Bitcoin rally catalyzes gains in Ethereum, Solana, and XRP, as traders digest Donald Trump incident

- Crypto tokens added nearly 4% to market capitalization, pushing it to $2.52 trillion as traders digest news of the shooting at Donald Trump’s rally.

- Spot Ethereum ETF approval is expected this week, fueling the anticipation of Ether token holders and crypto traders.

- Bitcoin sustains above $65,000 as Ethereum, Solana, and XRP extend gains on Wednesday.

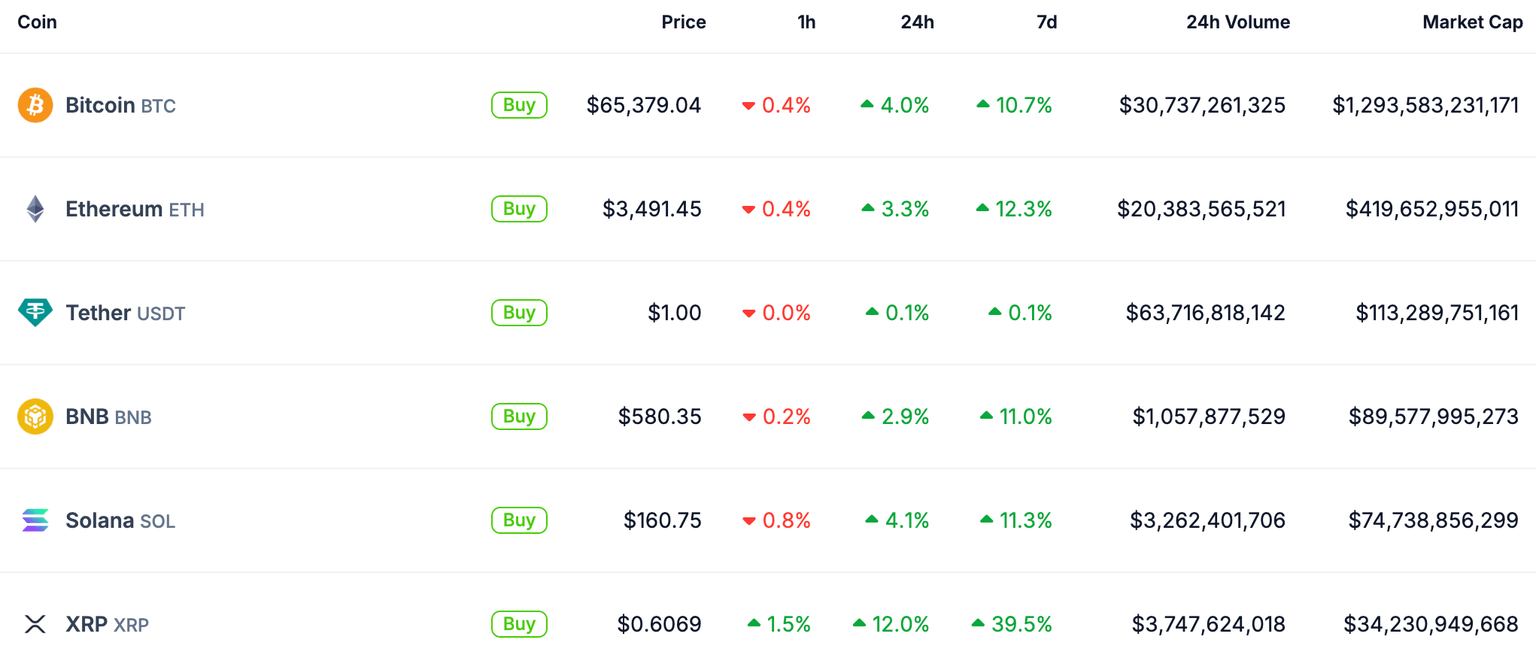

Crypto market capitalization increased nearly 4% in the last 24 hours and climbed to $2.522 trillion on Wednesday, as seen on CoinGecko. Almost all cryptocurrencies ranked in the top 10 assets by market capitalization have rallied in that period.

Bitcoin’s gains have likely catalyzed rallies in Ethereum, Solana, and XRP, among other assets. At the time of writing, Bitcoin trades at $65,260, and Ethereum, Solana, and XRP extend recent gains.

Additionally, Spot Ethereum ETF approval is anticipated this week, and this is likely the other key market mover for the assets.

Ethereum, Solana, and XRP rally amidst ETF hype, Donald Trump rally incident

ETF experts and analysts believe that a Spot Ethereum ETF approval is likely this week. As anticipation brews, Ether holders and traders expect gains, and the sentiment is positive, as seen on cryptoeq.io.

Eric Balchunas, Senior ETF analyst at Bloomberg, believes that the US Securities & Exchange Commission (SEC) will likely approve the ETF by Thursday, July 18.

We don't have a new over/under launch date yet because we haven't heard what the SEC's game plan is. Hope to hear soon. But if you forced me gun to head style to give my best guess for date I'd go with July 18th.

— Eric Balchunas (@EricBalchunas) July 8, 2024

Crypto traders are likely digesting the news of the events that unfolded at former US President and candidate Donald Trump’s rally on Saturday, as the shooting was followed by a rally in crypto prices. Analysts at on-chain data tracker Santiment attributed this to traders anticipating Trump’s win in the November 2024 Presidential elections and his pro-crypto stance.

Former US President Trump is scheduled to deliver a speech at a Bitcoin Conference later this month, on July 27. The Presidential candidate is expected to deliver his speech in Tennessee, in person, despite injuries sustained at the shooting.

In the last 24 hours, Ethereum, Solana and XRP extended gains by 3.2%, 4.1% and 12% respectively, per CoinGecko data. The three assets have positive returns for the last seven days period.

Bitcoin, Ethereum, Solana and XRP extend gains

At the time of writing, Ethereum trades at $3,488, hitting a new two-week high at $3,517 previously on the day, while XRP touched a three-month high at $0.6188.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.