Bitcoin Weekly Forecast: Bitcoin moves to a new grade as the network turns 12 years old

- Bitcoin becomes more mature and moves to another stage.

- The technical picture implies that the price may continue growing but there are some risks.

Bitcoin has just finished one of the best months in terms of growth since May 2019. The pioneer digital currency gained nearly 30% in October and entered November with intense bullish fervour. Neither COVID-19 fears nor US presidential election jitters stopped Bitcoin from growing, even though the traditional markets were under pressure.

On election week, BTC stopped within a whisker of $16,000 and hit the highest level since January 2018, as the bullish run was fuelled by a combination of strong fundamental factors, including growing interest from the hi-tech industry and traditional investors, perspectives of new fiscal stimulus and a crypto-friendly US president.

Also, history shows that the US presidential elections serve as a significant turning point and a bullish catalyst for Bitcoin. The cryptocurrency has experienced strong growth after Obama and Trump elections.

Bitcoin enters the teenage stage

On October 31, 2020, the cryptocurrency people celebrated the 12th anniversary of Bitcoin's white paper dubbed "Bitcoin: A Peer-to-Peer Electronic Cash System." The document detailed a peer-to-peer version of electronic money that would allow sending payments online directly from one party to another.

During these 12 years, Bitcoin moved from a strange geek concept to truly international money in the portfolios of large institutional investors. Here's a short timeline of the events:

January 2009 – Bitcoin's birthday. A few months after the white paper, the first Genesis block was created and an anonymous Bitcoin creator, Satoshi Nakamoto, sent roughly 10 BTC to a computer programmer, Hal Finney. That's how the decentralized financial system was born.

May 2010 – Pizza Day. To help the new currency gain traction within the community, it was decided to set an exchange rate that was established valuing 1,309.03 BTC for $1. Soon after this, Laszlo Hanyecz performed the first-ever real-life transaction with Bitcoins. He paid 10,000 BTC for two pizzas. That was the precedent that started the ball rolling. People realized that the coin has an intrinsic value and by the end of 2010, Bitcoin market value exceeded $1 million.

November 2013 – One Bitcoin costs $1,000, MT Gox goes bust. As the new network's economic activity picked up, the coin's price experienced a parabolic growth and exceeded $1,000. However, a few months later, the largest cryptocurrency exchange Mt. Gox was hacked and filed for bankruptcy; Bitcoin price collapsed to $164 roughly a year later.

Early 2017 – ICO boom and Bitcoin Cash (BCH) emergence. By the start of 2017, BTC got back above $1,000. As an essential barrier was left behind, Bitcoin got on the radar of traditional mass media and its popularity skyrocketed. A massive demand led to network congestion and high transaction fees, while dispute within the developer community resulted in a hard fork that gave birth to a new coin known as Bitcoin Cash.

December 2017 – Bitcoin costs nearly $20,000. ICO boom and news that the Chicago Mercantile Exchange Group was creating the first regulated Bitcoin financial product took speculations to a whole new level. They pushed Bitcoin price to an all-time high of $19,783.

December 2018 – Crypto winter. A year later, BTC was trading at a low of $3,150, down nearly 84% from its highest point. Almost two years passed, but the flagship cryptocurrency is still recovering from the slump. Considering the latest developments, the chances are that it will surpass $20,000 and hit another record high sooner rather than later.

The sky is the limit for Bitcoin

At the time of writing, BTC/USD is trading at $15,450. The coin has gained nearly 20% in the past seven days and briefly touched the $15,977 mark. The election results have not been officially announced yet but the cryptocurrency market is on the move already with little to stop the bulls on their trip to the north.

The In/Out of the Money Around Price (IOMAP) indicator shows that there isn't much resistance above the current price, meaning that BTC may continue climbing towards $17,000. Once this milestone is passed, BTC will be ready to conquer a new record high.

Bitcoin's IOMAP data

On the other hand, the first support comes at around $14,900, as approximately 522,00 addresses previously bought 400,000 BTC. This barrier is expected to slow down the potential correction and provide substantial support for the price as BTC holders in this range will try to stay profitable on their positions. If the buy orders in this area are absorbed, the sell-off may continue towards the $14,000 range. Significant clusters of addresses confirm the strength of this price barrier.

BTC/USD bears are ready to jump in

As discussed in the previous Bitcoin Price Analysis article, Bitcoin may be ripe for the downside correction as the market is overhyped. The Fear and Greed Index is in Extreme Greed territory, signaling that the buying side is overstretched. Even though the hype may continue and push the price to new highs, the reversal is imminent and it may be really violent considering the sharp price increase.

