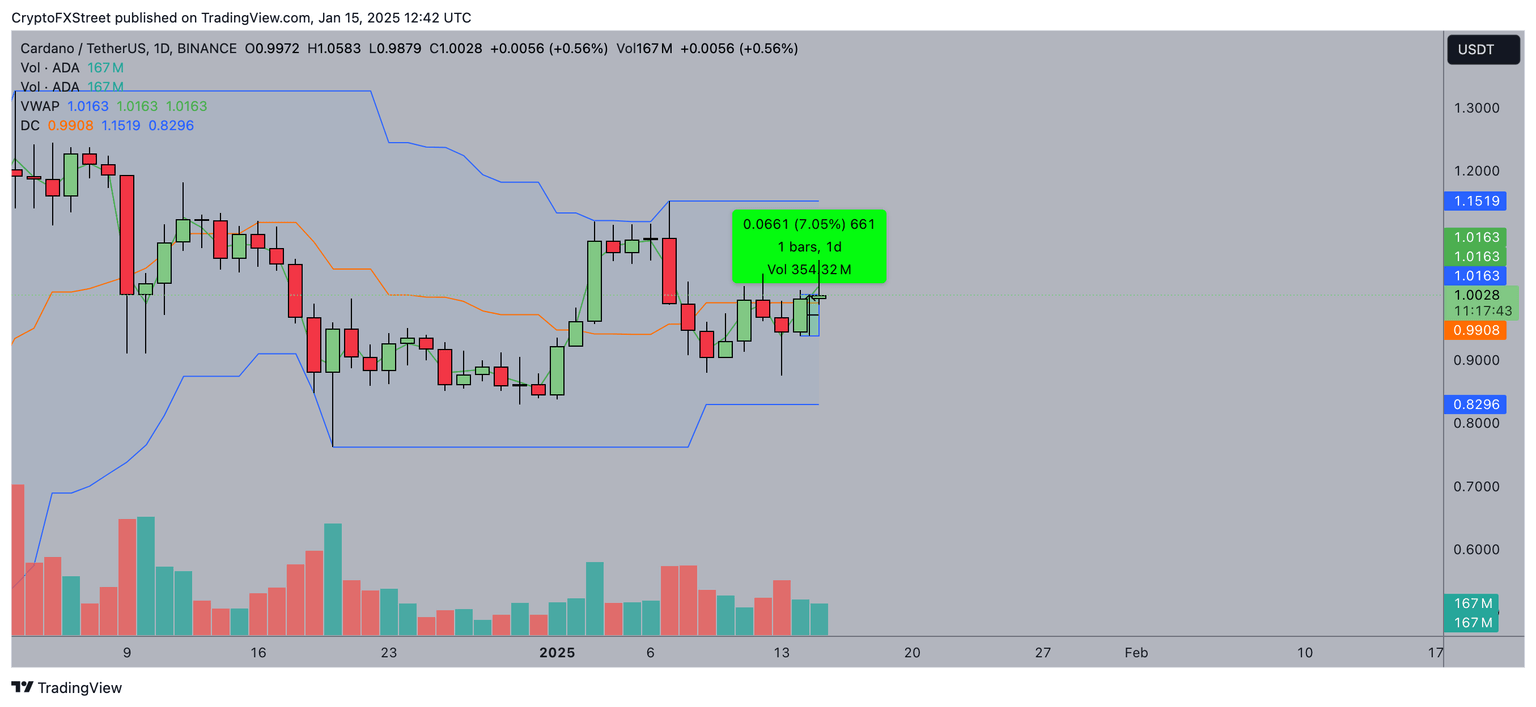

From a technical standpoint, ADA price has moved above the Volume Weighted Average Price (VWAP), a critical indicator that suggests buyer dominance in the market.

With the recent $90 million surge in Open Interest in ADA perpetual futures, bulls could push for a sustained rally toward the $1.20 resistance level.

The accompanying spike in trading volume, which has risen sharply to 354 million, further reinforces this bullish narrative.

Historically, such high-volume movements above VWAP signal strong market confidence, which could propel ADA to retest the $1.20 level in the near term.

If momentum continues, a break above $1.20 could open the door for a move toward $1.30, supported by the broader cryptocurrency market's tailwinds.

However, failure to sustain the breakout above VWAP could see ADA retrace toward the $0.99 Donchian Channel midline, where it may find support.

A breakdown below this level would signal waning bullish momentum, potentially driving prices back towards the lower boundary at $0.82.

Author

Ibrahim Ajibade

FXStreet

Ibrahim Ajibade is an accomplished Crypto markets Reporter who began his career in commercial banking. He holds a BSc, Economics, from University of Ibadan.