Cardano hits three-month peak, climbs to $0.50 despite bearish on-chain metrics

- Cardano price rallied to $0.50 early on Friday, hitting a three-month peak.

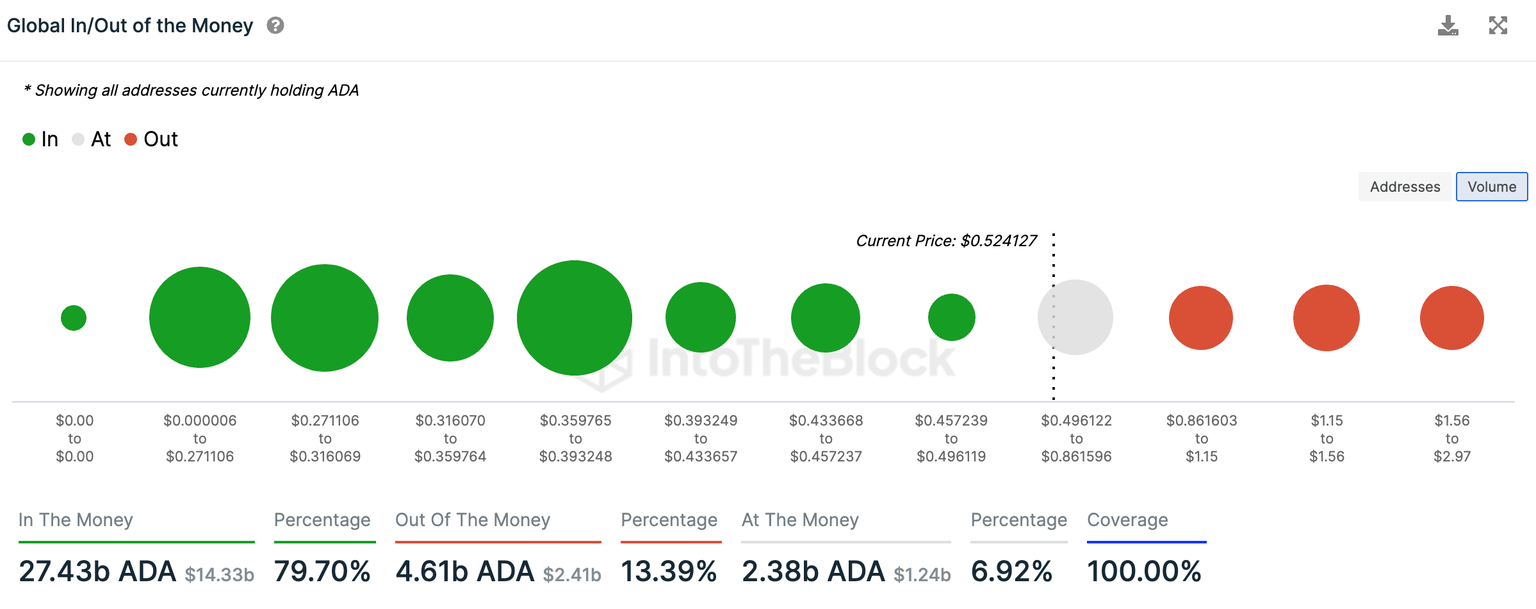

- Nearly 80% of Cardano wallet addresses are currently profitable, priming ADA for sell-off.

- Cardano retail investors are accumulating ADA tokens while large wallet investors distribute their holdings.

Cardano price climbed to $0.50 after a three-month wait by ADA holders. The Ethereum-alternative token rallied alongside other top cryptocurrencies. Cardano’s price increase is accompanied by a distribution of whale wallet holdings.

Also read: Bitcoin analyst calls early bull market as BTC price targets $50,000 in December

Cardano price hits highest level in three months

Cardano price climbed from $0.38 on December 1 to $0.50 early on Friday, a rally of 31.5% in an eight-day timeframe. At the current price level of $0.52, nearly 80% of Cardano wallet addresses are sitting on unrealized profits, according to IntoTheBlock data.

ADA price is at a risk of correction if the aforementioned wallet addresses realize their gains, as it would increase the selling pressure on the asset.

Global In/Out of the Money Source: IntoTheBlock

On-chain metrics paint bearish picture

Large wallet investors holding ADA tokens have distributed their holdings starting September 24 while retail traders holding between 1,000 and 1 million ADA accumulated the altcoin consistently. According to Santiment data, this marks distribution by whale wallets and accumulation by retail traders.

Typically, distribution by whales is profit taking, however in the case of Cardano, despite whales shedding their assets, ADA price has risen.

Cardano wallet holdings of whales and retail traders Source: Santiment

The Market Value to Realized Value (MVRV) ratio for a 30-day timeframe is 19.59%, its highest level in three months, according to Santiment data. This is likely bearish for ADA as holders who acquired Cardano in the past 30 days are sitting on unrealized gains.

Cardano MVRV (30-days) Source: Santiment

At the time of writing, Cardano price is trading above the $0.50 level, after yielding nearly 38% weekly gains for ADA holders.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.

%2520%5B17.30.18%2C%252008%2520Dec%2C%25202023%5D-638376367994017752.png&w=1536&q=95)

%2520%5B18.11.54%2C%252008%2520Dec%2C%25202023%5D-638376368331252934.png&w=1536&q=95)