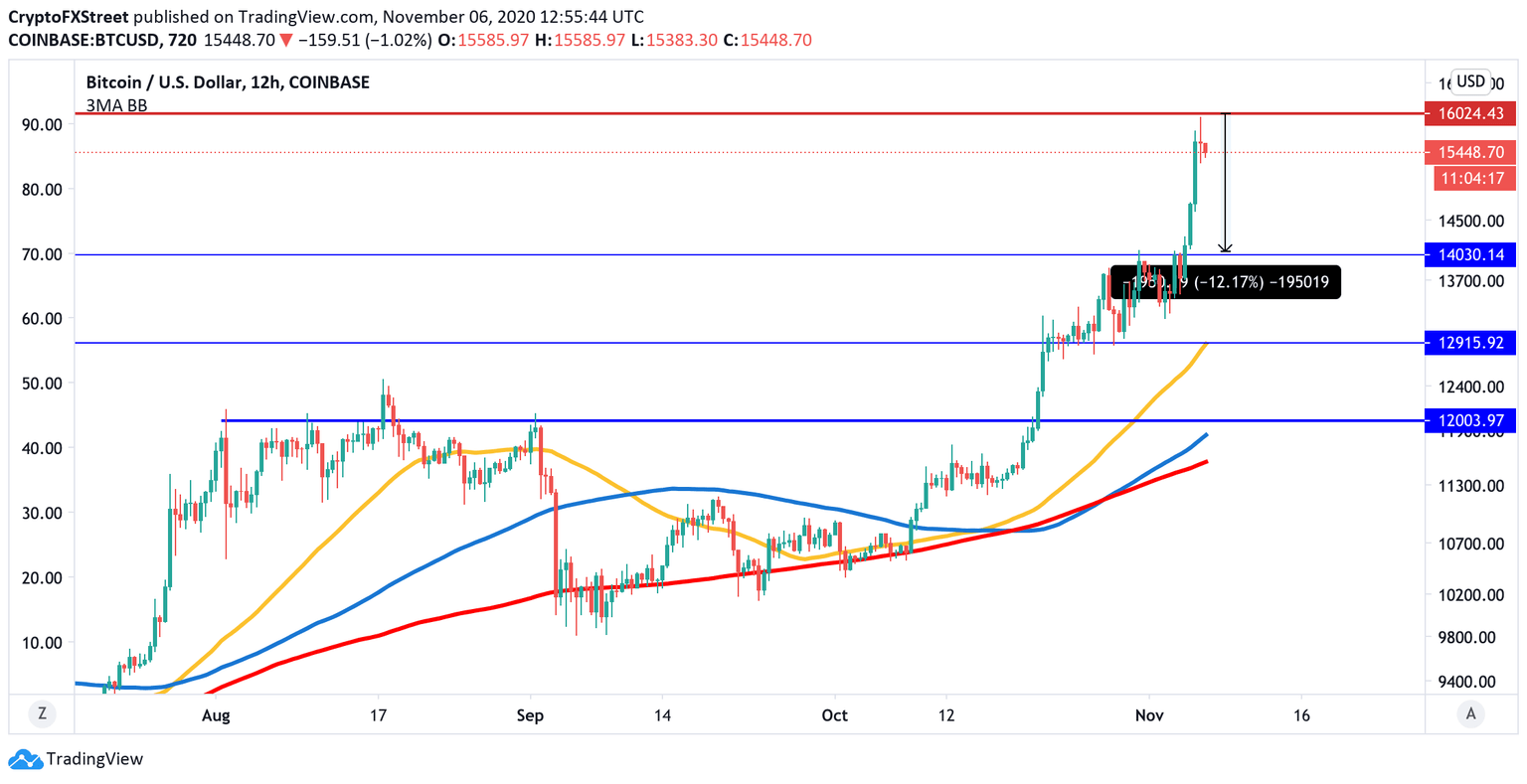

The technical picture on the 12-hour chart implies that the price may retreat to a psychological $14,000 level. This barrier served as a resistance area at the beginning of November and now may be verified as support, as confirmed by the IOMAP data.

BTC/USD 12-hour chart

If this barrier is out of the way, $12,900 will come into focus, reinforced by 12-hour EMA50 and $12,000. This barrier has limited BTC recovery since August. EMA100 and EMA200 add credibility to this support area.

