Bitcoin SV Price Analysis: BSV stands at a crucial breaking point of its future trend

- BSV is trading at $155 after a 40% decline from its peak on August 2.

- The digital asset has been trading inside an ascending parallel channel since 2019.

Bitcoin SV is still one of the biggest cryptocurrencies globally, currently ranked 11th by market capitalization and ignoring the criticism from the community. Several major exchanges, including Binance, delisted BSV back in 2019; however, the digital currency has remained strong.

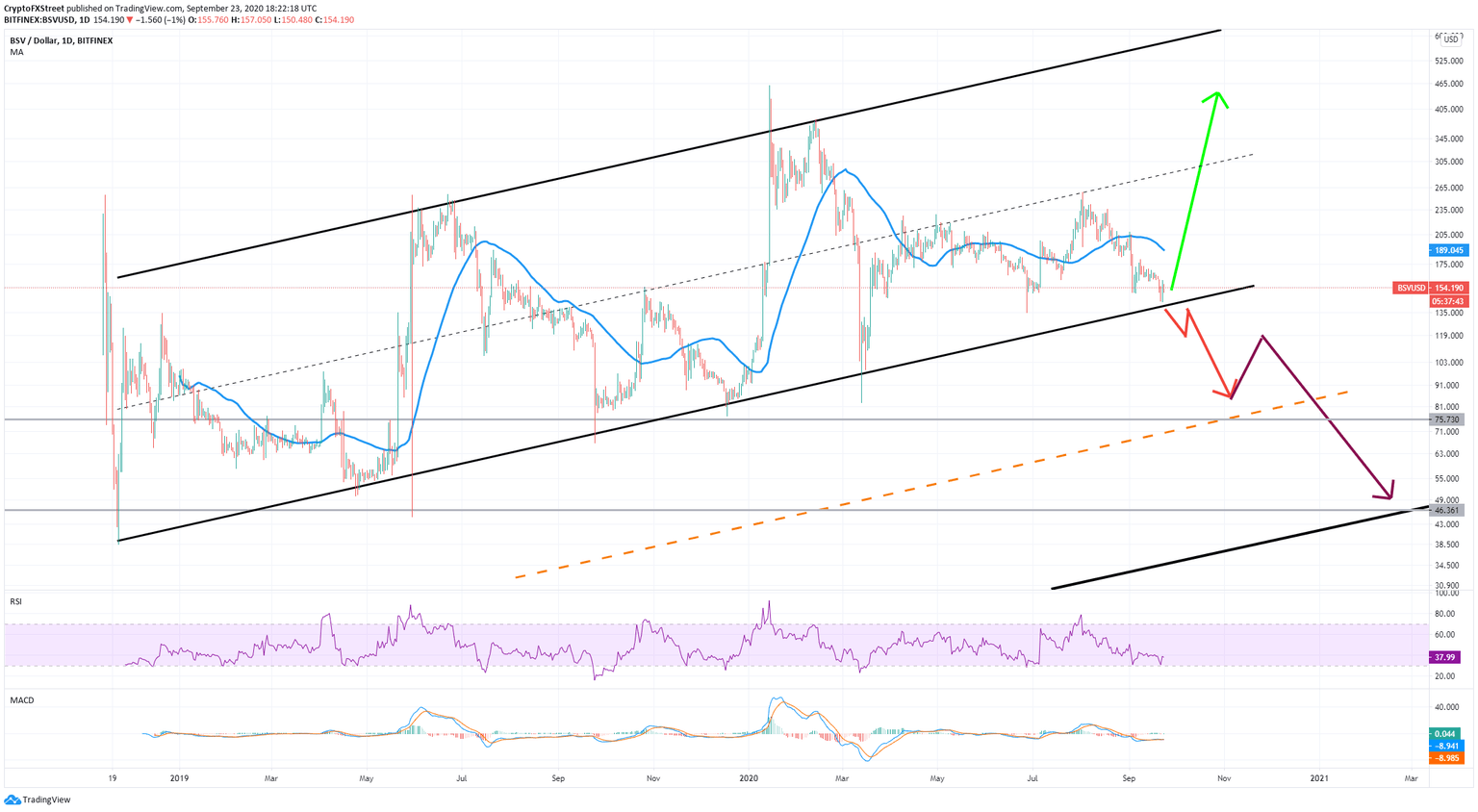

BSV/USD daily chart

The most notable pattern developed on the daily chart is by far the ascending parallel channel. This pattern has been developing since 2019 and although BSV price did pierce slightly above and below the trendlines, it always quickly corrected back up or down.

Once again, BSV is on the verge of a potential bearish breakout or continuation of the pattern to the upside. The lower trendline is currently around $140, which means that a clear breakout below this level well into the $130s and a re-test of the trendline into continuation would confirm the bearish breakout of this pattern.

