Bittensor Price Forecast: Is China's Deepseek vs OpenAI rivalry behind $1.4B TAO rally?

- Bittensor (TAO) price hits $498 on Wednesday, defying crypto market volatility to rise 37% since Saturday.

- TAO market capitalization has increased by $1.4 billion since Chinese developers launched Deepseek on Saturday.

- Deepseek and OpenAI rivalry discussions triggered strong bullish sentiment around decentralized, open-source AI solutions like Bittensor.

- Bittensor's social volume score rose to a 50-day peak, signaling spikes in TAO media mentions since the Deepseek AI launch date.

Bittensor (TAO) price peaked $484 at for Wednesday, defying crypto market volatility with a 37% increase over the last seven days. On-chain data suggests discussions around China’s Deepseek and OpenAI may have driven TAO’s strong performance.

Bittensor (TAO) emerges as crypto’s top gainer amid market crash

This week, Bittensor price has outperformed all top 50-ranked cryptocurrency assets. While the broader crypto market started the week in decline, facing more than $975 million in liquidations, Bittensor defied bearish sentiment to post multiple bullish records.

Amid volatile market trends, Bittensor is the only top 50-ranked crypto asset to record gains on each day since the start of the week. TAO has posted four consecutive green candles since Deepseek AI’s launch on Saturday. With a 37.2% price surge in that period, Bittensor has added over $1.4 billion to its market capitalization.

Why is Bittensor price going up?

- TAO price gained 37% this week as OpenAI vs. Deepseek Rivalry sparked a 400% surge in Bittensor media traction

Discussions surrounding Deepseek’s launch have triggered strong bullish sentiment around decentralized, open-source AI solutions like Bittensor.

While CEO Sam Altman issued a series of posts on X defending Open AI’s operational structure, arguments favoring Deepseek’s efficient and open-source model have fueled further interest in Bittensor’s technology.

Social media analytics link Bittensor’s market-leading performance this week to positive momentum from the Deepseek vs. OpenAI debate.

While the broader market struggled with $97 billion in liquidations on Monday, Bittensor extended a four-day winning streak, raising speculation about its unique correlation with recent developments within the global AI sector.