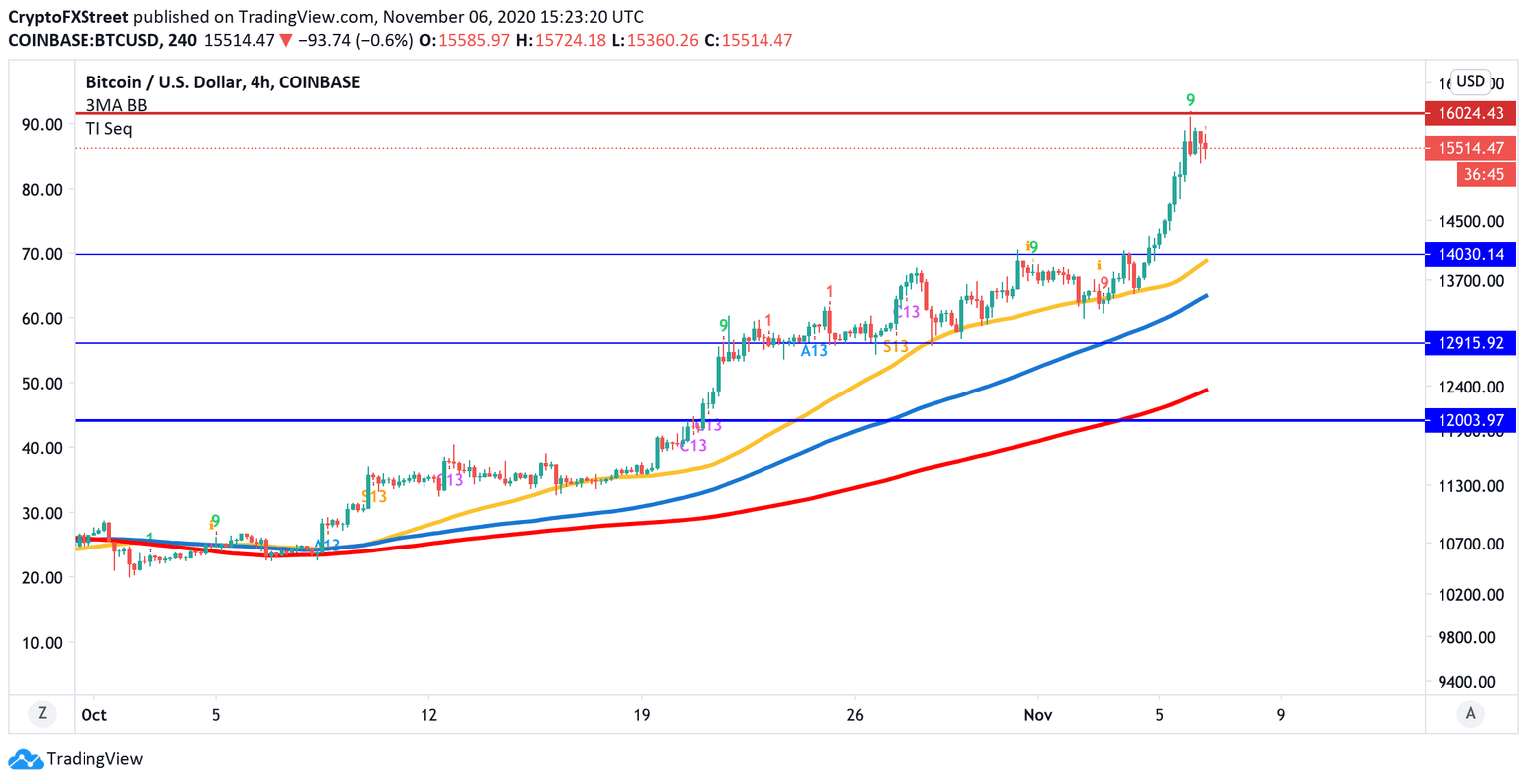

BTC/USD 4-hour chart

The TD Sequential indicator produced a sell signal, confirmed by a red two candlestick trading below a preceding red one candle on the 4-hour chart. This setup implies that BTC is ready for a short-term downside correction with the initial aim at $14,000 strengthened by 4-hour EMA50 and followed by 4-hour EMA100 at $13,500.

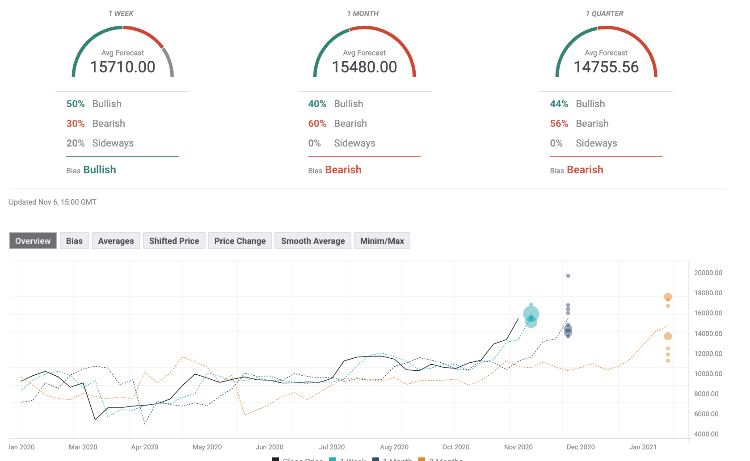

BTC/USD Forecast Poll

Bitcoin Forecast Poll of experts shows a mixed picture as the expectations on a monthly and quarterly basis have turned bearish, while the weekly forecasts are mostly bullish. Notably, the price predictions imply that the participants are less optimistic about Bitcoin price in the long run as an average forecasted price stays above $15,000 only on a weekly and monthly basis.

Author

Tanya Abrosimova

Independent Analyst

%20Analytics%20and%20Charts%20weekly-637402730993314985.png&w=1536&q=95)