Bitcoin primed for a major price movement as second U.S. stimulus checks go out

- The US government will distribute the second package of stimulus checks worth $600.

- Bitcoin hit another all-time high as people are expected to invest the stimulus money in cryptocurrencies.

The outgoing U.S. President Donald Trump finally endorsed the long-awaited stimulus bill worth $900 billion, meaning that every American citizen will soon receive a check for $600. Back in spring, many people used the first stimulus checks worth $1,200 distributed by the government to invest in Bitcoin. At that time, the US-based cryptocurrency exchange Coinbase reported a spike of first-time deposits worth $1,200.

Those who purchased BTC with their stimulus checks back in April might have doubled their proceeds as Bitcoin's value increased from $10,000 to over $28,000. Bitcoin analyst Jason Deane notes that people who have seen the steady growth of Bitcoin and read crazy price forecasts on Twitter might want to try their luck and become a part of this volatile but highly lucrative market.

According to a Twitter account tracking the value of the first stimulus check, now it is worth over $5,000, over 300% higher from what it was worth in April.

#Bitcoin pic.twitter.com/xKI6tLY1FI

— $1200 Stimulus Is Now Worth (@BitcoinStimulus) December 30, 2020

As the U.S. economy is struggling due to the devastating pandemic effect, the government continues printing money at an unprecedented rate and flooding the system with liquidity. The conventional wisdom says that such policies may lead to unwanted inflationary consequences in the long run.

Meanwhile, Bitcoin is considered a deflationary asset as its maximum supply is limited by 21 million tokens. Due to this feature, many high-profile investors and influencers have been touting BTC as an effective hedge against inflation.

Anthony Pompliano, co-founder and partner of the crypto hedge fund Morgan Creek Digital, says that it is not surprising that people want to convert U.S. dollars into sound money.

The U.S. dollars that are being used to pay the stimulus checks are guaranteed to lose its purchasing power over time, while bitcoin's structure is built in a way to protect and increase purchasing power over time, he Pompliano in the interview with Forbes.

Bitcoin jumps on the stimulus announcement

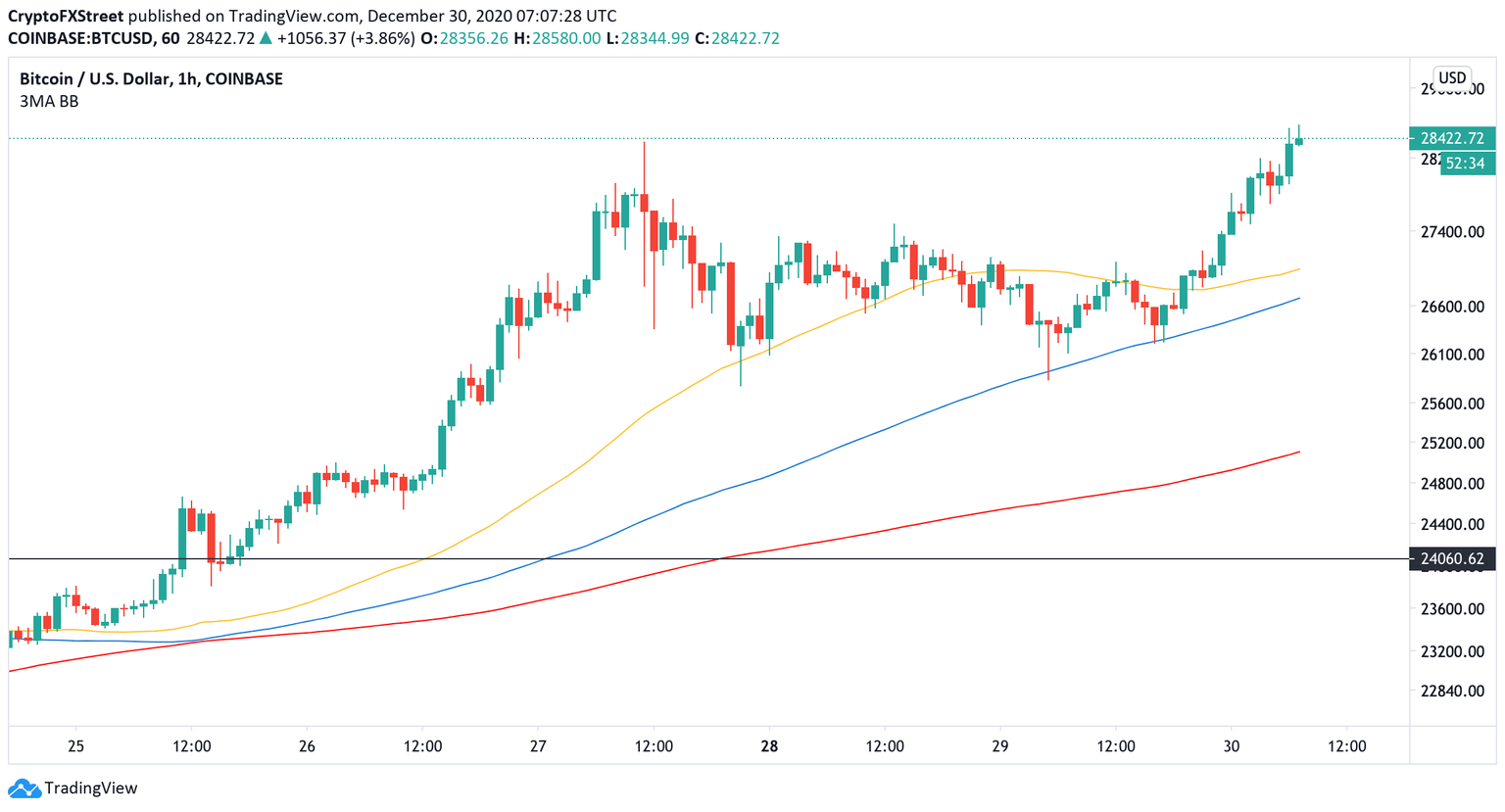

The stimulus announcement triggered a massive rally across the board, and Bitcoin is no exception here. The pioneer digital currency jumped above $28,000 and hit a new all-time high at $28,550.

From a technical point of view, Bitcoin is in uncharted territory. As FXStreet previously reported, a sustainable move above $26,800 created a strong upside impulse. As the bullish momentum continues to gain traction, BTC may test $30,000 before 2020 ends.

BTC, 1-hour chart

On the downside, the critical support comes at $27,000-$26,700 area. This area served as a resistance at the beginning of the week now; it is reinforced by 1-hour EMA50 and EMA100. If it is verified as support, BTC will get another boost with the next stop at $30,000. Otherwise, the sell-off will gain traction with the next bearish target at $25,000, followed by $24,000.

Meanwhile, In/Out of the Money Around Price (IOMAP) data confirms strong support on approach to $27,000 as over 480,000 addresses purchased 460,000 BTC from $26,770 to $27,000. If this area is cleared, the selling pressure will increase.

Author

Tanya Abrosimova

Independent Analyst

%252030-637449093964171045.png&w=1536&q=95)