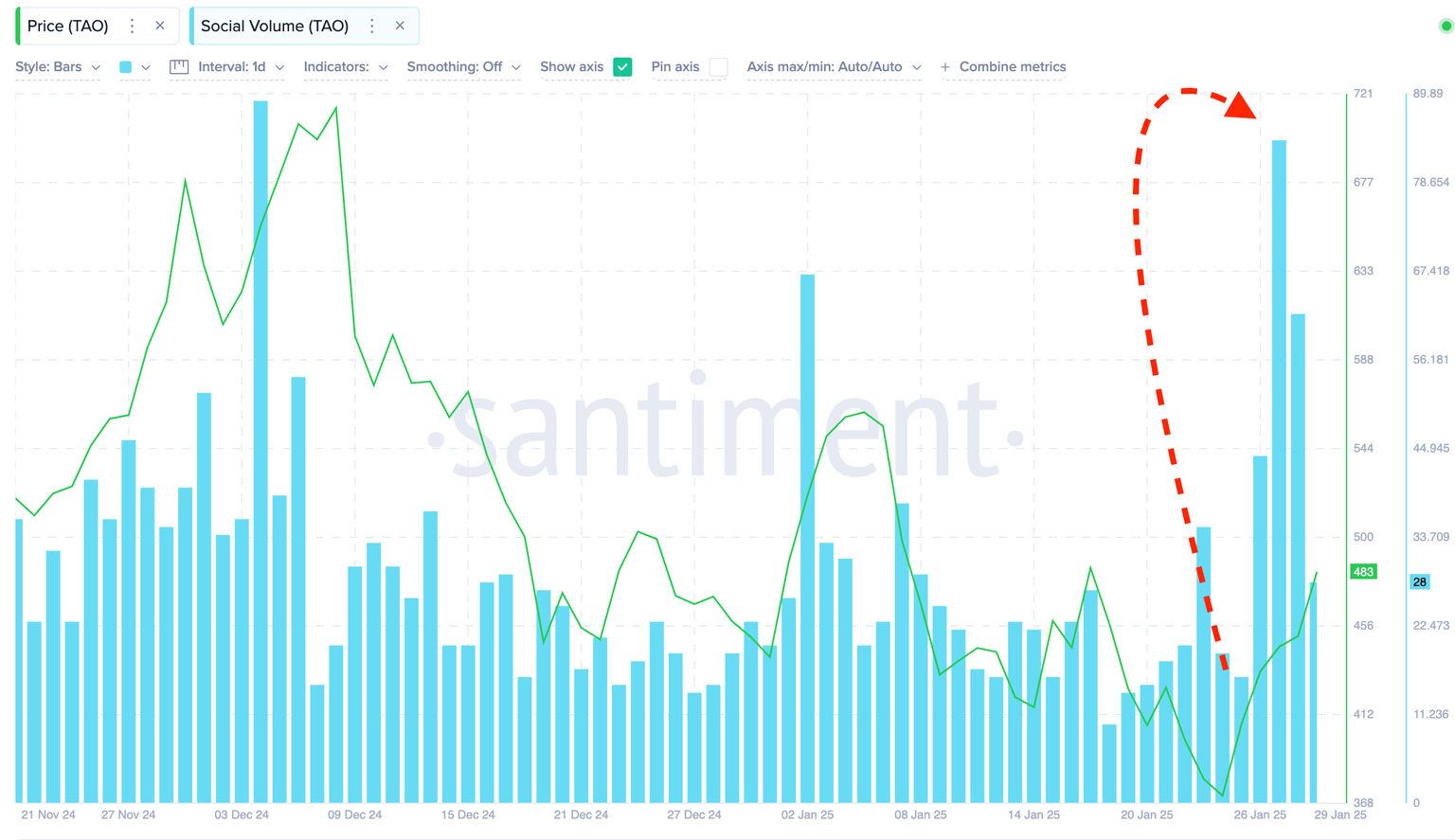

This narrative is emphasized by Santiment’s Social Volume chart below, which tracks the number of mentions a cryptocurrency project receives across platforms like X, Reddit and Telegram.

The data shows that Bittensor’s social volume score rose by more than 400% to hit a 50-day peak of 84 on Monday, coinciding with the breakout of the Deepseek vs. OpenAI debate.

This Social Volume surge aligns with the narrative that Deepseek’s launch directly influenced Bittensor’s price rally.

Amid a flurry of comments from industry leaders, such as OpenAI CEO Sam Altman and Donald Trump’s recent decision to impose a tariff on Taiwanese semiconductor chips, the media traction around Bittensor remains at euphoric peaks.

From this viewpoint, if the media fanfare persists around Deepseek's “open source” threat to OpenAI's dominance, TAO price could continue to attract more speculative demand.

More so, a clear historical pattern in the charts shows continuous uptrend in TAO social volume has often led to upward price action.

