Bitcoin price prediction: BTC/USD struggles to make its way to $8,300 – Confluence Detector

- BTC/USD is vulnerable to further losses as the recovery falters.

- A sustainable move above $8,300 will ensure a strong recovery.

Bitcoin (BTC) is changing hands фе $8,250, off the intraday high of $8,289. The first digital coin managed to regain some ground during weekend, however, the further upside is limited as bullish momentum is fading away on approach to the resistance at $8,300.

Read also: Bitcoin failed as a medium of exchange and a store of value - G7

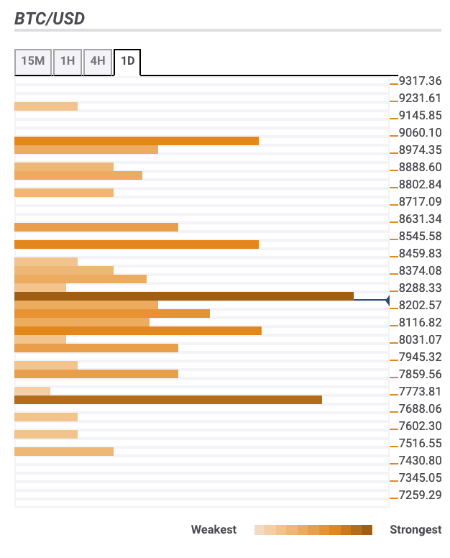

Bitcoin confluence levels

During early Monday hours, BTC/USD tried to develop a recovery, however, but failed to break from the short-term channel limited bu $8,300 on thee upside. Weak upside momentum bodes ill for Bitcoin bulls, though bears should push the price towards $8,000 to increase the chances of the downside scenario. There are a few barriers both below and above the current price.

Let’s have a closer look at the technical levels that may serve as resistance and support areas for the coin.

Resistance levels

$8,250 - 61.8% Fibo retracement weekly, 23.6% Fibo retracement daily, SMA10 (Simple Moving Average) daily, the middle line of one-hour and daily Bollinger Bands;

$9,000 - Pivot Point one-week Resistance 3.

Support levels

$8,100 - 61.8% Fibo retracement daily, 38.2% Fibo retracement weekly, SMA50 one hour;

$7,850 - the lower line of the Bollinger Band on a daily chart, the lowest levels of the previous week;

$7,750 - Pivot Point one-day Support 2, Pivot Point one-week Support 1, thee lowest level of the previous month.

Author

Tanya Abrosimova

Independent Analyst