Bitcoin Price Outlook: A revisit of $52k is highly likely to shake weak hands before next leg up for BTC

- Bitcoin price is trading within a range with expectations of a sideways weekend before eventful week starting Monday.

- Hong Kong BTC and ETH ETFs to start trading on Monday before Fed meeting next week.

- In past cycles, BTC has dropped 20% to 25% as part of immediate post-halving correction.

- A 20% drop from $73,777K ATH would see BTC price dip into liquidity pool between $60,600 and $59,200.

Bitcoin (BTC) price outlook hints at a further downside, which some say will see the weak hands churned out. As hype relating to the halving continues to phase out for BTC, altcoins could be the next place to look for short-term gains.

Also Read: Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000

Daily digest market movers: Bitcoin drops to shake off weak hands

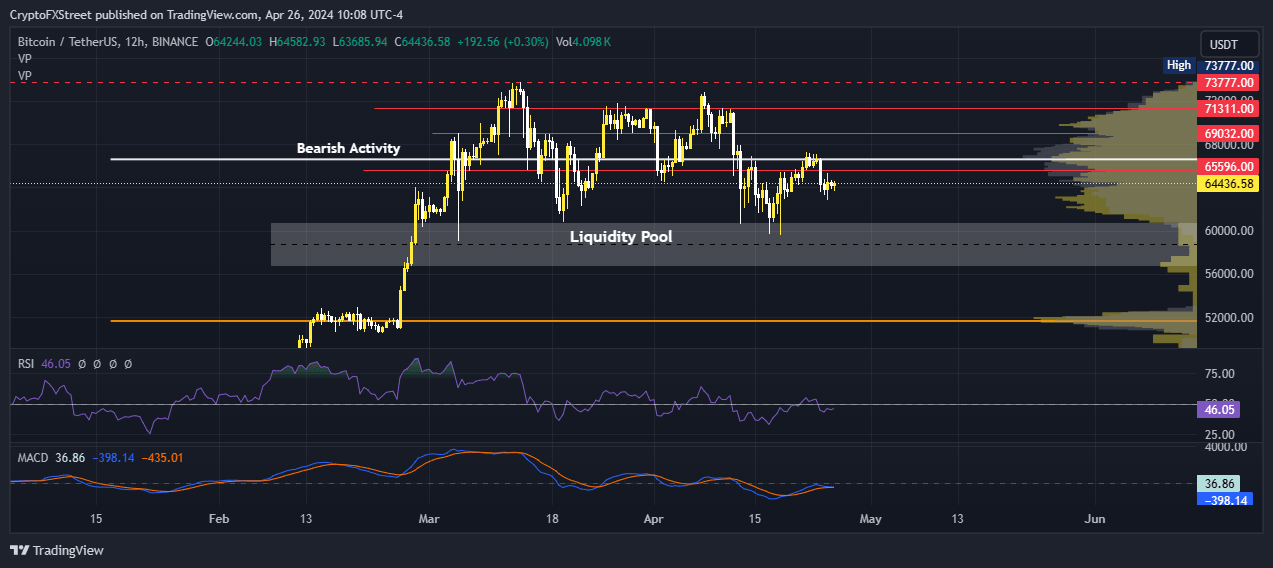

Bitcoin price continues to consolidate just above the $63,500 threshold. A look at the volume profile shows that at the current price, both bullish and bearish activity are not as pronounced or spiking. This is relative to the areas above and below, meaning not many bulls or bears are buying or selling at current price levels.

It is likely that the markets will witness a sideways consolidation through the weekend and into the new week. Volatility could resume on Monday when Hong Kong exchange-traded funds (ETFs) for BTC and ETH are expected to hit the market. This could be the catalyst that kicks off the next rally.

Usually what happens when the market looks like this is…

— Kyle Chassé (@kyle_chasse) April 26, 2024

Also, the next Federal Open Market Committee (FOMC) meeting, slated for Tuesday, April 30 and Wednesday, May 1, could move markets. This will be an important event for the overall market, with implications for the cryptocurrency industry.

Nevertheless, even as the market continues to lean in favor of the downside, it is not surprising considering historically, Bitcoin price has dropped between 20% and 25% from its peak as part of a post-halving correction.

- .

— Ted (@TedPillows) April 26, 2024

Historically, #BTC has dropped 20%–25% from its peak during halving.

A 20% drop from $74k would be at $59,200, which BTC recently hit.

A 25% drop would put #Bitcoin at $56k, which is a… pic.twitter.com/vy4Ri74A33

If history rhymes or repeats, the 20% dip could see the Bitcoin price dip into the liquidity pool that extends from $60,600 to $59,200. @TedPillows on X says this could be a shakeout to rid the market of weak hands.

Technical analysis: Bitcoin price could drop below $60,000 before next leg up

Bitcoin price downside momentum is likely to continue with bearish activity still hovering right above the current price. This coupled with the overall pull of the liquidity pool on Bitcoin price could see the market slide lower.

The Relative Strength Index (RSI) remains below the mean level of 50, a stance worsened by the Moving Average Convergence Divergence (MACD) that remains in negative territory. A crossover of the MACD below the signal line, reinforced by a lower low on the RSI could precipitate an extended fall for BTC price. This could send Bitcoin price into the liquidity pool before a possible recovery.

Based on the volume profiles on the 12-hour chart below, bulls are also waiting to interact with BTC near the $52,000 level, shown by the large spikes of the yellow nodes.

BTC/USDT 12-hour chart

On the other hand, if the $62,000 range holds as support, with a lot of bullish activity also seen here (yellow spikes), Bitcoin price could recover. Key levels to watch in a northbound directional bias would be $65,596, above which BTC bulls would have to confront the $69,032 and $71,311 levels for a chance to reclaim the $73,777 all-time high (ATH).

A decisive candlestick close above $69,032 in the 12-hour time frame would invalidate the bearish thesis. In a highly bullish case where the pioneer cryptocurrency clears its ATH, markets could see a new peak near $80,000.

Cryptocurrency prices FAQs

Token launches like Arbitrum’s ARB airdrop and Optimism OP influence demand and adoption among market participants. Listings on crypto exchanges deepen the liquidity for an asset and add new participants to an asset’s network. This is typically bullish for a digital asset.

A hack is an event in which an attacker captures a large volume of the asset from a DeFi bridge or hot wallet of an exchange or any other crypto platform via exploits, bugs or other methods. The exploiter then transfers these tokens out of the exchange platforms to ultimately sell or swap the assets for other cryptocurrencies or stablecoins. Such events often involve an en masse panic triggering a sell-off in the affected assets.

Macroeconomic events like the US Federal Reserve’s decision on interest rates influence risk assets like Bitcoin, mainly through the direct impact they have on the US Dollar. An increase in interest rate typically negatively influences Bitcoin and altcoin prices, and vice versa. If the US Dollar index declines, risk assets and associated leverage for trading gets cheaper, in turn driving crypto prices higher.

Halvings are typically considered bullish events as they slash the block reward in half for miners, constricting the supply of the asset. At consistent demand if the supply reduces, the asset’s price climbs. This has been observed in Bitcoin and Litecoin.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.