Bitcoin price under $27,000 incentivizes investment as the market remains at a cyclical low

- Bitcoin price is struggling to stay above $26,500 at the moment as the bearishness continues to persist.

- The risk of investing in BTC is at a low right now, making rewards all the more tempting.

- HODLing is currently the primary market dynamic as investors remain focused on making profits once recovery begins.

Bitcoin price has not been able to bounce back from the crash witnessed at the beginning of the month. The impact on investors, surprisingly, has not been as significant since their behavior has not changed much since the end of March. This suggests that the next trigger for profit-taking won't arrive until BTC actually notes a bankable rally.

Bitcoin price leaves investors HODLing

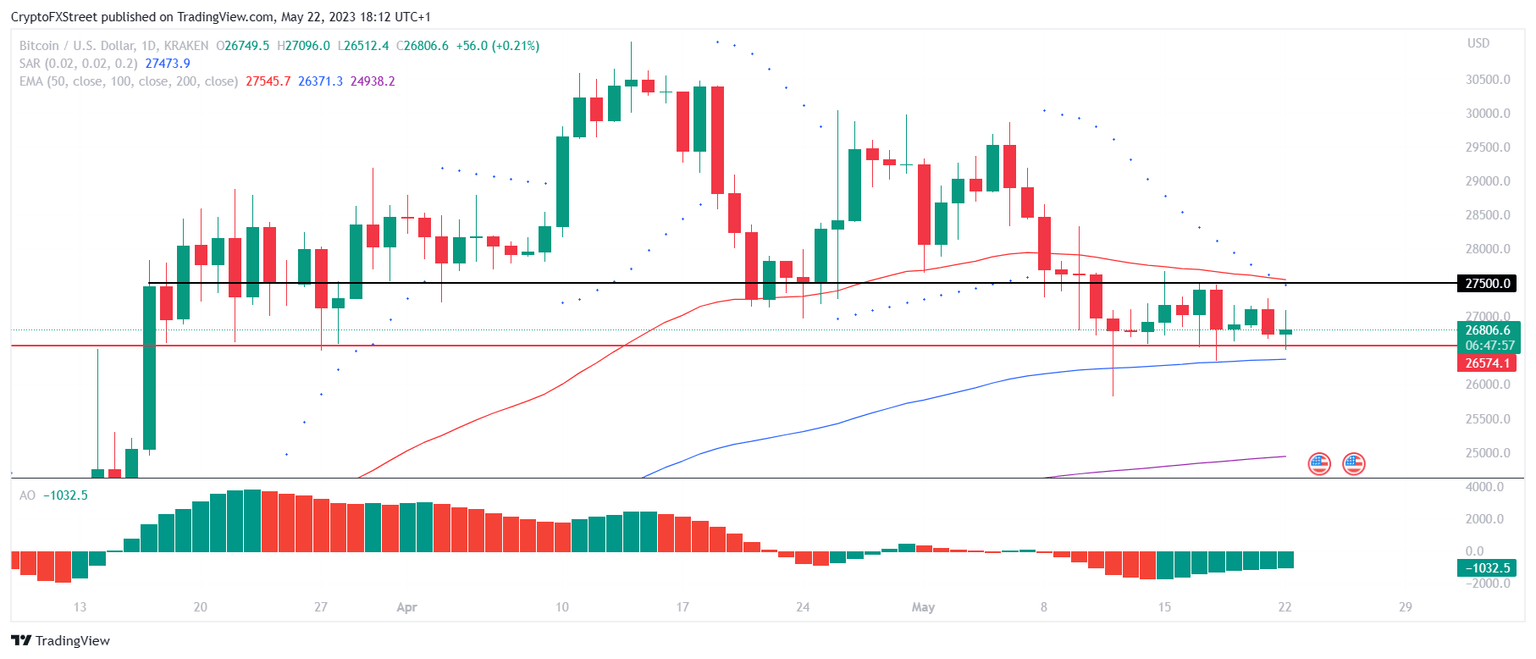

Bitcoin price is currently trading at $26,844, consolidating between $27,500 and $26,500 for more than ten days now. The decline noted on the charts since mid-April has dragged BTC down from $30,500 to its current price. Interestingly this did not trigger excessive selling among investors, which is a positive sign.

BTC/USD 1-day chart

This confidence suggests that investors are willing to hold on to their assets as potential recovery will bring about profits.

Although some bouts of selling have been observed in the market over the last few months, for the majority of the last 12 months, HODLing has been the primary market dynamic. This is visible in the decline in liveliness.

Bitcoin Liveliness

This sentiment grew stronger since the FTX collapse as the amount of BTC accrued in that duration is now maturing to a long-term holder status. For a coin to reach the LTH status, it must remain unmoved for a period of 155 days or more, which translates to a little over five months.

