Cardano, avalanche lead fed-driven crypto rally, traders still wary of long-term recovery

Tokens of Cardano (ADA) and avalanche (AVAX) led gains among crypto majors in the past 24 hours. The recovery follows a jump in the broader markets after the U.S. Federal Reserve (Fed) raised rates on Wednesday.

The overall crypto market added capitalization of some 4.9%, almost reaching the early-April level of $2 trillion. Bitcoin (BTC) and ether (ETH) moved 5%, nearing pivotal resistance levels of $40,000 and $3,000 respectively.

Liquidations on crypto-tracked futures remained relatively low, despite the move. The market saw $177 million in liquidation losses in the past 24 hours, suggesting the rally was mostly driven by spot assets.

ADA spiked as much as 14% during early Asian trading hours before dropping slightly to the $0.86 level. The driving factor for the token was demand from retail traders, as on-chain data shows a 186% rise in the number of wallets holding ADA for 30 days or longer.

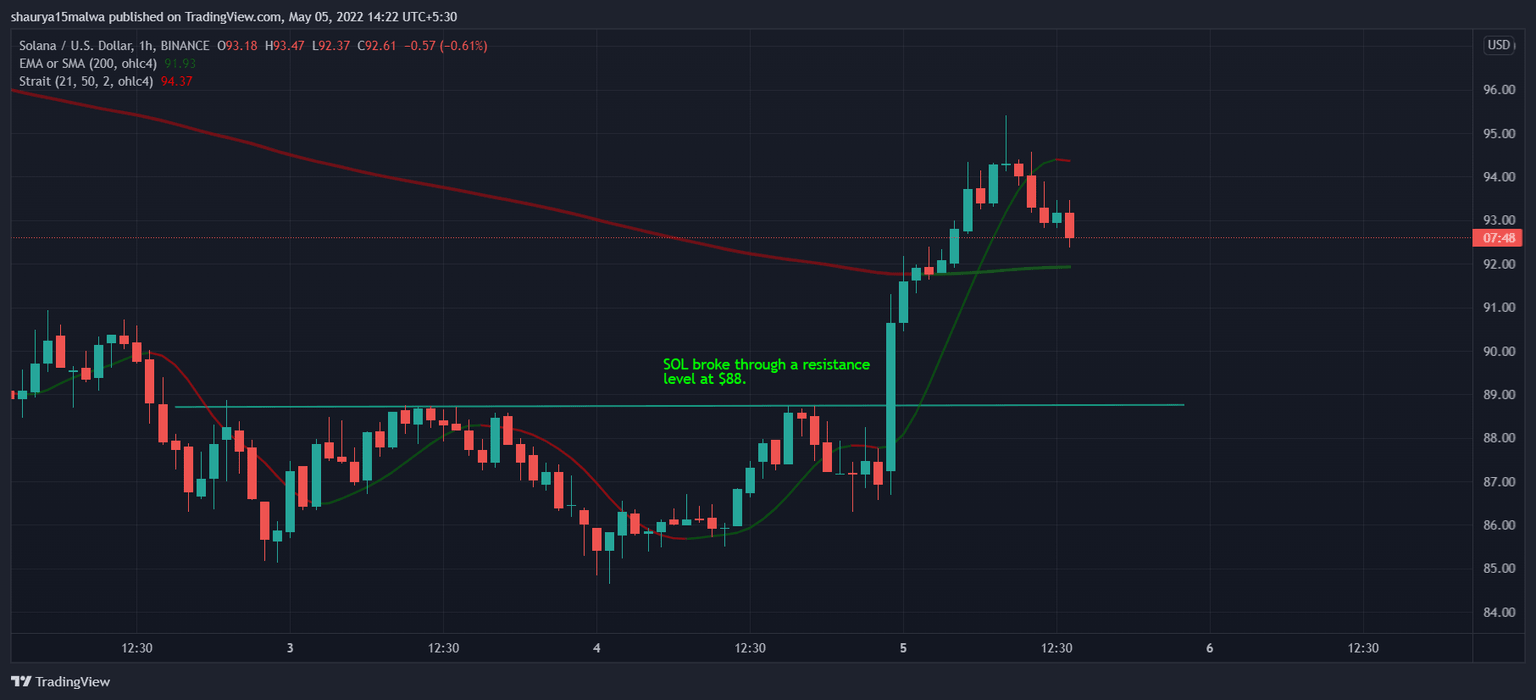

SOL jumped 9% to just over $93, while Avalanche’s AVAX jumped as much as 12%. Other majors like BNB Chain’s BNB and XRP rose just over 5%, mimicking bitcoin’s move.

SOL was partly buoyed by fundamental improvements to the Solana Pay product. Developers added a transaction request feature that would now allow merchants to provide customized transaction links to users, such as unique non-fungible tokens (NFTs) or virtual gifts.

SOL rose above resistance at $88 last night. (TradingView)

Previously, Solana Pay only allowed one-way transfers between users and merchants, as reported on Thursday.

US markets recover after Fed hikes rates

The moves came amid a broader market recovery in the U.S., which likely served as a bullish sign for investors. The Fed raised interest rates by 50 basis points, while Powell said similar moves can be expected in June and July.

Fed Chairman Jerome Powell addressed growing concerns around surging inflation in a meeting on Wednesday, stating the Fed would move “expeditiously to bring it back down.” Powell added the move could cause “some pain” in the economy as it took steps to deal with inflation.

The Fed’s confidence in tackling a slowing economy led to a market upheaval: Equity markets in the U.S. jumped, with technology-heavy Nasdaq ending the day 3.19% higher and S&P 500 gaining 2.99%.

Some traders and developers said the economic decisions in the U.S. fuelled last night's rally in cryptocurrencies, but the sentiment for longer-term recovery remains mixed.

"Going into the meeting we have seen risk-off action across the board in global markets, crypto inclusive. The 50 bps rate hike was the most likely outcome of the FOMC meeting and the narrative has shifted to the Fed being in control and no longer behind the yield curve," explained Kurt Grumelart, trader at crypto fund Zerocap, in a Telegram message.

Johnny Lyu, CEO of crypto exchange KuCoin, said in a Telegram chat that market participants expected volatility ahead of last night's meeting. "The focus of the market was the announcement of the final decision of the FOMC to raise the benchmark interest rate by 50 points to the range of 0.75%-1.00%. This was the largest rate hike since May 2000," he said.

"We can see that Powell ruled out a 75 basis point rate hike and expressed confidence that the U.S. could avoid a recession, a so-called hard landing, as the Fed raises borrowing costs to reduce high inflation," Lyu explained, adding Wednesday's bounce in cryptocurrencies showed that despite the macroeconomic pressures, the cryptocurrency market remained "surprisingly strong in relative terms."

Anton Gulin, Regional Director at crypto exchange AAX, said much of the moves came due to an underlying correlation between U.S. equities and the global crypto market.

"The expectations were worse than the actual outcome, therefore we can see recovery across all markets. The correlation between crypto and stock markets has always been quite manipulative," Gulin said. "The following month is gonna be the interesting cause as we know: "Sell in May and go away"."

Some like Zerocap's Grumelart remain wary about that correlation. "While we don't explicitly expect more downside (particularly because we are near a long-lasting support base), you can't look past current headwinds and high correlation to traditional markets," he said.

Author

CoinDesk Analysis Team

CoinDesk

CoinDesk is the media platform for the next generation of investors exploring how cryptocurrencies and digital assets are contributing to the evolution of the global financial system.