- Bitcoin price could crash by 45% and fall below $16,000, according to Capo of Crypto.

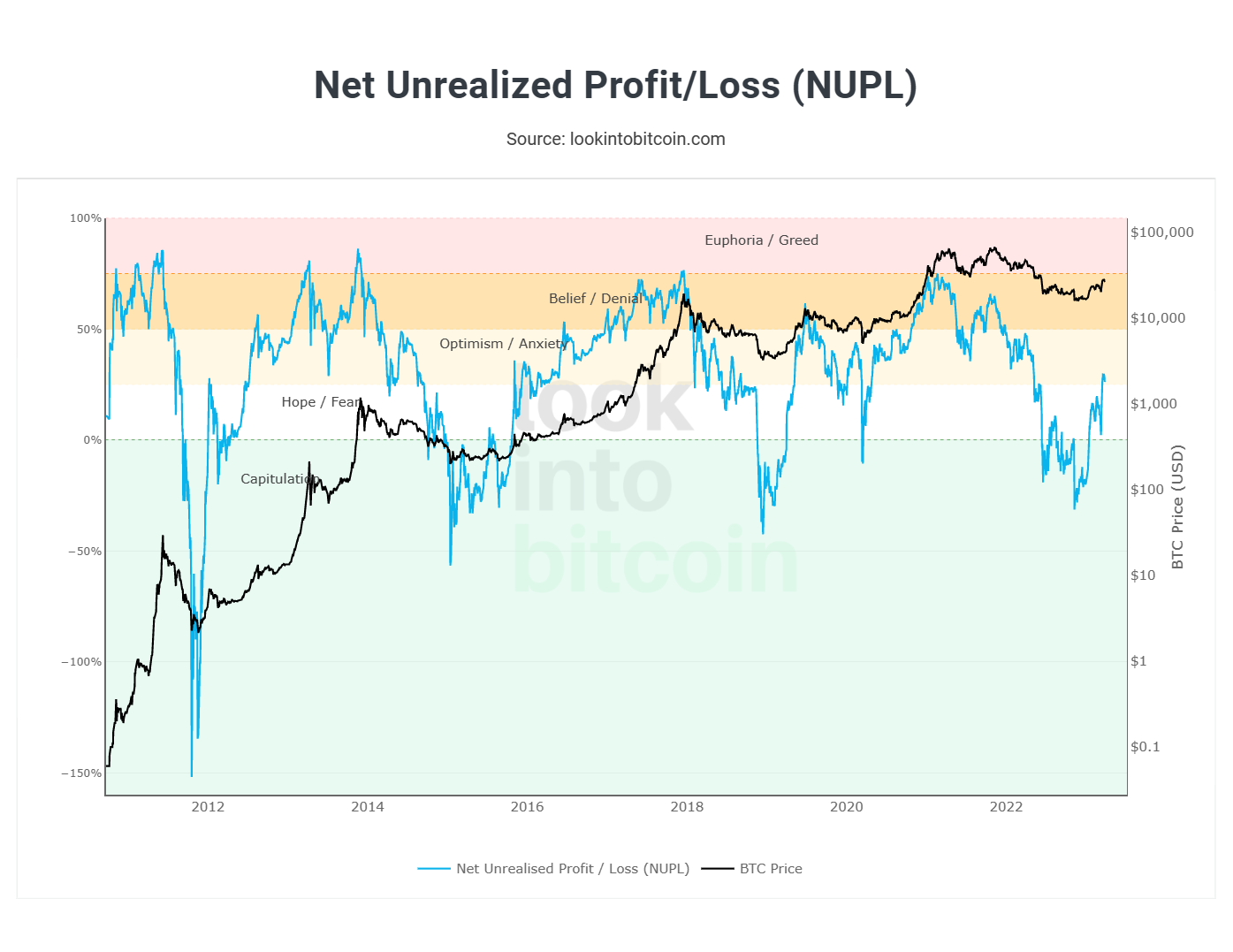

- BTC, on the other hand, is far from capitulating, just recovering from the capitulation zone over this quarter.

