Bitcoin speculators panic sell at $92K in 'good time for accumulation'

Bitcoin market indicators are getting a reset as investors nurse 4% weekly BTC price losses.

In a Quicktake blog post on Jan. 10, onchain analytics platform CryptoQuant reported a new chance to buy the dip.

Onchain data shows Bitcoin moving at a loss

Bitcoin BTC $94,623 sentiment has taken a hit this month as volatility favored the downside and bulls failed to reclaim and hold the $100,000 mark.

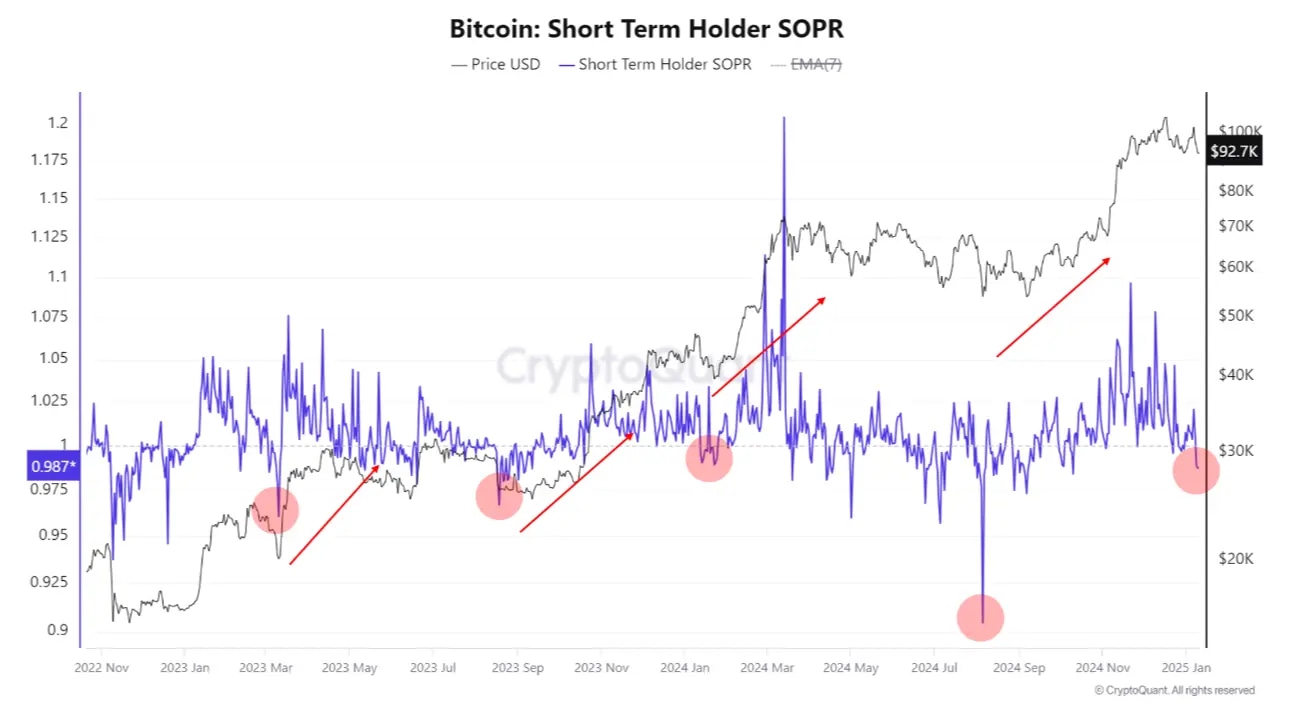

Among the signs of rising capitulation among speculative investors — those who are traditionally more sensitive to short-term price movements — is a dip in the spent output profit ratio (SOPR).

SOPR monitors the proportion of unspent transaction outputs, or UTXOs, created at a profit or loss compared to when the coins involved last moved.

The result is a snapshot of investors’ willingness to spend coins at a profit or loss, and thus analysts can gain an insight into prevailing sentiment trends.

Currently, the SOPR value for short-term holders (STHs) — entities hodling a given unit of BTC for up to 155 days — is below the breakeven point of 1.

“As BTC declines, negative headlines are increasingly visible on YouTube and news media. This indicates that market sentiment is turning bearish,” CryptoQuant contributor MAC_D said.

“This is reflected in the short-term SOPR, which shows the market sentiment of short-term investors, at 0.987, indicating that investors holding for less than 6 months are selling Bitcoin at a loss.”

Bitcoin STH-SOPR chart (screenshot). Source: CryptoQuant

While bearish on the surface, loss-inducing onchain activity can be a silver lining for bulls. Capitulation among speculative investors, historical data shows, often coincides with short-term BTC price bottoms.

In August 2024, STH-SOPR hit its lowest levels in more than three years, an event that coincided with the first of two near-term bottoms of about $55,000 for BTC/USD, which remain in place.

“Ironically, historical examples show that when short-term investors experience losses, the market has often shown an upward trend, making it a good time for accumulation,” the blog post said.

Analysis: Selling BTC may be “very unwise”

As Cointelegraph reported, other sentiment gauges currently paint a similar picture of increasing market nerves.

This week, the Crypto Fear & Greed Index returned to “Neutral” territory, marking its lowest level since October.

This is still notably higher than the equivalent index for traditional markets, which currently measures just 32/100 in a return to “Fear.”

Fear & Greed Index as of Jan. 10 (screenshot). Source: Feargreedmeter.com

At the same time, large-volume investors have upped BTC exposure once more after the holiday lull, with CryptoQuant showing Bitcoin whales adding 34,000 BTC in the 30 days through Jan. 8.

“As short-term investors experience more pain, it often presents better opportunities for accumulation,” MAC_D said.

“If there is further decline from the current price, smart investors will likely accumulate the coins sold cheaply by short-term investors. Therefore, selling coins at this juncture might prove to be a very unwise decision.”

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.