Bitcoin Price Forecast: Strong resistance levels keep BTC/USD below $10,475 – Confluence Detector

- The daily confluence detector shows a lack of healthy support levels.

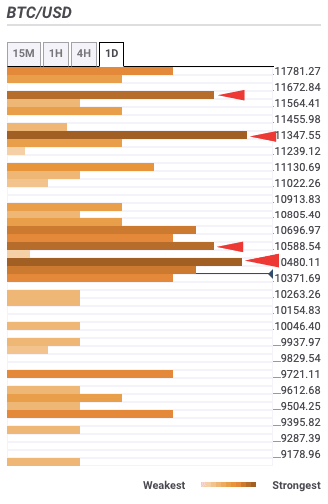

- There are four strong resistance levels $10,475, $10,580, $11,335 and $11,600.

BTC/USD daily confluence detector

BTC/USD bears have taken control of the market in the early hours of Saturday as the price went down from $10,459.46 to $10,421.45. The daily confluence detector shows a lack of healthy support levels on the downside. On the upside, we have four strong resistance levels at $10,475, $10,580, $11,335 and $11,600.

The $10,475-level has the one-day Fibonacci 23.6% retracement level, while $10,580 has the Previous Month low. Up next, the $11,335-level has the one-month Fibonacci 61.8% retracement level and one-day SMA 10. Finally, the $11,600 resistance level has the 4-hour SMA 200.

Author

Rajarshi Mitra

Independent Analyst

Rajarshi entered the blockchain space in 2016. He is a blockchain researcher who has worked for Blockgeeks and has done research work for several ICOs. He gets regularly invited to give talks on the blockchain technology and cryptocurrencies.