- With Bitcoin's "high correlation with the stock market" narrative coming to an end, it seems like the cryptocurrency would be safe from the effects of the broader market.

Bitcoin was created as a form of independent currency that would not have to depend on the traditional financial market to dictate its value. BTC deviated from the same a while ago as it followed the stock market's lead, but following the recent crashes, the cryptocurrency seems to be back on its own.

Why capitulation is called on Bitcoin price

Bitcoin price trading at $28,346 is inching closer to the $30,000 mark, which is a crucial psychological resistance level. Investors have been expecting BTC to be at this mark by the next month. However, some analysts are looking at the cryptocurrency heading in the opposite direction, potentially even crashing by 45%.

Capriltulation. pic.twitter.com/IAlTCvkiqC

— il Capo Of Crypto (@CryptoCapo_) March 29, 2023

Analyst Capo of Crypto suggested that April would see Bitcoin price falling to as low as $16,000 and below. When asked for the logic behind this forecast, the analyst stated that the worsening macroeconomic conditions would bear some significant impact on the price. Calling the recent BTC rally a dead cat bounce, Capo of Crypto further noted,

"The main reason for this bounce from the lows is a liquidity gap formed after the FTX crash that has been filled thanks to an initial bounce with from BUSD + USDC mint and the squeeze of late shorts, plus traditional markets recovering too. Smart money is not buying.

Bitcoin is not a hedge against inflation or disasters yet, that's why when the stock market enters a bear market, BTC does too (2022), and also the reason why it crashes during black swan events like the 2020 one (Covid crash).

The recent statements from Federal Reserve Chair, Jerome Powell, indicating higher interest rates hike already suggest that the TradFi market could be seeing some bearish effects going forward.

Furthermore, Russia recently announced that it would be favoring the use of the Chinese Yuan for settlements between Russia and the countries of Asia, Africa and Latin America. The de-dollarization would significantly impact the US markets.

However, Bitcoin price is safe from facing the likely adverse effects on the US markets.

Capitulation unlikely for BTC

This is because the recent rally made it pretty evident that the biggest cryptocurrency in the world is no longer correlated to the US stock markets. Regaining its label of being a safe haven just like Gold, Bitcoin price stands far from capitulation.

This is evident on the Net Unrealised Profit Loss (NUPL) indicator as well, which recently recovered from the capitulation zone after nearly four months at the beginning of this year. Rising since then, Bitcoin price currently stands in the Optimism zone suggesting unrealized profits are dominating the market.

Bitcoin NUPL

However, if institutional investors make any sudden move due to worsening macroeconomic conditions, Bitcoin price and the crypto market as a whole could take a hit. Although even in such a situation, BTC is expected to stay above $20,000.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Week Ahead: Crypto market eyes a bullish turnaround Premium

A new week has begun, but crypto markets seem to be doing the same thing they have for the past few weeks – consolidate. However, this week will likely bring new opportunities as Bitcoin begins to show signs of revival.

Eigenpie announces EGP token airdrop for 100,000 centralized exchange users

Eigenpie is a SubDAO protocol, a multichain project that manages digital assets. The project focuses on staking Ethereum Liquid Staking Tokens (LSTs) like EIGEN and offers points to stakers.

SEC vs. Ripple lawsuit update: All related parties to file letters to seal motions and evidence

Ripple, SEC and any third parties are expected to file letters to seal proceedings and supporting evidence by Monday. Ripple CEO voiced concerns over the SEC’s treatment of the largest stablecoin, USD Tether.

Top AI tokens bleed despite reports of Apple closing deal to use OpenAI features

Apple has closed a deal with OpenAI to use the latter’s technology in its new iPhone, Bloomberg reports. The giant’s iOS 18 could come packed with ChatGPT features, per the report.

Bitcoin: Why BTC is close to a bottom

Bitcoin (BTC) price efforts of a recovery this week have been countered by selling pressure during the onset of the American session. However, the downside potential appears to have been capped.