Bitcoin price likely to revisit $36,000 as BTC bulls approach local top

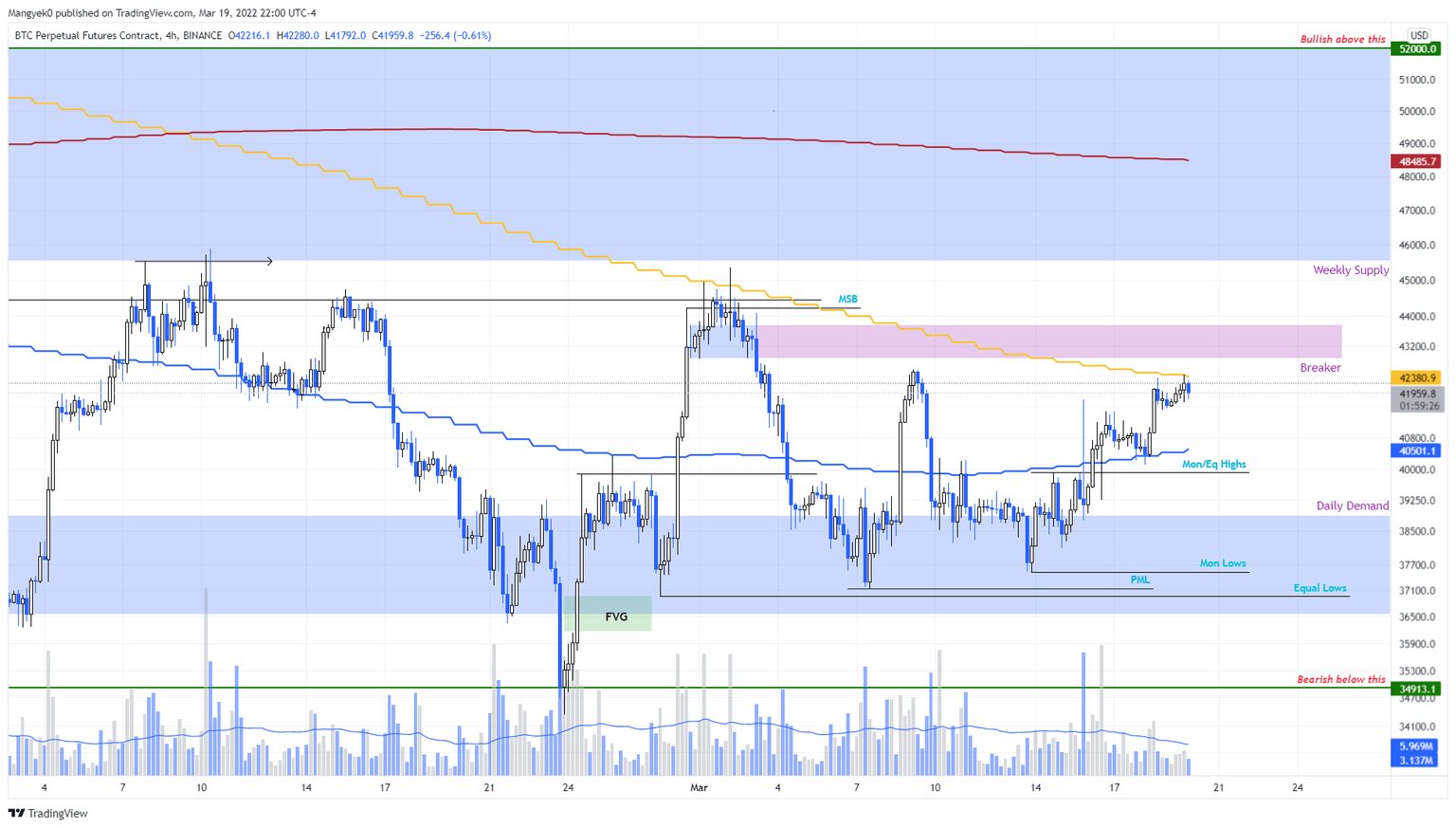

- Bitcoin price faces multiple resistance barriers as it approaches the $45,000 local top.

- A retest of the $42,867 to $43,755 bearish breaker is likely to result in a downtrend to $38,889 and lower.

- A daily candlestick close above $52,000 will invalidate any bearish thesis in existence.

Bitcoin price is approaching its upside limit after nearly a week-long slow strut-up. Due to the presence of multiple hurdles, a reversal is likely to stable support levels for BTC.

Bitcoin price at an inflection point

Bitcoin price rallied roughly 13% after setting up Monday’s low at $37,524 on March 13. This move albeit slow is aimed at retesting the bearish breaker, extending from $42,867 to $43,755. This setup contains a Market Structure Break (MSB) aka a higher between February 28 and March 2 followed by a flip of the demand zone formed between the swing highs.

On March 3, BTC breached the said demand zone, extending from $42,867 to $43,755 and flipped it into a bearish breaker. This technical formation forecasts that a throwback that leads to the retest of the breaker will face intense rejection. Moreover, the presence of the 100-day Simple Moving Average (SMA) at $42,380 makes it tough for bulls to push BTC higher. So, there is a chance the big crypto could face premature rejection due to the 100-day SMA and trigger a down move.

Regardless, investors can expect Bitcoin price to retrace to Monday’s low at $37,524. In some cases, BTC could slide lower to fill a tiny Fair Value Gap (FVG) extending from $36,170 to $36,966. In total, this down move would constitute a 15% loss and is likely where Bitcoin price will form a local bottom before establishing directional bias.

BTC/USDT 4-hour chart

On the other hand, Bitcoin price might plow through the breaker and retest the weekly supply zone, extending from $45,551 to $51,966. Such a move will invalidate the bearish thesis. However, this uptick does not kick–start a bullish move. For this to occur, Bitcoin price needs to produce a daily, preferably, weekly candlestick close above $52,000.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.