TAO Price Forecast: $500 breakout hopes alive if $465 support holds

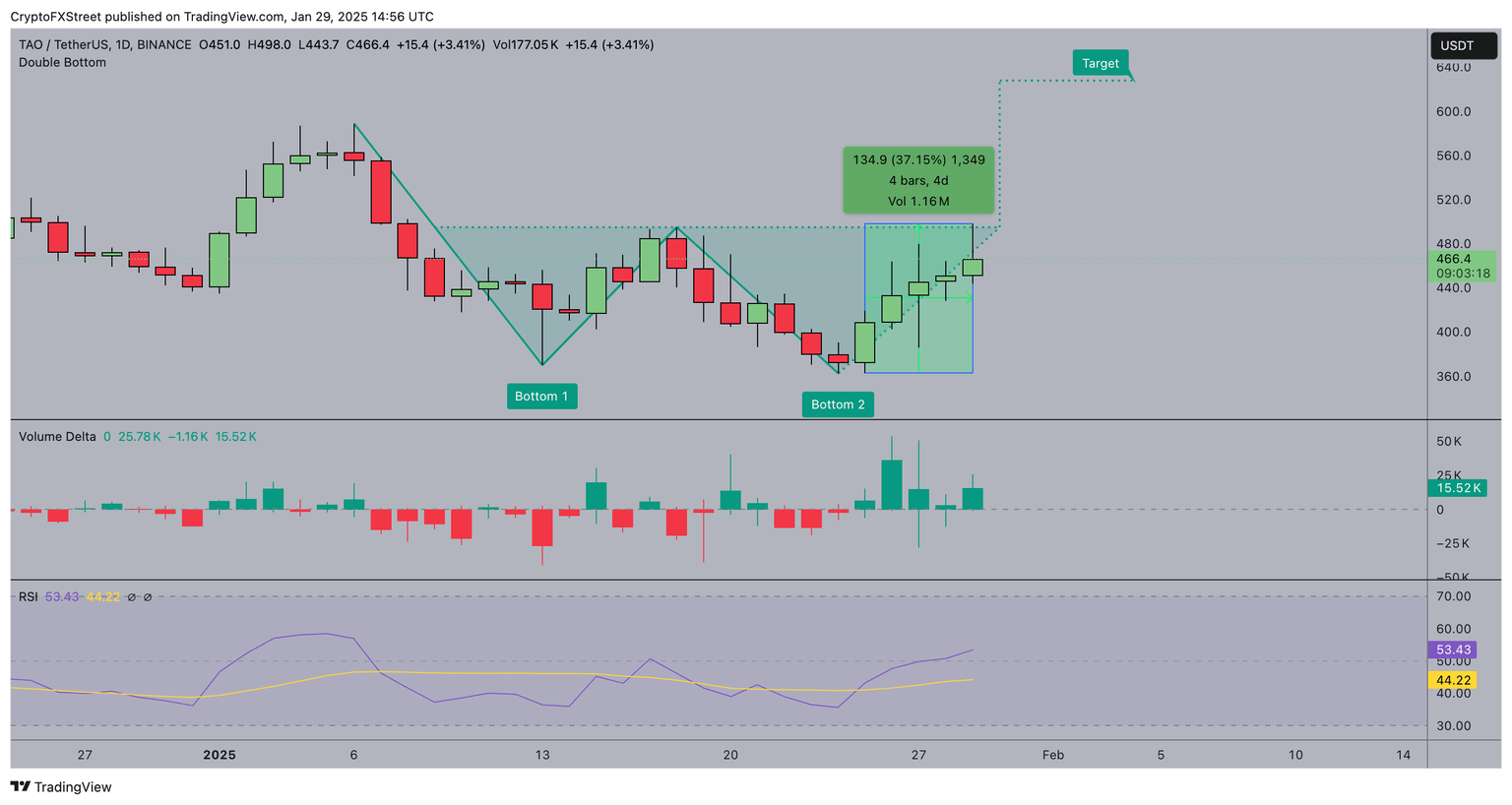

Bittensor price forecast is still leaning towards a further upside constructive outlook, with a Double Bottom pattern hinting at another 30% uptick towards the $640 target.

The recent price action has been underpinned by rising volume, indicating growing buying interest.

The Relative Strength Index (RSI) at 53.43 suggests the market is not yet overbought, leaving room for further upside.

A break above the $500 mark could confirm the bullish scenario and set a path towards the $640 target.

The consecutive positive values in Volume delta signal daily in capital entering the TAO spot markets since Monday, reinforcing the bullish outlook.

Conversely, failing to hold above the $465 support could signal a bearish reversal. This level is crucial as it represents the neckline of the Double Bottom pattern.

A close below this could trigger a decline towards the $443.7 low. However, the overall technical setup leans bullish, with the potential for a significant price increase if the support level holds.

In summary, the $465 level is a key determinant of the short-term trend. A successful defense of this support could lead to a rally towards the $640 target, driven by the bullish technical indicators and positive market sentiment.

Author

Ibrahim Ajibade

FXStreet

Ibrahim Ajibade is an accomplished Crypto markets Reporter who began his career in commercial banking. He holds a BSc, Economics, from University of Ibadan.