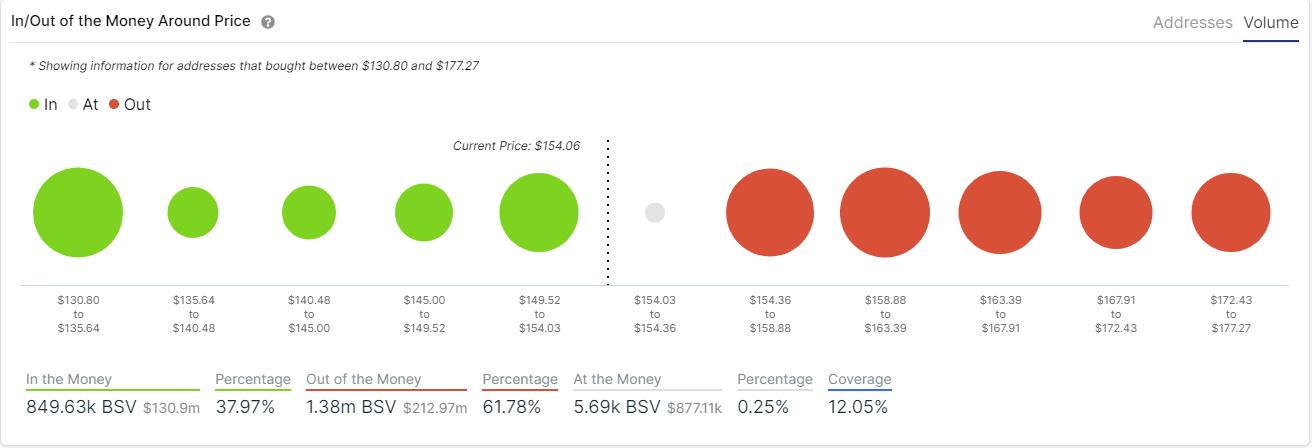

BSV IOMAP Chart

In the short to mid-terms, the most likely target for BSV would be around $75. However, in the long-run, it could drop towards $40. Although the In/Out of the Money Around Price metric from IntoTheBlock shows a fair amount of support at $152, it is lower relative to the resistance at $156 and above. The chart clearly indicates more buyers at $156 with a total volume of 318,000 BSV compared to 244,000 BSV at $152. Furthermore, towards $174, resistance continues being stronger than support.

Nonetheless, BSV has defended the lower trendline several times before. If bulls can hold it again, the price of the digital asset will most likely re-test the middle and upper trendlines at $330 and $650, respectively.

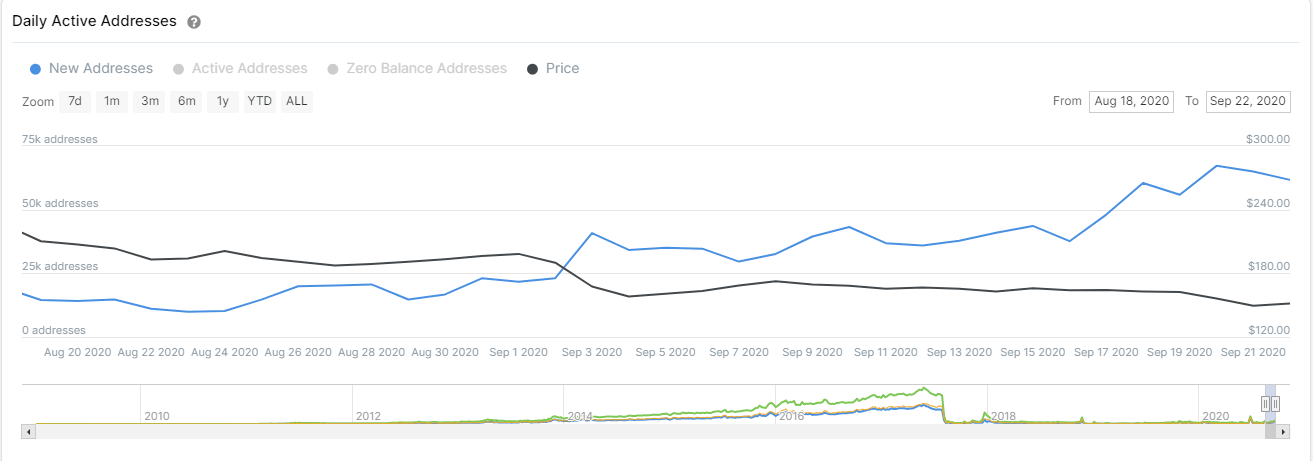

BSV Daily Active Addresses

An apparent increase in new addresses seems to support this idea. BSV had around 9,920 new addresses on August 23, a small number compared to the current 62,000 new addresses per day.

Either way, investors need to pay close attention to the lower trendline of the parallel channel as it will determine the direction of BSV for the next few months.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.