Bitcoin LTH supply

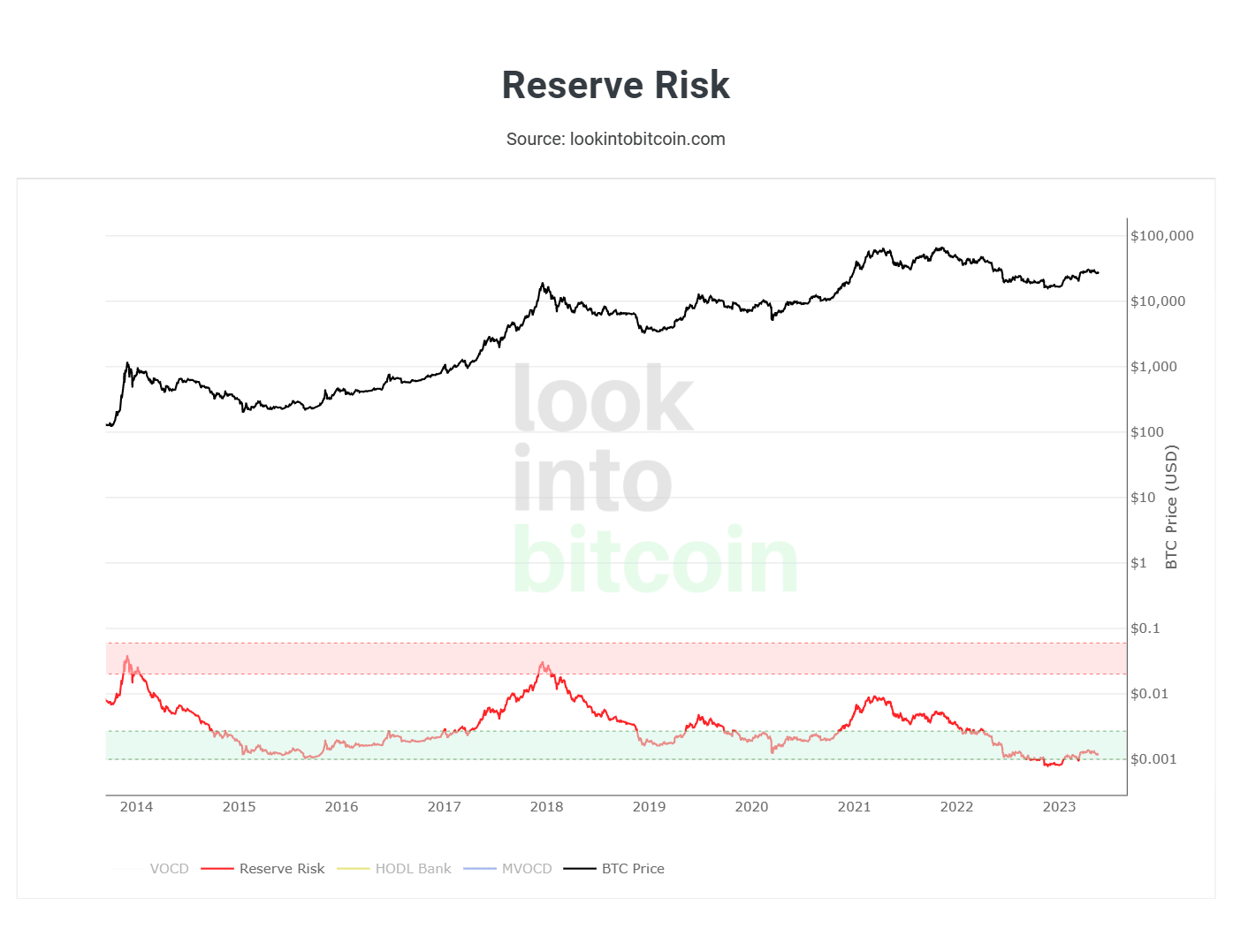

However, even after five months, the market has not changed much. While Bitcoin price has bounced back from lows of $20,000, it is still struggling to stay above $26,500. The optimism present in the market still makes accumulation the preferred stance to take, as is indicated by Reserve Risk (RR).

This indicator highlights the confidence of investors relative to the price action. A low RR is suggestive of high confidence and low risk, which translates to an attractive reward for investing in the asset. The indicator has been in this zone since last May when Bitcoin price was a little above $31,000.

Bitcoin Reverse Risk

Thus at least until this level is breached and flipped into a support floor once again, accumulation is the way to go. Declining macroeconomic conditions are also a contributing factor to the price action, making BTC capable of recovery soon.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.