Bitcoin price to likely cross $48,000 as US CPI inflation rises to 3.4% from 3.1% in November 2023

- Bitcoin price is presently trading around $47,100, recovering from a fall to $46,800 following the release of the US CPI data.

- The headline inflation rose to 3.4% year on year in December 2023, surpassing expectations of 3.2%.

- The core CPI rate, on the other hand, fell to 3.9% from 4.0% in November 2023, above expectations of 3.8%.

Bitcoin price and the rest of the crypto market are set to continue enjoying the bullishness of the past few days, thanks to rising inflation as measured by the United States Consumer Price Index (CPI). With inflation surpassing expectations, the crypto market is expected to witness higher inflows.

US CPI rises beyond expectations

Inflation in the United States, as measured by the Consumer Price Index (CPI) data, has risen to 3.4% year on year in December 2023. The expectation was around 3.2% as inflation in November 2023 was at 3.1% on a yearly basis.

The higher-than-expected inflation was also reflected in the change in the core CPI rate, which, as reported by the Bureau of Labor Statistics (BLS), rose to 3.9% in December. It edged lower than November’s 4.0% but above the expectation of 3.8% on a yearly basis.

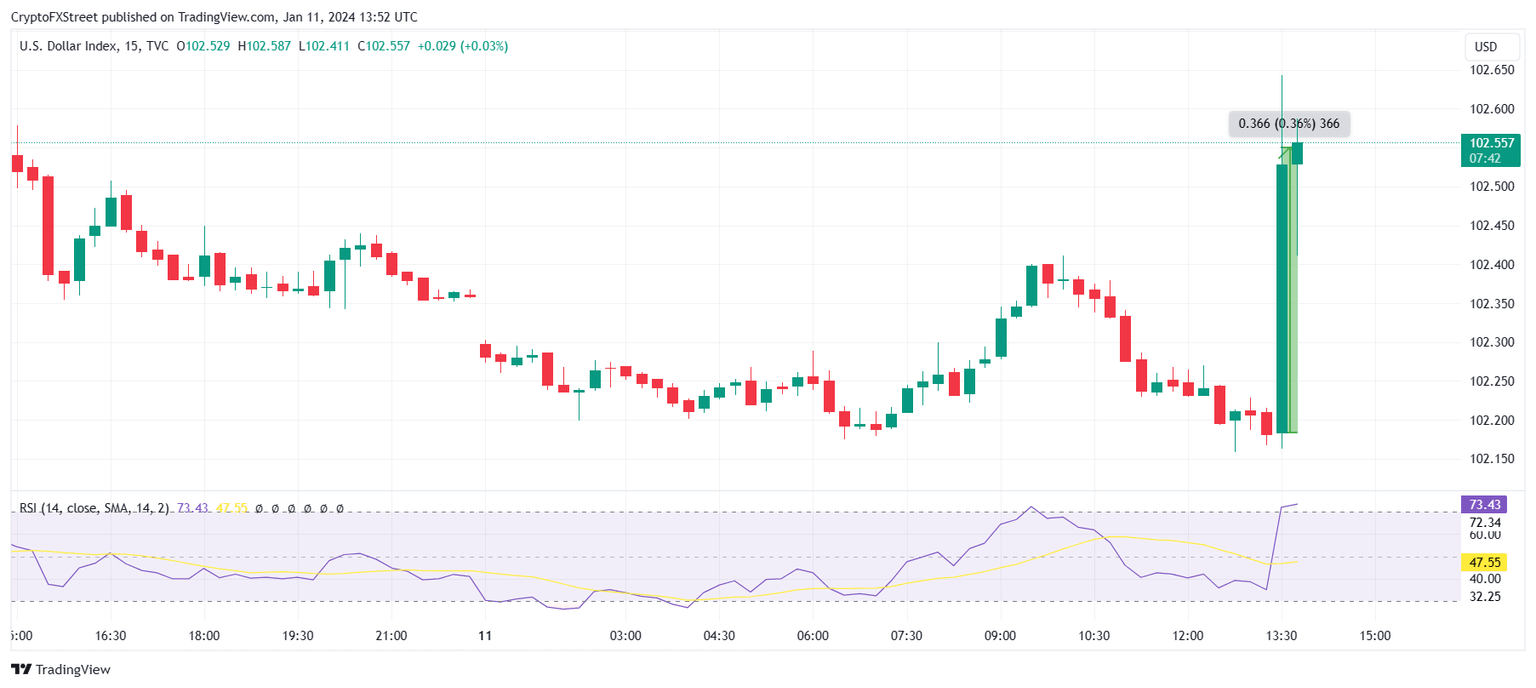

The initial reaction of the US Dollar Index (DXY) was rather bullish. At the time of writing, the DXY was up by 0.36% on the 15-minute chart.

DXY 15-minute chart

The crypto market, on the other hand, which was expected to have a bullish reaction, did not perform accordingly in the first minutes after the data.

Bitcoin price remains calm

Bitcoin price is trading at $47,284 at the time of writing, barely making a move since the US CPI data came out. Rising inflation tends to move investors’ funds from fiat to other investment options, such as cryptocurrencies, as the fear of the fiat losing value increases.

However, with the DXY noting a rise this time around, BTC stayed largely unmoved, rising by just 0.58% on the 15-minute chart.

BTC/USD 15-minute chart

Nevertheless, despite the initial reaction being lukewarm, the broader market bullish cues, fueled by the approval of spot BTC ETF applications, could push Bitcoin prices higher over time. The cryptocurrency is expected to reach $48,000 over the next few trading sessions.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.